Could This Be the Turning Point in the Presale Market? An unbiased comparison mode. These early crypto presales in 2026 feel different than the previously staged presales. Now, all one wants is to ensure the story behind a cryptocurrency holds some truth. The legitimacy and market traction of each project is being watched far more closely.

It’s not a trend, A quiet movement is taking shape, this prioritizes proof, purpose, and long-term viability.

IPO Genie ($IPO), BlockDAG, and Bitcoin Hyper are three names that keep surfacing in conversations around leading presale opportunities. Because each takes a completely different approach to solving problems in the crypto space. That contrast makes comparing them tricky but necessary.

What Makes These Three Stand Out?

IPO Genie isn’t reinventing blockchain infrastructure. It aims to bridge private equity and retail crypto, using AI to tokenize access to early-stage deals typically reserved for venture capital.

BlockDAG is a pure infrastructure presale, using a DAG-based architecture to boost speed and scalability while maintaining EVM compatibility, allowing Ethereum apps to migrate with minimal friction.

Bitcoin Hyper addresses Bitcoin’s speed and smart contract limits with a Layer 2 on the Solana VM, offering faster, programmable transactions while retaining Bitcoin’s core security.

How BlockDAG’s Technology Actually Works

Traditional blockchains process transactions sequentially, with one block following another in a straight line. This feels intuitive but creates bottlenecks. Many transactions don’t interact with each other, yet every node still has to process them in order. BlockDAG uses the Phantom GhostDAG protocol to allow parallel processing of unrelated transactions.

BlockDAG’s design is often explained as running multiple transactions at once, then organizing them afterward. Its presale allocated a third of the 150 billion token supply to the public, with only a small portion reportedly remaining. Still, concerns linger. Community discussions point to questions around website control, third-party marketing involvement, and transparency, issues that warrant closer scrutiny before committing funds.

Bitcoin Hyper’s Layer 2 Approach

Bitcoin wasn’t designed for speed or flexibility, which is both its strength and weakness. Security came first; everything else was secondary. Bitcoin Hyper doesn’t try to change Bitcoin itself. Instead, it processes transactions off-chain using extremely low latency sequencing, then batches proofs back to Layer 1 at intervals.

The environmental angle matters as well. While Bitcoin’s energy use remains high, Bitcoin Hyper’s Layer 2 design claims minimal consumption. Its fixed 21 billion token supply and extended presale, running from Q3 2025 to Q1 2026, have drawn strong interest alongside scrutiny. Some investors question the long timeline and raise wallet security concerns, factors worth weighing when evaluating any crypto presale.

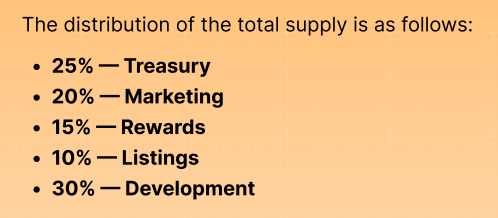

Proof of Bitcoin Hyper tokenomics: a clear breakdown of token distribution

Why IPO Genie Attracts Attention Among the Best Crypto Presales 2026

| This early crypto presale is on the 37th presale stage, sitting at $0.00011440 per token. But price alone doesn’t mean much without context. What makes it interesting is the use case. Democratizing access to private company investments through blockchain rails. The platform uses AI to scout promising startups, then tokenizes investment opportunities so retail participants can get in early. |

IPO Genie isn’t just another DeFi or infrastructure play. It aims to bridge Web3 technology with traditional startup investing through real-world utility. While analysts have noted its growth potential, there again risk is inevitable with any early-stage projects. What sets it apart so far is transparency, clear documentation, verified team structures, and a focus on education and tools over short-term token hype.

Crypto Presale Comparison: All Three Side by Side

| Feature | IPO Genie ($IPO) | BlockDAG (BDAG) | Bitcoin Hyper (HYPER) |

| Core Focus | AI-powered private equity access | DAG infrastructure scalability | Bitcoin Layer 2 with smart contracts |

| Current Phase | Phase 37 at $0.00011440 | Final 40M tokens at $0.003 | Multi-stage, currently ~$0.013575 |

| Total Raised | Growing community participation | Substantial but disputed figures | Over $30.44M reported (5th Jan 2026) |

| Payment Methods | ETH, BNB, USDT | Standard crypto options | ETH, USDT, BNB, Credit Card |

| Key Strength | Real-world startup access | High-throughput DAG technology | Bitcoin security + DeFi flexibility |

| Main Concern | Execution complexity | External agency control | Extended presale duration |

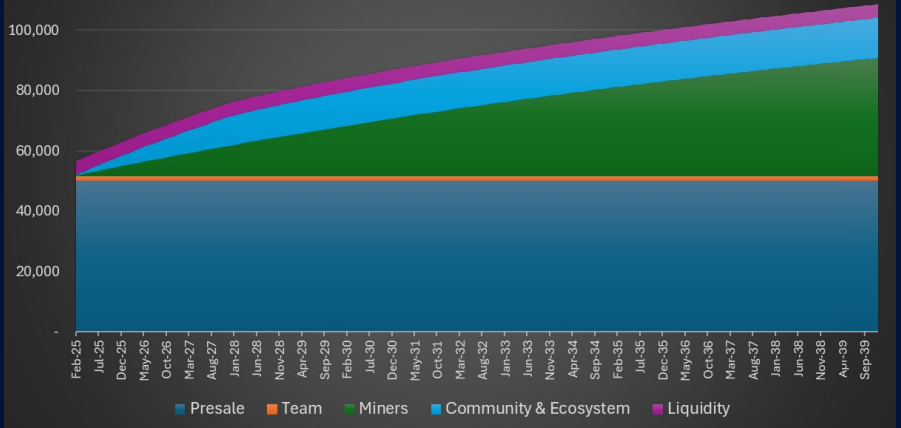

Understanding presale tokenomics analysis reveals different distribution strategies. BlockDAG allocated 33.3% for presale and 50% for mining rewards. Bitcoin Hyper dedicated 30% to development and 25% to treasury operations. IPO Genie emphasizes community rewards through airdrops and educational initiatives, though complete allocation percentages weren’t disclosed in available materials.

Snapshot from the BlockDAG whitepaper showcasing the token economics distribution

Quick Decision Framework:

- Choose IPO Genie if you’re looking for a crypto presale that offers exposure to private-market deals, paired with governance rights and AI-supported investment selection

- Opt for BlockDAG if you prioritize infrastructure innovation and can tolerate governance uncertainty

- Select Bitcoin Hyper if you need Bitcoin’s security with programmability and accept longer token release timelines

- Choose none if current risk levels exceed your comfort zone; waiting costs nothing but potential upside

What Actually Matters When Choosing the Top Crypto Presales to Buy Now

The best crypto presales of 2026 won’t be determined by price alone or even technology. Sustainability matters more. Can the project deliver on promises? Does the team have credible experience? Is there genuine demand beyond speculative trading?

No presale is risk-free. Weighing crypto presale risks and rewards requires honest assessment. Even the most promising projects can fail due to market conditions, technical challenges, or regulatory shifts. The crypto presale comparison here is about understanding what each project attempts and whether that aligns with your investment thesis.

The next few months will reveal which of these projects had substance and which relied too heavily on marketing. Results, not marketing, will show which projects are built to last.

Official Channels:

Website URL & Whitepaper | Telegram | X – Community

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Always research before investing in digital assets.

Frequently Asked Questions

What does Token Generation Event (TGE) mean for presale buyers?

TGE is when your purchased tokens become actual blockchain assets you can transfer or trade. Before TGE, you hold a claim, not the token itself. Projects can delay TGEs for development or regulatory reasons, and many lock tokens through vesting schedules that release gradually over months.

How do DAG structures differ from regular blockchains?

Traditional blockchains process transactions one-by-one in sequence. DAG structures handle multiple transactions simultaneously, like opening several checkout lanes instead of one. This can mean faster speeds and lower fees, but requires more complex validation to prevent conflicts.

What risks come with extended presales?

Long presales may signal weak demand or give teams funds without delivering products. Early buyers risk overpaying if later stages offer better terms. Market conditions and regulations can shift dramatically during multi-month presales, affecting both launch timing and token value.