Ethereum is hovering around the $3,000 mark again, and the mood around it feels tired. Every small push higher runs into sellers, and the chart looks more sideways than explosive. At the same time, a new coin priced at just $0.035 is starting to grab serious attention from early investors. Mutuum Finance (MUTM) has already grown 3x from its first presale stage and could have far more room to run into Q1 2026. With many investors hunting for the best crypto to buy now before the next alt season, the contrast between ETH and MUTM is getting harder to ignore.

Ethereum’s Size Is Now Its Biggest Problem

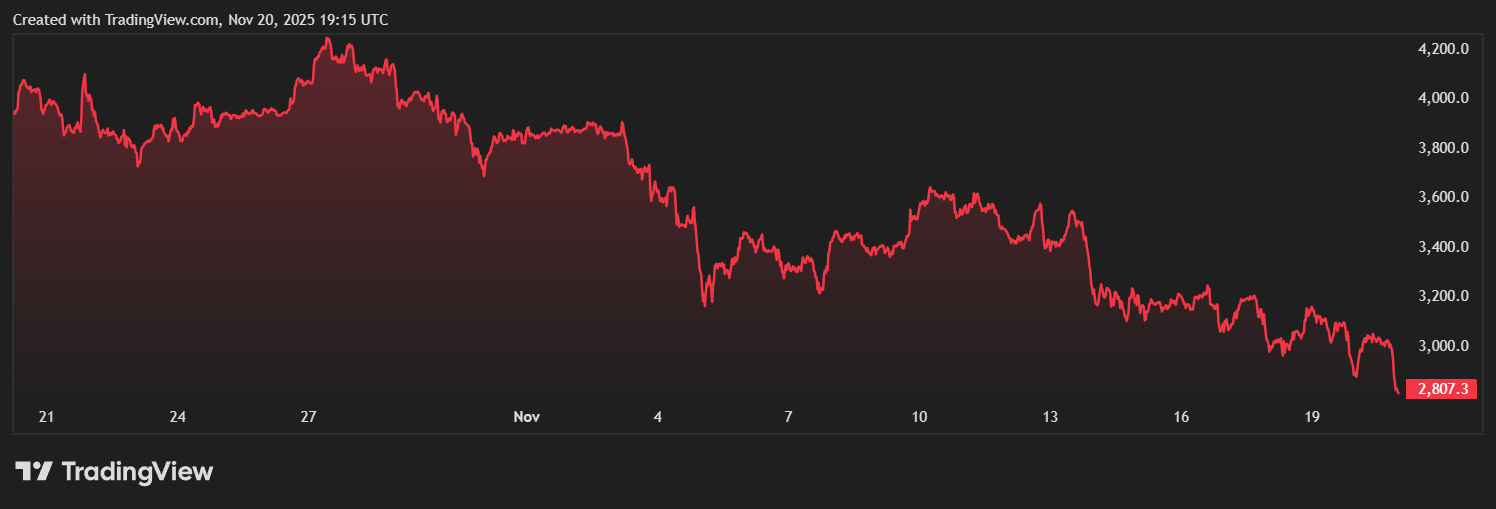

Ethereum trades close to the $2,800 region with a market cap around the mid-$300B range. It remains the second-largest cryptocurrency and still powers a huge part of DeFi and NFTs. But being that large comes with a cost. Big caps move slower. To push ETH even a little higher, the market needs billions in new capital.

On the technical side, ETH faces tough resistance above $3,200 and again higher in the $3,300 to $3,400 area. Each move toward those levels has stalled. Sellers take profits, and momentum fades. Support sits just below $2,800, but if that line gives way, ETH could easily drift lower.

Investors looking at crypto prices today see a pattern. Ethereum is no longer the explosive trade it once was. Gas fees can still spike when the network gets busy. The chart is choppy. And the market cap makes it harder to see big upside in the short term. This is why many people searching for what crypto to buy now are rotating into lower-cost tokens with stronger growth potential.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is building a decentralized lending protocol that puts smart contracts at the center of everything. It is designed so users can lend assets to earn yield and borrow against their holdings without leaving the chain.

On the Peer-to-Contract side, users deposit assets into a liquidity pool and receive mtTokens. These mtTokens grow in value as borrowers repay interest. For example, imagine a user deposits $1,000 worth of ETH into the pool. In return, they receive mtTokens. As loans are taken and repaid, those mtTokens slowly increase in value, delivering an effective APY without the user having to micromanage anything.

On the Peer-to-Peer side, borrowers take loans by posting collateral within set Loan-to-Value (LTV) limits. They can choose variable borrow types based on their needs. If the value of their collateral falls and the loan crosses the liquidation threshold, liquidators can step in. They repay part of the debt and receive collateral at a discount. This keeps the protocol solvent and protects lenders from major losses.

Presale Numbers, Security And Daily Rewards

Mutuum Finance launched its presale in early 2025 with a starting price of $0.01. Since then, the token has climbed to $0.035 in Phase 6. That is a 250% increase from the first stage. The project has raised about $19M so far and attracted more than 18,200 holders. Around 805M tokens have already been sold.

From the total supply of 4B MUTM, 45.5% is reserved for the presale. That means roughly 1.82B tokens are available for early buyers before the project reaches exchanges. Phase 6 is already over 90% allocated, which shows how quickly demand is building at this price level.

Security is a key selling point. Mutuum Finance has completed a CertiK audit with a 90/100 Token Scan score. That is a strong score for a project still in presale. On top of that, there is a $50K bug bounty program focused on code vulnerabilities. This invites external experts to stress test the protocol before it goes live.

To keep engagement high, Mutuum Finance runs a 24-hour leaderboard. Every day, the top contributor wins $500 worth of MUTM. This mechanic pushes extra volume into the presale and adds urgency, especially as each phase gets close to selling out. Card payments are also supported, with no purchase limits, which makes it easier for new users to join.

V1 Launch, Stablecoin Plans And Why Phase 6 Matters

According to the project’s official X account, the V1 version of the Mutuum Finance protocol is scheduled to go live on the Sepolia Testnet in Q4 2025. V1 will include the core lending pool, mtTokens, a debt token system and the automated liquidator bot. ETH and USDT are set to be the first supported assets for lending, borrowing and collateral.

The roadmap also includes a planned stablecoin. This stablecoin will be minted and burned based on collateralized borrowing inside the protocol. That revenue can then be used to support the ecosystem, including buying MUTM on the open market.

There is a powerful loop here. The more people use the lending and stablecoin features, the more revenue the protocol generates. According to the design, MUTM purchased on the open market is redistributed to users who stake mtTokens in the safety module. That creates structural buy pressure tied directly to usage. If the platform grows, demand for MUTM grows with it.

Phase 6 selling out quickly matters because it marks the last chance to buy at $0.035 before the next price move. The official launch price is set at $0.06. That means anyone entering now already has a clear path to potential gains if MUTM simply reaches its listing price and holds. In a stronger scenario, analysts believe the token could move far beyond $0.06 into 2026 as the protocol gains users.

Some analyst outlooks suggest a possible 300% to 500% upside from current levels across Q1 2026 if the market turns bullish and Mutuum Finance delivers on its roadmap. That does not mean it is guaranteed. But it explains why so many early investors see MUTM as one of the best crypto to invest in for the next cycle.

Ethereum is still the backbone of DeFi, but its sheer size and current resistance levels make it less attractive as a high-growth play heading into Q1 2026. Investors who want faster moves and stronger upside are naturally looking further down the list at promising new cryptocurrency projects.

Mutuum Finance stands out in that group. It has a working lending design, mtTokens for yield, clear liquidation logic, strong audit results, a planned stablecoin, a confirmed V1 launch on testnet and a presale that is already over 90% through Phase 6 at $0.035. Combined, those factors explain why many investors now see MUTM as one of the top cryptocurrencies to watch for possible 500% growth into Q1 2026.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance