On November 20th, Coinbase launched Ether-backed loans for US users, letting customers borrow up to $1 million in USDC against their ETH without selling. Built on Base and powered by Morpho, this product signals something bigger: DeFi infrastructure is going mainstream fast.

Markets moved quickly and everyone started hunting for the best altcoins to scoop up. XRP price prediction searches picked up again as payment tokens usually benefit when the market cools down.

But the real hype right now is DeepSnitch AI. It is blowing up because it mixes real AI utility with meme energy, so traders feel like they’re getting in early on something fun and actually useful to provide .

Coinbase ETH loans go live: What this means for crypto lending

Coinbase just opened the floodgates for institutional-grade DeFi. The new product lets users across most US states (except New York) borrow USDC stablecoins against their Ethereum holdings without triggering taxable events from selling.

When major exchanges start integrating DeFi protocols like Morpho directly into their platforms, it validates the entire space. Coinbase’s onchain lending already processed over $1.25 billion in loan originations with roughly $810 million still outstanding.

This infrastructure expansion benefits payment-focused networks like XRP. When traditional finance sees crypto lending, staking, and payment rails all functioning smoothly, they start allocating beyond Bitcoin. They start exploring networks built specifically for cross-border settlements and institutional liquidity. That’s XRP’s wheelhouse.

DeepSnitch AI: Intelligence infrastructure for trader edge

All this fresh momentum from Coinbase, institutional lending and clearer regulations points to one thing. The next cycle is going to reward projects that provide real intelligence, not just hype. When exchanges start running onchain lending at scale, every move becomes data. Every loan, every liquidation, every collateral shift creates signals that smart traders can use long before the crowd notices.

This is where DeepSnitch AI fits right into the narrative. While Coinbase is unlocking institutional DeFi infrastructure, DeepSnitch is building the intelligence layer that helps everyday traders keep up. The platform runs five AI agents that monitor everything from whale rotations to fresh contract deployments. Instead of chasing pumps after they show up on Twitter, traders get alerts the moment the chain starts moving.

Two agents are already live and the rest roll out as development milestones hit. The project has passed security audits through Coinsult and SolidProof, something most presales never bother with. It started at $0.0151 and now sits around $0.02429 with more than $564,000 raised, giving early buyers over 60% gains before the token even lists.

In a market where institutions are getting better tools every week, DeepSnitch gives retail the chance to level the playing field.

XRP price prediction for 2026

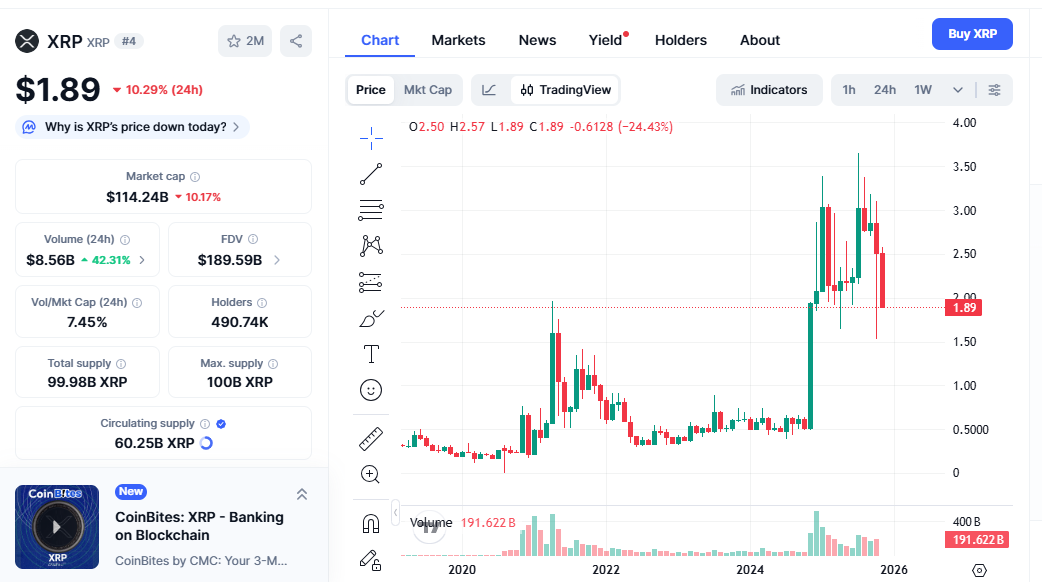

XRP trades around $1.89 as of November 21st after the Bitwise XRP ETF debuted on the NYSE.

The XRP price prediction for 2026 actually looks solid when you notice what’s happening. The Canary Capital XRP ETF launched November 13th and pulled $58.5 million first-day turnover with roughly $128 million volume over four trading days. That’s serious institutional interest.

If XRP reclaims and holds above $2.50, the XRP price prediction models suggest momentum shifts bullish toward $2.90-$3.05.

November historically has been XRP’s strongest month, averaging +88% gains. While that exact performance seems unlikely given current holder selling pressure, the setup isn’t terrible.

For a realistic XRP price prediction for 2026, consider the catalysts. Multiple spot XRP ETFs are now approved or pending. Regulatory clarity finally exists after years of SEC battles. RippleNet continues expanding payment partnerships. The Trump administration actively supports crypto infrastructure.

If Bitcoin enters a sustained bull phase and institutional capital flows into payment infrastructure plays, XRP price prediction models suggest 3x to 5x gains from current levels is achievable.

Aster coin update: Can Aster maintain its DeFi momentum?

Every DeFi trader wants to know: can Aster coin sustain its recent rally and deliver transformational returns?

Aster currently trades around $1.17 as of November 21st. The DeFi perpetuals token surged 26% recently after CZ (Changpeng Zhao) purchased 2 million tokens, sparking speculative demand.

With roughly 2.4 billion tokens circulating, Aster holds a $2.7 billion market cap. Analysts like MoEthWhale project Aster could hit a $10 billion market cap, which would put the price around $5.

Conclusion

Crypto markets are responding positively as Coinbase’s ETH-backed loans validate DeFi infrastructure and traditional finance integration accelerates. The XRP price prediction for 2026 suggests strong gains are achievable if institutional adoption continues, though the path depends on ETF flows and payment network expansion.

What’s clear is that this cycle rewards utility and infrastructure. DeepSnitch AI represents exactly this shift, combining AI capabilities with practical trading solutions.

The platform’s AI agents tackle information asymmetry head-on. With the presale accessible at $0.02429, early participants already holding 60%+ gains, and 100x potential realistic after exchange listings, the setup deserves attention.

Join the DeepSnitch AI presale and follow updates on X and Telegram.

Frequently asked questions

What is the realistic XRP price prediction for 2026?

Most realistic XRP price prediction models place XRP between $6.00 and $10.00 depending on institutional adoption. These estimates factor in ETF flows, payment network expansion, and cross-border settlement adoption rates.

Can XRP reach $50 or deliver returns?

Reaching $50 would require a market cap around $3 trillion, which seems unlikely in the near term. From current levels around $2, a gain faces mathematical constraints unless global payment adoption accelerates dramatically beyond current projections.

How does XRP institutional adoption impact its value?

XRP institutional adoption usually boosts confidence because banks and payment providers bring real volume. More usage means more demand for liquidity, which can support higher prices over time.