Cardano price recovery is facing pressure as investor focus shifts sharply toward high-utility, payments-focused presale tokens that could become the next breakout altcoins. Over the last week, discussions on X (formerly Twitter) and crypto forums have seen capital flowing out of Cardano.

Analysts, such as Michael van de Poppe, observe that this reflects the initial phases of the 2020 alt-season, when Bitcoin dominance briefly soared and then collapsed, releasing enormous liquidity that rotated into altcoins.

However, in contrast to past cycles, capital is now being invested in DeFi projects that have on-chain use cases that place the needs of businesses and individuals center-stage, further cementing the narrative that the next crypto wave is all about utility. Let’s dive into all the details.

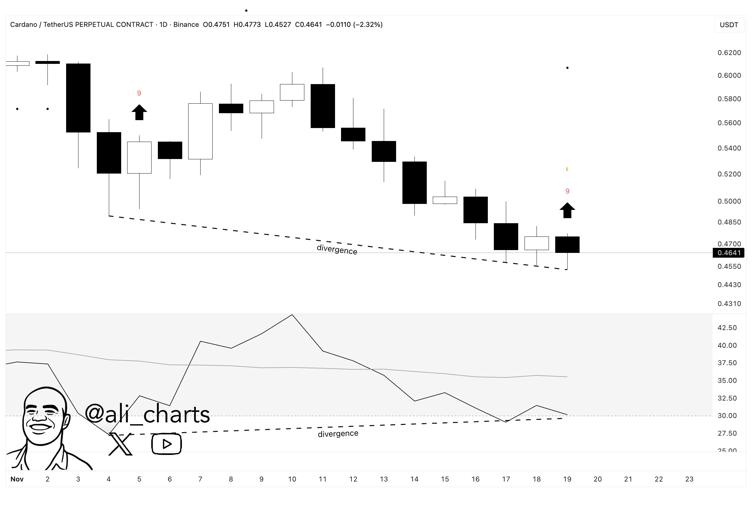

Cardano Price Technicals: RSI Divergence and TD Sequential Buy Signals Point to $1 Recovery Path

Cardano’s price structure has reached what many analysts consider a classic reversal zone, with several indicators aligning at once. Analyst Ali highlights a bullish RSI divergence on the daily chart, while price slipped to new 90-day lows, the RSI quietly formed higher lows, hinting that selling pressure is fading. This type of divergence often appears a few weeks before momentum shifts.

Adding to the setup, the TD Sequential has printed a rare buy signal, a pattern known for appearing near exhaustion points before strong rebounds. Cardano is currently near the significant support level of $0.43. A decisive move above $0.50 could open the door to $0.55 and even $0.65 in a few weeks. Various analysts also forecast a possible 30% increase in December, and long-term estimates of $1 by the end of 2026 as scaling upgrades continue.

However, technical optimism clashes with weak on-chain performance. Cardano’s Total Value Locked has dropped to about $213 million, far from its former peaks, and daily active addresses have fallen to their lowest levels in years.

The Remittix Revolution: Why a Fresh Presale Startup Could Outpace Cardano’s Recovery to $1

While the Cardano price struggles with adoption and ecosystem utilization, Remittix (RTX) has emerged as the fastest-growing presale of 2025, capturing investor imagination with a radically different approach: solving real-world payment problems rather than chasing abstract protocol improvements.

The platform has already raised over $28.1 million in presale funding, with prominent crypto hedge funds and family offices allocating capital at accelerating rates.

This remarkable momentum reflects a market realization that Cardano’s price improvements depend on theoretical upgrades. At the same time, Remittix delivers concrete, testable products for the $700 billion annual remittance market, which remains dominated by archaic banking infrastructure and predatory wire fees.

Core features that set Remittix apart;

- Crypto-to-bank transfers completed in under 24 hours across 30+ countries

- Full Certik smart contract audit with a Grade A score of 80; one of the highest possible ratings for pre-launch projects

- Raised more than $28.1 million and sold 685 million RTX tokens, showing a high level of institutional confidence.

- Business API: Enterprise integration enabling merchants to accept crypto and receive fiat instantly, unlocking institutional adoption channels

Most critically, Remittix’s deflationary token model includes holder rewards tied to transaction volume, generating intrinsic value that differs fundamentally from the Cardano price, which depends entirely on ecosystem adoption and execution.

Why Capital Rotation Favors Emerging Utility Over Proven Infrastructure

Altcoin season is heating up as Bitcoin dominance falls to 55–59%, creating ideal conditions for multi-100x performers. Historically, similar dominance lows preceded massive Ethereum and mid-cap altcoin rallies.

Bitcoin itself has rallied from $85,000 to $88,000, signaling simultaneous institutional buying in BTC and altcoins. Market sentiment shows retail capitulation while institutions quietly accumulate. Cardano price, beaten down yet technically poised, could see a 20–30% bounce toward $0.60–$0.65.

Payments-focused projects with strong adoption metrics are even better positioned, with early investors in such high-utility tokens historically seeing returns of 5–10x during altcoin season.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

FAQ: Essential Questions About Cardano, Remittix, and Altcoin Investing

1. Are crypto presales a good investment?

Presales carry significantly higher risk than public tokens but offer asymmetric return potential. Remittix’s CertiK audit, $28.1M funding milestone, and institutional investor participation suggest lower risk than most presales.

2. How risky are new crypto tokens?

Presale tokens carry concentrated risk: project failure, regulatory challenges, founder exit scams, and market volatility can result in total loss. Remittix’s transparent team KYC, CertiK audit, and working product reduce risk meaningfully compared to typical presales, though substantial downside remains possible.

3. Is now a good time to invest in crypto?

With Bitcoin losing its dominance below 60%, sentiment in capitulation territory, and possible Fed easing ahead, the next 6-12 months are promising for the patient crypto investor. Still, volatility is high, so dollar-cost averaging into high-growth crypto presales is safer than going all-in at once.

4. How do I find new crypto projects early?

To find new crypto projects early, keep an eye on CoinGecko and CoinMarketCap communities and follow credible analysts on X. Remittix is a good example of a solid early-stage project—backed by institutions, audited, already shipping products, and built on a realistic roadmap, setting it apart from most presales.