NYSE approved Grayscale’s XRP and Dogecoin ETFs on Nov 21, clearing both products to launch on 24th Nov. This is the institutional validation XRP bulls have been waiting for, and it’s happening right now.

NYSE Arca filed with the SEC to certify approval for the Grayscale XRP Trust ETF (GXRP) and Grayscale Dogecoin Trust ETF (GDOG). Bloomberg’s Eric Balchunas confirmed the listings will go live on Nov 24, with a Chainlink ETF following within the week.

XRP price prediction chatter is exploding across crypto Twitter as institutional money prepares to flood the market. But while most traders are focused on the obvious play, the real alpha might be in presale projects like DeepSnitch AI that started presale at $0.0151 and already pumped to $0.02477 before hitting any exchange. With $585K raised and zero FOMO pricing yet, early movers are eyeing 300x upside potential.

NYSE’s XRP ETF approval changes the game for institutional adoption

Grayscale’s XRP ETF isn’t launching alone. Franklin Templeton and WisdomTree are both preparing competing XRP products set to launch imminently. That means three major asset managers are bringing regulated XRP exposure to traditional investors simultaneously.

Canary Capital already broke the ice on Nov 13 with the first spot XRP ETF in the US, pulling over $250 million in first-day inflows. Since then, Bitwise, 21Shares, and CoinShares have all launched their own XRP ETFs as the market flooded with options following the end of the government shutdown and the SEC loosening crypto ETF requirements.

The XRP price prediction for 2026 just got a lot more interesting. With five ETF providers now offering institutional-grade access, the distribution network for XRP exposure has expanded massively. Traditional finance has finally regulated on-ramps, and that’s exactly what crypto needed to break through resistance.

DeepSnitch AI booms 60% ahead of January launch: T1 & T2 listings?

When major ETF approvals hit the wire, smart money is already positioned while retail scrambles to chase headlines. By the time Grayscale’s XRP ETF starts trading on Nov 24, the move could already be priced in. That’s why presale plays like DeepSnitch AI matter.

DeepSnitch runs five AI agents that track whale wallets, scan smart contracts, flag honeypots, detect sketchy liquidity setups, and monitor cross-chain sentiment in real-time. You don’t need to juggle 10 tabs or trust random CT influencers. The signal feeds straight into your Telegram or X.

DeepSnitch stops you from getting rugged, front-run, or late to sector rotations. It flags low-liquidity traps and alerts you when institutional wallets are accumulating. The kind of alpha trading desks pay five figures for is now in your pocket.

Traders are loading up hard. Presale crossed $585K with the token initially priced at $0.015, it’s now sitting at $0.02477. That’s a 60%+ pump before touching a single exchange. If you’re seeing this now, you’re still early. Once listings hit and FOMO kicks in, that entry is gone.

Traders are loading up hard. Presale crossed $585K with the token initially priced at $0.015, it’s now sitting at $0.02477. That’s a 60%+ pump before touching a single exchange. If you’re seeing this now, you’re still early. Once listings hit and FOMO kicks in, that entry is gone.

XRP price prediction for November 2026: What the ETF wave means

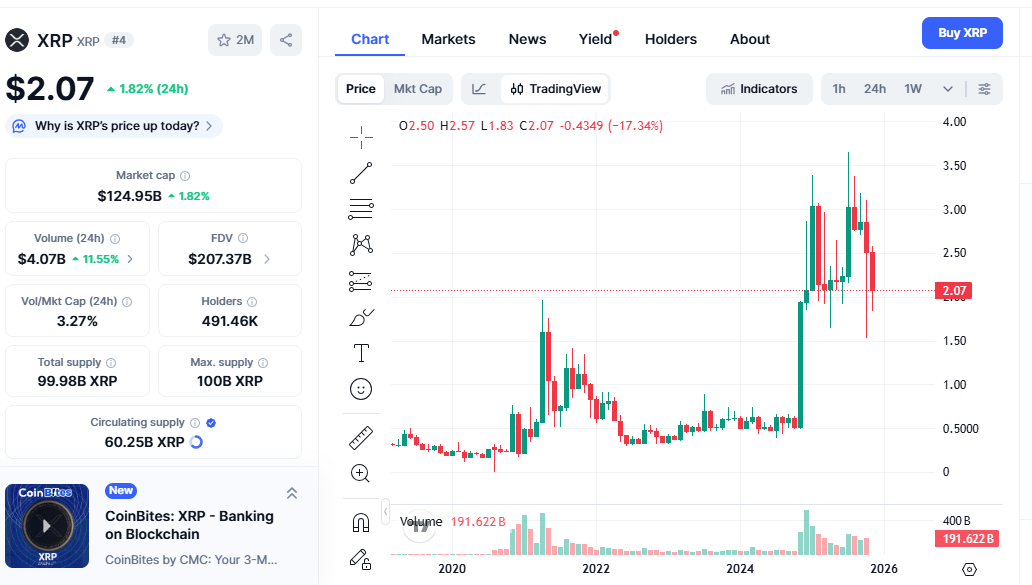

XRP is trading around $2.07 on Nov 24. Despite the ETF flood, XRP is actually down roughly 18% from the start of November, sitting about 30% below its July 2025 all-time high of around $3.65.

Short-term volatility is normal here. ETFs often trigger a sell-the-news reaction before the real buying starts. Once inflows stabilise, the XRP price prediction for 2026 leans strongly bullish.

In a neutral market where ETF demand stays weak, XRP will probably trade between 2.50 and $3.50 through 2026. That is the slow growth scenario with steady but modest adoption.

If institutional payment adoption picks up and XRP ETFs attract demand similar to Bitcoin and Ethereum, a move toward the $3.65 all-time high becomes realistic. In that case, a bullish XRP price prediction for 2026 lands between $4 and $5.50.

In a full bull run with strong capital inflows, clearer regulations and rapid payment network growth, XRP could reach $6 to $8. That is the top range scenario, extra upside rather than the base case.

Overall, the XRP price prediction depends on three things: consistent ETF inflows, real payment adoption, and overall crypto market strength. If these three come together, XRP has plenty of room to climb in 2026.

Tether Gold (XAUt): The stability play as volatility heats up

Tether Gold is trading around $4,048 on Nov 24, tracking gold’s real-time spot price with each token representing one troy ounce of physical gold held in Swiss vaults.

Tether Gold is getting more attention after reports confirmed that Tether now holds about 116 tons of physical gold, with around 12 tons specifically backing XAUt. This has boosted confidence in the token’s backing and stability.

In terms of future price, traders expect XAUt to benefit from the long-term strength of gold, with many projecting it to trade between $4,200 and $6,400 by 2026. One common forecast places it near $6,380 if gold continues its steady upward trend and more users adopt gold-backed crypto for stability.

Conclusion

If you are tracking the XRP price prediction for 2026, things just turned seriously bullish. The NYSE approving Grayscale’s XRP ETF, along with Franklin Templeton and WisdomTree, signals real institutional backing. With everything ready to go live on Nov 24, this could be the moment XRP finally breaks out of its boring range.

But while XRP is a solid long-term play, traders looking for fast, explosive upside are watching DeepSnitch AI. It is early, undervalued, and already giving traders real-time alpha through its AI tools. Think of XRP as your steady macro bag and DeepSnitch as the potential moonshot you catch before everyone else hears about it.

The DeepSnitch AI presale is still at $0.02477. Get in before the next price increase and follow the official X and Telegram channels to stay ahead of the crowd.

Frequently Asked Questions

What is the XRP price prediction for 2026?

With several ETFs going live and institutional interest picking up speed, a realistic XRP price prediction for 2026 ranges between $4 and $5.50 as long as inflows stay strong and the broader market remains bullish.

Can XRP reach $6 in the next cycle?

If ETF demand holds, regulatory clarity continues, and payment adoption scales, XRP hitting $6 to $8 in a full bull run isn’t unrealistic. The institutional infrastructure is finally in place.

What does the XRP long-term outlook suggest after ETF approval?

With five major ETF providers now offering regulated XRP access, the long-term outlook is bullish. If institutional inflows match Bitcoin and Ethereum ETF trends, XRP could finally break its multi-year range and make a sustained move higher.