We have seen that most tokens don’t really do anything. They promise the future, talk about community, maybe slap “AI” in the name, and hope attention follows. But every once in a while, projects emerge that are built around real utility, real access, and real use cases.

Right now, three projects are getting attention for very different reasons: IPO Genie ($IPO), Ozak AI, and DeepSnitch AI. Each approaches the market from a unique angle. But only one is aiming to open the door to something that has been historically inaccessible to everyday investors, a multi-trillion-dollar private market.

Let’s break down what makes each one different and why it matters.

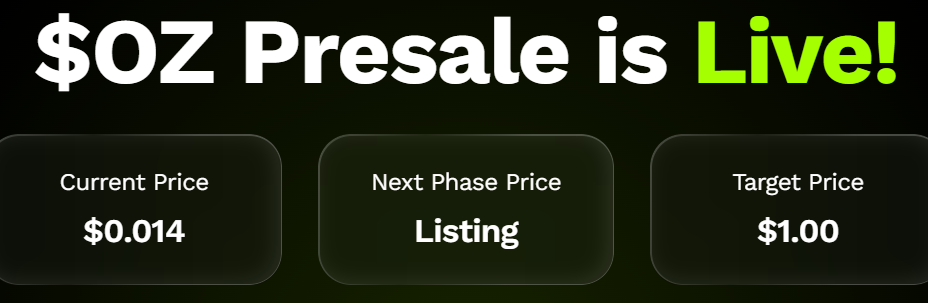

Ozak AI: Predictive Intelligence for Crypto Markets

Current presale screenshot form the Ozak AI website

Ozak AI centers on data analysis. Its core idea is straightforward: use artificial intelligence to process large sets of market data and identify trends, sentiment shifts, and possible price movements.

Where Ozak AI shows strength is in tooling. It’s designed for users who already operate inside the crypto market and want clearer signals rather than relying on instinct or fragmented data.

What works well:

- AI-driven analytics for market behavior

- Designed for traders and developers seeking insight, not speculation

- Appeals to users who value data over narratives

Where it stops short:

Ozak AI improves decision-making, but it doesn’t expand access. Users still operate within the same public crypto environment. The tools may sharpen awareness, but they don’t introduce new asset classes or early-stage investment opportunities beyond existing markets.

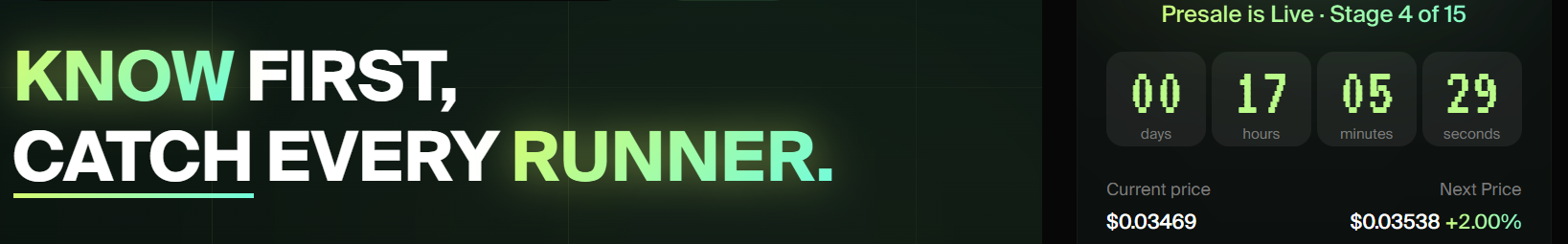

DeepSnitch AI: Transparency and Security Through AI

Current presale snapshot form DeepSnitch AI official site

DeepSnitch AI takes a more defensive role. Instead of helping users trade better, it helps them avoid risk. The platform monitors blockchain activity to flag suspicious behavior, fraud patterns, and manipulation.

This kind of infrastructure has practical relevance as the crypto market matures and regulatory scrutiny increases.

What it does well:

- AI-based on-chain monitoring

- Risk detection without exposing user identity

- Useful for exchanges, platforms, and compliance-focused participants

Where it stops short:

DeepSnitch AI strengthens safety inside existing systems. It doesn’t change who gets access to capital or investment opportunities. For individual token holders, value depends largely on institutional adoption rather than direct participation benefits.

Best Crypto Presale for Access: Why IPO Genie ($IPO) Is Different

IPO Genie approaches the problem from an entirely different direction.

| Instead of improving how people trade crypto, it focuses on what people are allowed to invest in. Specifically, it targets the private equity and pre-IPO market, estimated at around $4 trillion, which has long been limited to venture capital firms, institutions, and high-net-worth individuals.

For decades, retail investors only gained exposure after companies went public, often long after most growth had already occurred. |

What sets IPO Genie apart:

- Exposure to private and pre-IPO opportunities through tokenization

- Lower barriers to entry compared to traditional venture platforms

- Designed as an access layer rather than a trading tool

The platform frames participation as possible with relatively small capital, sometimes described at a $10-level entry rather than six-figure minimums. That structural difference is what separates IPO Genie from most tokens currently discussed as the best crypto presale.

Why Access Matters More Than Tools

Ozak AI and DeepSnitch AI both improve how participants interact with crypto systems. IPO Genie aims to change what those participants can interact with.

That distinction matters.

Private companies now stay private far longer than they did two decades ago. Many of the largest gains occur before any public listing. By the time retail investors can participate, valuations have already expanded.

From a structural perspective, IPO Genie is less about market timing and more about correcting access imbalance. If successful, it functions less like a typical utility token and more like a gateway to early-stage investment opportunities that were previously unavailable.

What the $IPO Token Represents in Practice

Holding $IPO is tied directly to platform participation rather than abstract ecosystem benefits.

Utility described by the project includes:

- Tiered access to private deals

- Governance voting on deal selection

- Staking mechanisms tied to platform activity

- Revenue participation through platform fees

- Secondary liquidity rather than long lock-ups

Importantly, the team has outlined extended vesting schedules, with tokens locked for two years and released gradually. This mirrors traditional venture structures rather than short-term speculation cycles.

Can All Three Projects Coexist?

Yes. They solve different problems.

- Ozak AI improves how blockchain data is analyzed

- DeepSnitch AI improves trust and safety

- IPO Genie expands access to capital formation

As the crypto market matures, demand is shifting away from attention-driven tokens toward systems connected to real usage, governance, and economic activity.

Tokenized private markets are expected to grow significantly over the next decade. Whether that growth remains restricted to institutions or becomes accessible to broader participants is still unfolding.

What This Comparison Reveals About Crypto in 2026

The strongest projects emerging in 2026 aren’t necessarily the loudest. They’re the ones tied to real infrastructure, real access, or real constraints being solved.

Ozak AI and DeepSnitch AI each serve a purpose. But when placed side by side, IPO Genie stands out for addressing a long-standing structural gap rather than optimizing within existing boundaries.

As early-stage investment opportunities continue to move on-chain, participation may depend less on capital size and more on access design. That shift, more than short-term price movement, is what makes this comparison worth paying attention to.

Official Channels:

Website URL & Whitepaper | Telegram | X – Community

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Always research before investing in digital assets.

Frequently Asked Question

What makes a crypto project a “legitimate” AI token rather than a marketing label?

A legitimate AI token is usually tied to a working system where artificial intelligence performs a clear function, such as data analysis, risk detection, or automation. Independent documentation, technical explanations, and real users matter more than branding. Research from organizations like the World Economic Forum highlights that transparency and measurable use cases are key indicators of credibility in emerging technologies.

Source: /topics/blockchain

Why are private markets considered harder to access than public crypto markets?

Private equity and pre-IPO investments typically require high minimum capital, long lock-up periods, and accredited investor status. According to PwC, most value creation in high-growth companies happens before public listing, which explains why access is tightly controlled.

Source: Private equity and principal investors

How do AI tools like Ozak AI and DeepSnitch AI fit into the broader crypto market?

AI-driven analytics and security tools support decision-making and risk management within existing crypto systems. Chainalysis notes that such infrastructure helps improve market transparency and trust, especially as regulatory oversight increases.

Source: crypto-crime-and-compliance/