Bitcoin’s push toward $94,000 has changed the tone of the market. After weeks of consolidation below key resistance, the latest move higher is being backed by something bulls have been waiting for: renewed institutional demand and improving technical structure.

For large holders, the rally looks like confirmation. For retail investors, it raises a different question: what comes next once Bitcoin’s move is already underway?

As BTC attracts fresh capital at higher levels, attention is once again turning toward earlier-stage opportunities positioned to benefit from the next phase of adoption.

That shift is putting small-cap high-utility projects like Digitap ($TAP) back on the radar as one of the best cryptos to buy for 2026, particularly for investors looking beyond large-cap momentum.

ETF Inflows And Corporate Buys Fuel BTC Strength

One of the clearest signals behind Bitcoin’s recent strength is the return of institutional buying. On January 5, Strategy disclosed a $116 million Bitcoin purchase, bringing its total holdings to 673,800 BTC, valued at roughly $62.8 billion.

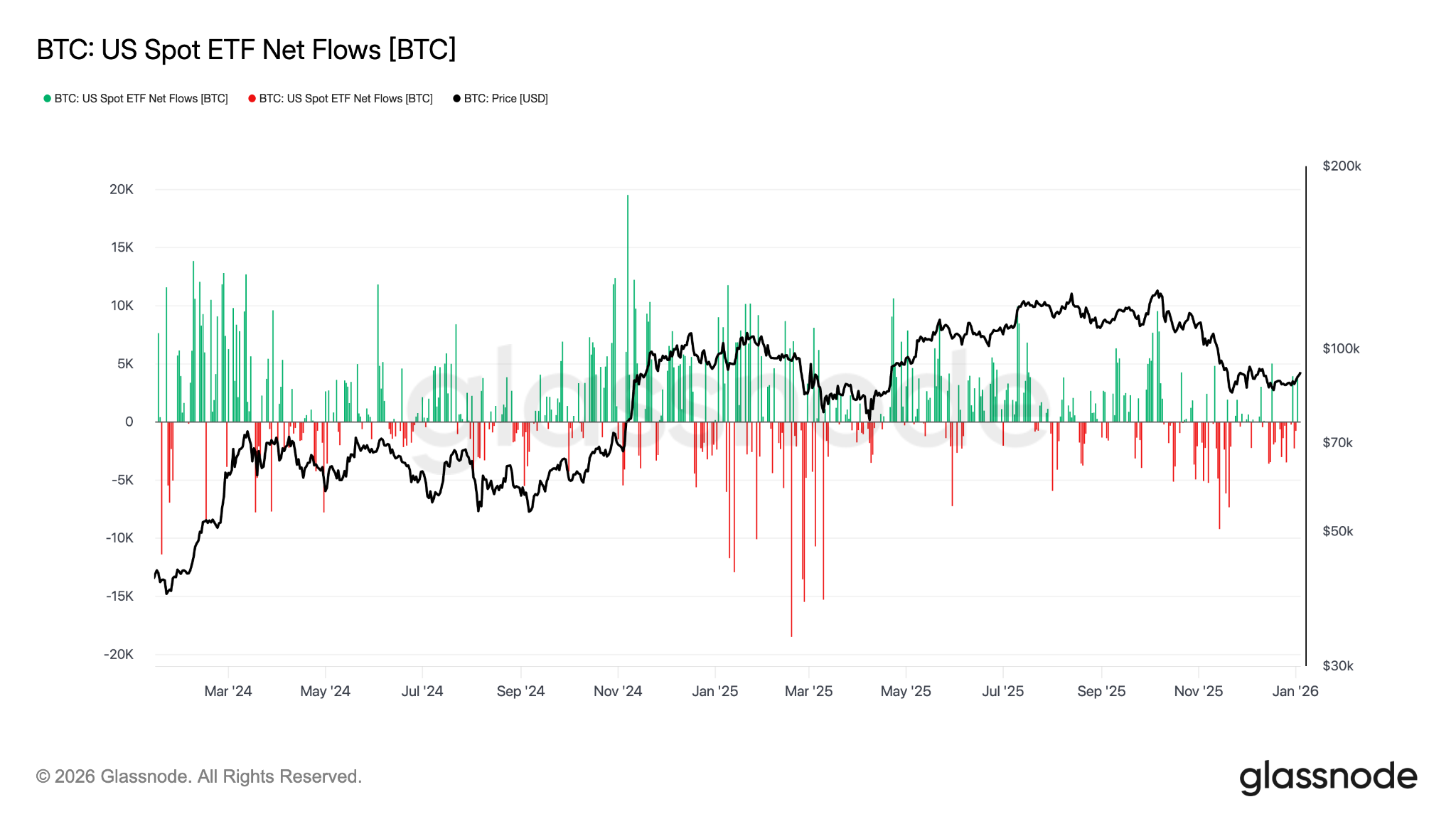

At the same time, U.S. spot Bitcoin ETFs recorded $324 million in net inflows this week, reversing December’s outflows, according to Glassnode.

This matters because ETF demand absorbs supply quietly. These flows remove coins from circulation, reducing sell-side pressure and helping support higher levels.

For Bitcoin, this reinforces its role as a macro asset. For the broader market, it signals that capital is flowing into crypto again, not just rotating within it.

Bitcoin Holds Key Levels As Momentum Builds

From a technical perspective, Bitcoin’s structure has strengthened. Price is holding above the 21-day moving average around $89,400, while the MACD histogram has turned positive, indicating growing upside momentum. RSI near 58 suggests Bitcoin is not yet stretched, leaving room for further gains.

Many traders now see the $92,000–$94,000 zone as a consolidation range rather than resistance. A sustained move above $95,000, the 61.8% Fibonacci retracement, could trigger systematic and algorithmic buying, with $98,000 cited by some analysts as the next major target.

Why Bitcoin’s Rally Changes Retail Strategy

When Bitcoin rallies through major levels, retail investors often face a dilemma. Entering at higher prices can feel late, yet sitting on the sidelines risks missing broader market expansion. Historically, this is when attention begins to shift toward lower-cap projects that haven’t yet repriced but stand to benefit from renewed interest in crypto.

That rotation isn’t about abandoning Bitcoin. It’s about balance. As BTC absorbs institutional capital and becomes more stable, retail investors often look for higher-growth best altcoins to buy tied to real-world use cases rather than pure price momentum. This is where Digitap enters the picture.

USE THE LIMITED CODE “NEWTAP” FOR BONUS TAP TOKENS

Digitap Leads as A Retail-Focused Platform For Crypto’s Next Chapter

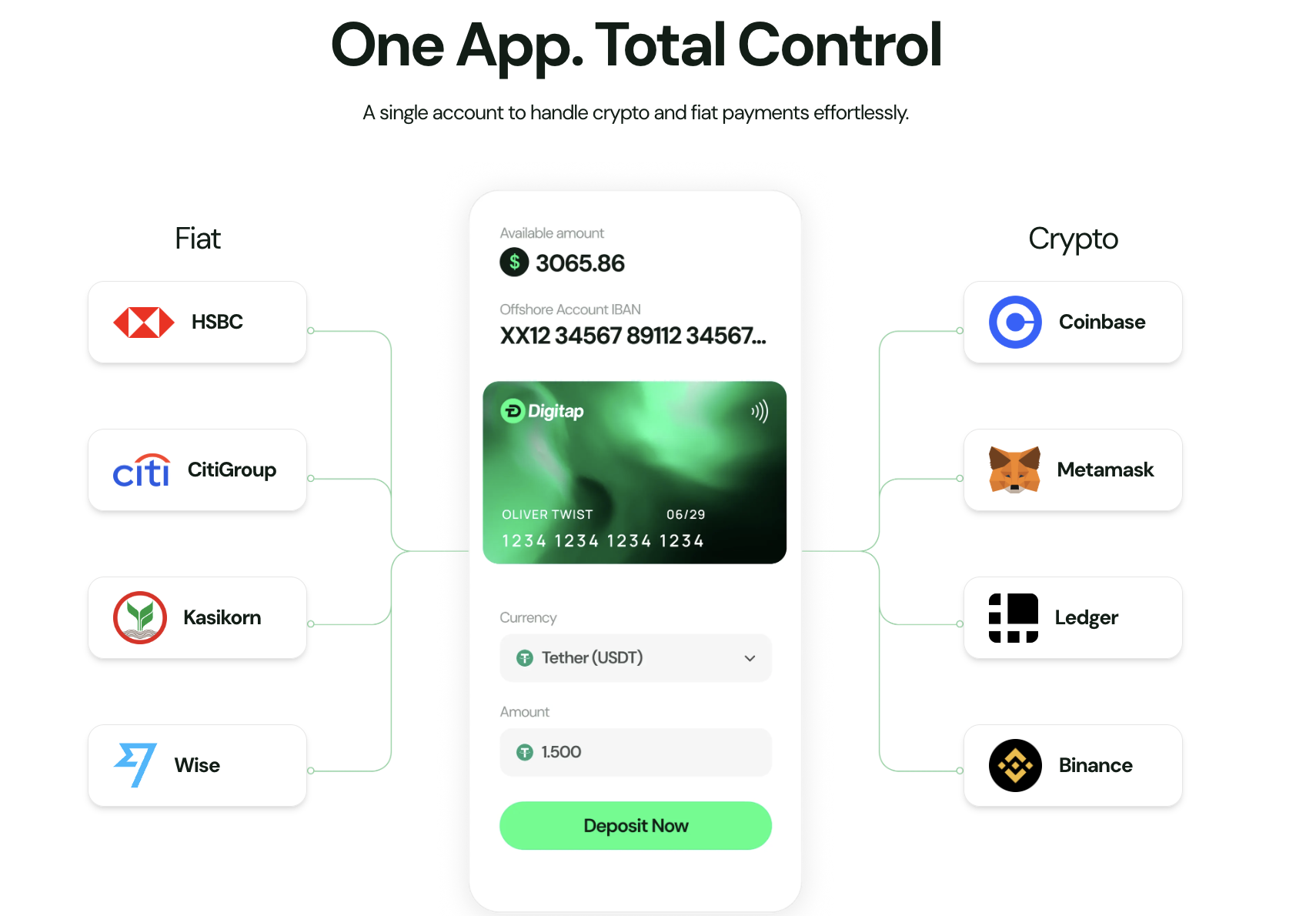

Digitap is designed around how crypto is actually used in everyday life. Cross-border payments, online income, and digital settlements are now common, yet moving funds between wallets, exchanges, and banks remains inefficient.

Digitap addresses this by keeping crypto and fiat balances in a single app, allowing funds to be received, converted, and spent without jumping between platforms. Even at the presale stage, the platform has already connected over 120,000 wallets, pointing to early real-world adoption.

Settlement is a core focus. Incoming crypto can be automatically converted into cash, reducing exposure to short-term volatility between payment and use.

Digitap also supports multi-rail settlement, routing funds into traditional systems like SEPA and SWIFT when needed. Transactions are dynamically routed rather than forced through a single path, helping limit unnecessary conversion costs.

Importantly, Digitap offers a No-KYC wallet plan for basic use, allowing users to get started with minimal friction. Higher limits and card features are available through optional, tiered verification handled discreetly by regulated partners. This structure gives users control over privacy while keeping compliance available when required.

The $TAP token powers platform activity. Holding it reduces fees, unlocks account features, and provides access to rewards. With a fixed supply of 2 billion tokens and buybacks and burns tied to usage, token value is aligned with real demand; one reason Digitap continues to be discussed among the best crypto to buy now heading into 2026.

$TAP Leads the Best Crypto Presales As Bitcoin Breaks $94K

Digitap’s presale is progressing steadily alongside Bitcoin’s rally. The current $TAP price is $0.0411, with the next stage set at $0.0427. So far, the project has raised approximately $3.5 million, with nearly 175 million tokens sold, and the presale is more than 66% complete.

Earlier stages began at $0.0125, meaning the token price has already climbed more than 220%. Each stage increase locks in higher entry points, creating upward pressure without the volatility seen in open markets.

USE THE LIMITED CODE “NEWTAP” FOR BONUS TAP TOKENS

Why The Next Opportunities May Sit Beyond BTC

Bitcoin’s break toward $94,000 confirms that institutional interest remains strong heading into 2026. For large players, BTC is the anchor. For retail investors, however, the next question is where additional upside may come from once Bitcoin’s move is already in progress.

Projects like Digitap sit in that window. With a live product, growing user base, and a token model tied to real-world use, $TAP offers exposure to the next stage of crypto adoption rather than the last one.

As Bitcoin pushes higher and capital flows back into the space, the best crypto to buy for 2026 may not be the one making headlines today, but the one quietly building underneath them.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app