TLDRs;

- Tesla stock dropped 3.5% Friday amid regulatory delays and mixed sentiment over its China prospects.

- Musk said full approval for Tesla’s driver-assistance software could come by February or March 2025.

- The EV giant is complying with China’s strict data and autonomy rules to expand its market share.

- Analysts view China’s approval as crucial for Tesla’s next growth phase and investor confidence.

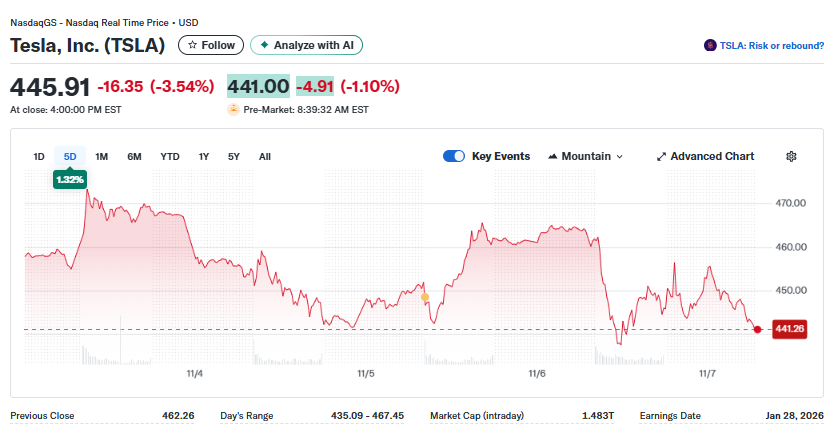

Tesla (TSLA) shares fell 3.54% on Friday, closing at $445.91, as investors weighed Elon Musk’s latest update on the company’s efforts to secure regulatory approval for its self-driving features in China.

The dip came despite optimism over Tesla’s long-term roadmap, as traders reacted to broader weakness in tech stocks and ongoing concerns about China’s stringent data rules.

In after-hours trading, Tesla shares slipped further, declining 1.06% to $441.20 in pre-market activity. Analysts say the move reflects investor caution, with markets awaiting more clarity on how fast Tesla can bring its Full Self-Driving (FSD) system to Chinese roads.

Musk Targets Full Approval by March

Speaking during Tesla’s annual shareholder meeting on Thursday, CEO Elon Musk said Tesla expects to gain “full approval” for its advanced driver-assistance system (ADAS) in China by February or March 2025. The milestone would allow the company to expand its FSD beta rollout beyond limited pilot tests currently authorized in select regions.

Tesla currently holds partial testing approval under China’s graded autonomy framework, which classifies systems from Level 0 (no automation) to Level 5 (full automation). Musk’s forecast suggests Tesla could soon transition toward Level 3 or higher, though such systems still require human oversight under Chinese law.

To meet local compliance standards, Tesla has rebranded its software in China to clarify its driver-assistance nature, aligning with Beijing’s rules mandating transparent communication about autonomous features and their limitations.

Data Compliance and Local Partnerships

To smooth regulatory approval, Tesla has strengthened ties with Baidu for mapping and navigation. The partnership ensures that Tesla vehicles in China use government-approved map data, addressing one of the biggest hurdles to full autonomy.

China’s Automotive Data Security Provisions and Personal Information Protection Law (PIPL) require foreign automakers to store all key vehicle and driver data locally. Cross-border transfers undergo strict review by the Cyberspace Administration of China (CAC), which has so far rejected nearly 16% of export requests involving sensitive data.

Tesla has reportedly built localized data storage facilities and improved its real-time monitoring systems to comply with these mandates. This push is part of a wider trend where global automakers are adapting to China’s data sovereignty laws, fueling growth for local cloud computing and cybersecurity providers.

Global Challenges Remain

While China moves closer to approval, Tesla’s FSD system has yet to receive clearance in Europe, where regulators are still reviewing safety and operational protocols.

Musk has urged European customers to lobby their governments for faster progress, arguing that Tesla’s system improves driver safety overall.

In the United States, Tesla faces ongoing investigations by the National Highway Traffic Safety Administration (NHTSA) over incidents involving its driver-assistance technology and crash reporting. The company maintains that FSD requires driver attention and continues to refine its algorithms to improve performance.