TLDR

- HYPE increased 14% in the past 24 hours after bouncing off a $40 support level

- Trading volumes reached nearly $1 billion in the past day, representing 6.6% of circulating market cap

- Hyperliquid holds 25% market share in decentralized perpetuals trading, ahead of competitor Aster at 19%

- Recent listings on Binance and Coinbase improved liquidity and accessibility for the token

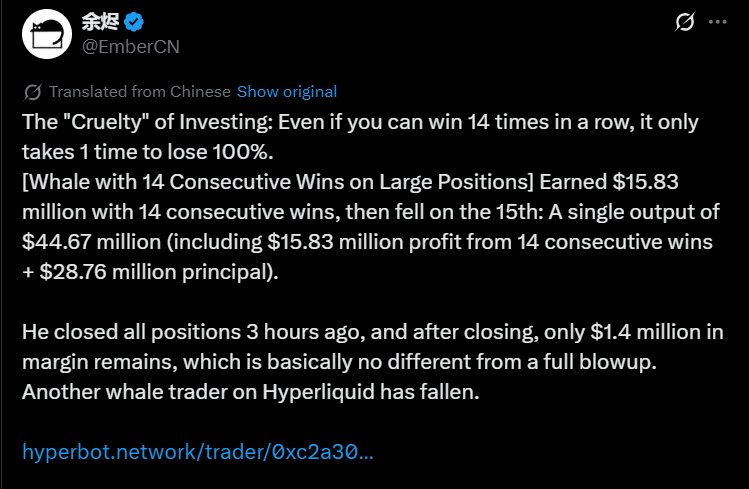

- The token recovered from a recent low of $36 following a $44 million whale liquidation earlier this week

Hyperliquid recovered strongly yesterday after hitting a key support level at $40 per token. The token posted a 14% gain in the past 24 hours and currently trades around $41.7.

Trading volumes reached nearly $1 billion in the past day. This accounts for 6.6% of the asset’s circulating market cap.

HYPE ranks as the top performer in the top 5 cryptocurrencies based on 24-hour gains. The price movement shows strong market interest compared to other altcoins.

The token recently experienced volatility following a $44 million whale liquidation earlier this week. Prices dropped to around $36 before the recovery began.

Binance and Coinbase both added HYPE to their platforms recently. The exchanges introduced major trading pairs including HYPE/USDT and HYPE/BTC.

These listings improved global liquidity and accessibility for the token. They mark Hyperliquid’s transition from a niche derivatives protocol to a mainstream platform.

Competition in Perpetuals Trading

Hyperliquid faces competition from Aster, a BNB-native perpetuals trading platform. Former Binance CEO Changpeng Zhao invested $2 million in Aster, giving the platform a credibility boost.

Data from CoinMarketCap shows Hyperliquid holds 25% market share in the perpetuals market among decentralized exchanges. Aster controls 19% of the market.

There have been instances when Aster surpassed Hyperliquid in 24-hour volume. However, Hyperliquid maintains the lead in open interest.

DeFi Llama recently expressed concerns about Aster’s trading volumes. The platform cited the protocol’s lack of transparency in reporting on-chain activity.

Hyperliquid operates as a fully decentralized and transparent protocol. The platform runs on its own layer-one blockchain rather than relying on existing networks like BNB Chain or Ethereum.

Technical Analysis Shows Support

The daily chart shows a major confluence area acting as support for Hyperliquid. The $39 level coincides with the 200-day exponential moving average and a former trend line resistance.

This represents a key retest area for a major breakout that occurred in late October. HYPE rose to $47 during that move.

The Relative Strength Index dropped below the 14-day moving average. This creates some risk that HYPE could lose the current support level.

Technical analysts suggest the token could reach $48 as a first target. That level would represent a 14% gain from current prices.

A move to $57 would offer approximately 36% upside potential. Traders point to this as a realistic target if bullish momentum continues.

Daily active addresses have doubled in the past week. Hyperliquid’s total value locked climbed over 150% since late October.

Funding rates have turned positive according to on-chain data from Coinglass. Whale accumulation has increased during the recent recovery.

The hourly chart suggests traders could look for a confirmed breakout above $43. This level should act as the market’s pivot point for the next move higher.

Exchange inflows have risen alongside the price recovery. The market’s swift rebound suggests continued confidence in the platform.