TLDR

- Bitcoin jumped over 4% to break above $95,000 while Ethereum climbed more than 7% to $3,330 on Wednesday

- Lower than expected US inflation data reinforced expectations that the Federal Reserve will continue cutting interest rates this year

- Over $688 million in crypto derivatives positions were liquidated in 24 hours, with short sellers accounting for $603 million

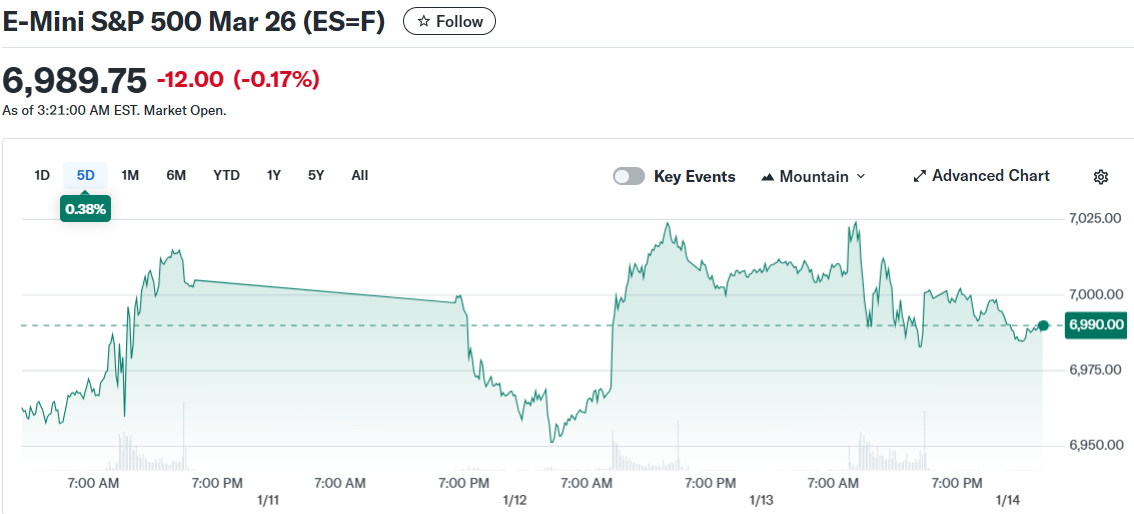

- US stock futures dropped Wednesday morning with Dow futures down 0.3% and S&P 500 futures sliding 0.2%

- Political tension increased after reports that the Justice Department served grand jury subpoenas on the Federal Reserve earlier this week

Crypto markets moved higher on Wednesday while US stock futures pulled back from recent highs. The divergence came as investors processed new inflation data and growing political pressure on the Federal Reserve.

Bitcoin rose more than 4% over 24 hours to break above $95,000. This marked the first time the cryptocurrency reached this level in a week. Ethereum outperformed other major cryptocurrencies with a gain of over 7% to reach $3,330.

Other large cryptocurrencies also posted gains. Solana, Cardano, XRP and BNB all moved as much as 9% higher during the trading session.

US inflation data came in lower than expected on Wednesday. The report reinforced market expectations that the Federal Reserve will continue reducing interest rates throughout 2026. Lower inflation typically reduces pressure on bond yields and improves liquidity conditions.

Core CPI is at the lowest level since 2021. https://t.co/pCbKkErSEW pic.twitter.com/rQ4iaiQe9N

— Geiger Capital (@Geiger_Capital) January 13, 2026

These conditions have historically benefited cryptocurrencies and other risk assets. The setup encouraged traders to move into digital assets viewed as alternatives to traditional currencies.

Political developments also influenced market movements. The Justice Department served grand jury subpoenas on the Federal Reserve earlier this week. This action created uncertainty around the central bank and weakened the US dollar.

Futures Markets See Heavy Liquidations

The crypto price surge triggered major liquidations in derivatives markets. More than $688 million in crypto futures positions were wiped out over the past day according to Coinglass data. Short sellers accounted for roughly $603 million of these liquidations.

Nearly 122,000 traders had their positions closed as prices moved higher. The largest single liquidation was a $12.9 million ETHUSDT position on Binance. The liquidation pattern shows many traders had bet on falling prices before the inflation report.

Traditional markets showed different behavior on Wednesday. Stock futures declined in morning trading after the Dow Jones and S&P 500 pulled back from record highs the previous day.

Dow futures dropped about 0.3% while S&P 500 and Nasdaq 100 futures slid 0.2%. The decline followed a down session on Tuesday when the Dow led major indexes lower.

Bank Earnings and Supreme Court Ruling in Focus

Major banks reported earnings on Wednesday morning. Bank of America, Wells Fargo and Citigroup all released their quarterly results before market open. JPMorgan Chase kicked off earnings season Tuesday with results that disappointed investors and sent its shares lower.

Investors also waited for a Supreme Court ruling on President Trump’s tariff authority. The court had its next scheduled opinion release set for Wednesday. Trump posted on social media Monday that an unfavorable ruling would be damaging for the United States.

Trump continued his public criticism of Federal Reserve Chair Jerome Powell on Tuesday. His comments came as the Justice Department launched a criminal investigation into the Fed leader. The legal action has drawn pushback from business leaders and some Republican lawmakers.

Financial stocks faced additional pressure from Trump’s proposal to cap credit card interest rates at 10% for one year. Visa and Mastercard shares closed lower Tuesday as investors considered how this policy might affect payment networks.

Asian equity markets climbed to record highs on Wednesday. Silver broke above $90 an ounce for the first time while gold traded near all-time highs.