In the rapidly changing landscape of 2026, the global financial network is no longer operating in isolation. It has become a race toward integration, as traditional banking operators are on the verge of being disrupted by blockchain.

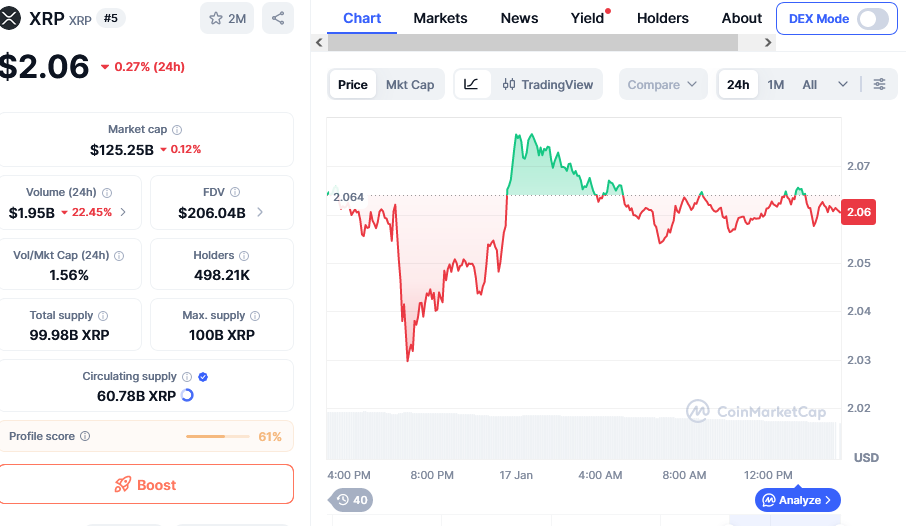

Investors are no longer interested in knowing which crypto will explode soon. All they want now is to find a project that could replace their bank account. Therefore, Ripple’s recent rise to $2.04 indicates the market is maturing but still hungry for smooth financial integration.

While XRP has long been the dominant force in cross-border settlements, a new project is challenging the status quo. Digitap ($TAP), an omni-bank ecosystem, is building infrastructure to make crypto spendable in the real world. It combines crypto and fiat into a single platform for everyday users.

This crypto presale project has bridged the gap between high-yield decentralized finance and institutional banking. As XRP trades at a stable $2.04, smart money is moving into $TAP, recognizing it as the best crypto to buy for banking this year.

From Institutional Bridges to Individual Banking

For more than a decade, the promise of banking the unbanked was the selling point of the blockchain industry. XRP led on this front, positioning it perfectly as the bridge between central banks and private institutions.

Nonetheless, the market has now matured, moving past the era of test programs into the phase of utility. While XRP is a major player in institutional liquidity, it is marketed as a tool for banks, rather than for individual users.

Digitap comes in to fill this gap. It is building an ecosystem where individual users are the main beneficiaries of blockchain efficiency. Its omni-banking infrastructure is built to be the all-in-one money app. It offers a bridge that allows users to hold, spend, and transfer fiat currencies alongside cryptocurrencies without leaving the platform.

XRP relies on external operators, such as banks and payment providers, to adopt its ledger for it to thrive. On the other hand, Digitap creates value using direct retail and business adoption. Its integration with Visa provides a clear pathway to real-world mass adoption while XRP still operates on-chain.

Digitap’s Omni-Bank Turns Digital Assets into Daily Buying Power

While most other cryptos thrive on hype and trends, Digitap is building an ecosystem to make crypto spendable. Its dominance in the banking sector arises from its omni-bank approach. The project offers a Visa-powered debit card that enables investors to spend their crypto like cash at over 80 million merchant locations worldwide.

Whenever users tap their phone at any store, the Digitap engine handles all conversions instantly. Therefore, the merchant receives payments in their local currencies while the buyer uses their crypto balance to pay. This tap-to-pay strategy has brought crypto to the global financial network.

Unlike many projects still struggling in their roadmap phase, Digital already offers live products. Its app is available on iOS and Google Android, offering features that respect user privacy while maintaining global compliance.

As investors look for solutions to fragmented wallets and complex DeFi platforms, projects focusing on making crypto simple to use have an advantage. $TAP is designed to work within a growing environment, connecting its value to participation, not speculation. Hence, it is a good crypto to buy for banking this January.

$2.04 XRP is No Match for the Omni-Bank Revolution

XRP has survived many years of regulatory scrutiny and endless legal battles. Nonetheless, it is now dominant in institutional portfolios, underpinned by spot ETFs and massive trading volumes. For investors looking for the best altcoin to buy this January, XRP’s massive size is its biggest hurdle.

Trading at around $2.04 could mean that XRP’s regulatory and uncertainty risk is mostly priced in. But this market maturity comes with limitations. The capital needed to double its price is massive. The token has become a blue-chip asset, reliable and stable, but it will hardly offer the massive ROI that investors want.

Moreover, Ripple has turned its attention strategically toward custody and corporate treasury services. Although this move secures XRP’s position in the financial world, it leaves a huge gap in the retail and small-business payment space.

XRP might be the bridge between banks, but Digitap is the bank. As the market now favors stablecoin-driven remittances, XRP might still have its place on-chain. Nonetheless, Digitap is rapidly taking over the entire financial system since it is building infrastructure to settle payments in the most efficient asset.

Scarcity and Revenue-Backed Burns Define the Better Banking Buy

A major reason why investors favor Digitap over XRP in the 2026 market is the underlying economic structure of these tokens. XRP already commands a huge circulating supply. Although its Ripple escrow network offers some level of predictability, it is still affected by macro-events, failing to maintain upward momentum in times of increased volatility.

On the contrary, $TAP is designed on a deflationary model. It has a hard cap of 2 billion tokens and has no secret inflationary mechanics. Thus, the token is developed for scarcity.

Digitap uses a buy-back and burn mechanism, where 50% of the platform’s revenue is used in the permanent removal of $TAP from circulation. This strategy creates a direct connection between the growth of the ecosystem and the value of the token.

As more users join the Digitap omni-bank and more transactions are processed, $TAP’s supply reduces. Hence, it rewards the long-term investors in a manner that XRP’s fixed utility model cannot match. Therefore, $TAP is the best crypto to buy for banking in 2026.

Why $TAP is the Best Crypto to Buy Over XRP for Banking

XRP has created a great opportunity for investors looking for mature tokens with reduced cases of uncertainty. After establishing itself over the years, this coin now provides familiarity and resilience for users who believe institutions will continue investing in cryptos.

On the other hand, Digitap is a perfect investment for users who are aware that early positioning comes with high risks but also offers great rewards. Smart investors allocate money to crypto presales for massive growth. Thus, $TAP is a good crypto to buy for the 2026 banking industry.

$TAP’s 69% Crypto Presale Discount Dominates XRP at $2.04

Digitap’s massive banking utility appeals to early investors who see it as a lucrative long-term investment. The project has raised over $4.1 million, making it one of the most successful crypto presales in the 2026 market.

Currently available at $0.0427, $TAP’s deeply discounted entry price and growth potential fuel its increased demand. More than 191 million tokens have been sold as investors prefer it over XRP at $2.04. The current price is 69.5% discount from the launch price of $0.14.

Why Digitap Beats XRP in 2026’s Banking Space

XRP at $2.04 is a safe bet for investors who believe that institutionalization of crypto will happen in the long term. The token is tried and tested and might remain among the top cryptos in the foreseeable future.

But for those who want the best crypto to buy for the 2026 banking market, Digitap is a great asset to acquire. This omni-bank project merges early-stage growth potential with a fully functional, live product. It offers a massive level of accessibility and utility that established projects like XRP cannot replicate.

Digitap has built a well-structured crypto presale, offering a huge discount before it reaches its $0.14 exchange listing price. Hence, $TAP offers the type of asymmetric upside that evaporated from XRP long ago.

In the race to become a dominant force in global banking, Digitap is leading the way.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app