The crypto market is once again driven by perception rather than price. As regulatory delays continue and large caps are stuck, traders are focused on one question. What could be next in a Binance new listing announcement?

This question is focused on late-stage presales with real utility, growing traction, and the right narrative timing. Deepsnitch AI is mentioned always in conversations around Binance listing rumors, upcoming, especially as its presale window tightens.

Regulatory delays push traders toward exchange-driven narratives

Crypto market structure legislation in the United States is facing another delay, according to reports. The delay has pushed key decisions around crypto regulation into late February or March, extending uncertainty across the market.

Trump’s executive order barring institutions from purchasing single-family homes has shifted political focus, leaving crypto legislation caught in limbo. Although this administration publicly supports the crypto community and innovation, some lawmakers still question the enforcement authority between the SEC and CFTC.

Binance listings have often acted as liquidity events during similar periods, redirecting capital toward tokens that show traction without regulatory dependence. That backdrop is why potential exchange listings are becoming one of the most powerful narratives in the market right now.

Why Deepsnitch AI fits the Binance new listing announcement utility playbook

Deepsnitch AI is unique because it is not waiting for launch to prove relevance. It is already live during presale, offering tools that traders can use. Snitchfeed tracks whale wallet movements and sudden token spikes in real time. SnitchGPT converts complex blockchain data into direct, actionable insights.

This functional approach aligns closely with the types of projects that tend to attract attention during Binance listing rumors and upcoming cycles. Exchanges favor tokens with clear use cases, active users, and measurable engagement, and Deepsnitch AI checks each of those boxes before launch.

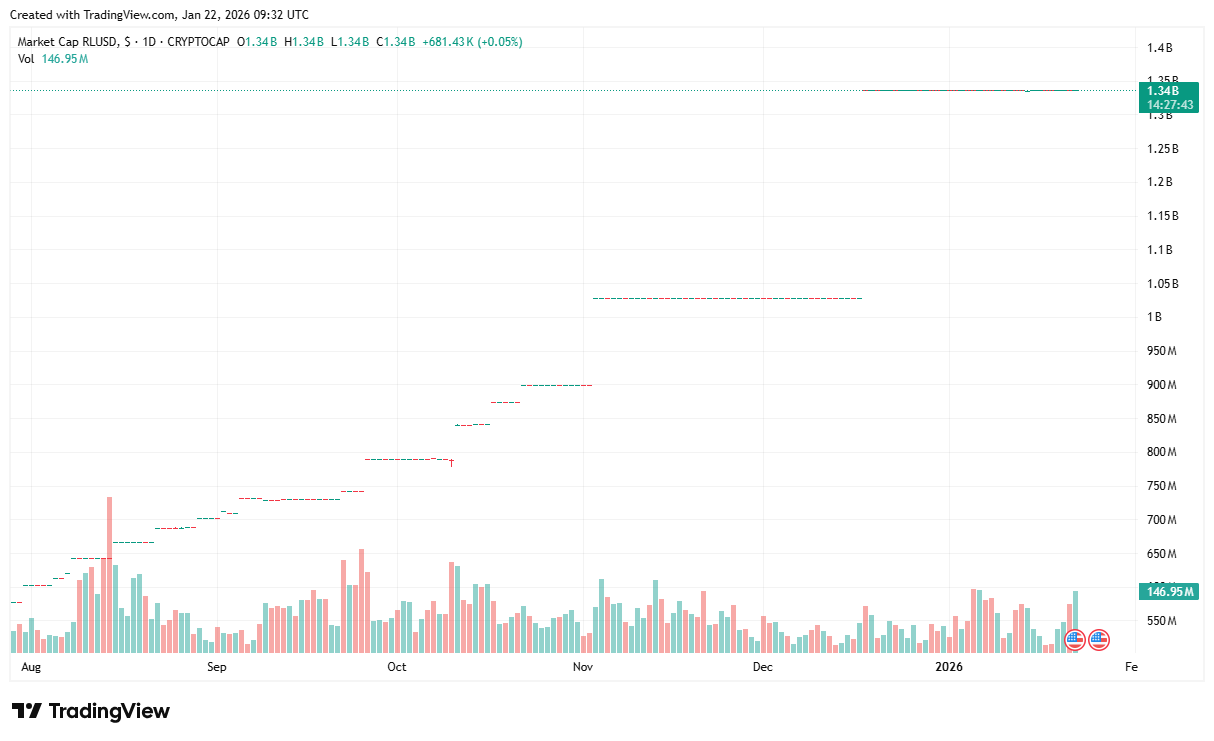

The token is priced at $0.03681 and has raised over $1.3 million, with more than 31 million tokens already locked in staking. That level of commitment matters when traders are speculating around potential exchange listings.

Momentum is also being amplified by access bonuses. Traders entering now are stacking allocation through DSNTVIP30, which offers a 30% bonus on $2,000 and above. DSNTVIP50 unlocks a 50% bonus at $5,000. DSNTVIP150 doubles allocation by 150% at $10,000, while DSNTVIP300 delivers a 300% bonus on $30,000 and above. These bonuses are fueling Binance new listing announcement chatter because they create urgency and concentrated positioning ahead of launch. However, the window to be a part of this moonshot project is closing very fast.

RLUSD shows how to get a Binance new listing announcement

Ripple’s RLUSD listing provides a blueprint on how to go about getting a Binance new listing announcement. On January 21, Binance confirmed RLUSD spot trading with zero fee promotions, portfolio margin eligibility, and future inclusion in Binance Earn. This was done on regulatory clarity, liquidity readiness, and multichain functionality.

Although RLUSD operates in a different category, the listing shows that Binance values utility, demand, and immediate use cases matter more than hype alone. That framework is why traders tracking Binance listings are watching presales like Deepsnitch AI more than meme-driven launches.

SUBBD has a chance to get a Binance new listing announcement, but its path is slower

SUBBD focuses on the creator economy, enabling tokenized subscriptions between creators and fans. The project has raised over $1.5 million and promotes access to a large creator network.

However, SUBBD’s adoption depends heavily on onboarding non-crypto users. That process takes time, education, and external platform cooperation. Although SUBBD could eventually feature in Binance listing rumors, its reliance on long-term behavioral change makes it less appealing compared to fast-cycle exchange narratives.

Final thoughts

No one can predict a Binance new listing announcement, but traders always try to position ahead of past narratives that exchanges have rewarded. Deepsnitch AI combines live functionality, rising presale urgency, and a narrowing entry window.

With DSNTVIP30, DSNTVIP50, DSNTVIP150, and DSNTVIP300 accelerating allocations, many traders see this as the final stage before the presale narrative closes and post launch speculation begins.

As regulatory delays persist and Binance new listing announcement continues to drive liquidity changes, Deepsnitch AI is perceived as one of the few presales for how exchange narratives actually form.

Visit the official DeepSnitch AI website, join Telegram, and follow on X for the latest updates.

FAQs

Is Deepsnitch AI confirmed for a Binance listing?

No. There is no confirmation. The discussion centers on market perception, utility focus, and how traders position ahead of Binance listing rumors, upcoming.

Why does a utility like Deesnitch AI matter for potential exchange listings?

Projects with active users and real demand tend to sustain volume post listing, which aligns with potential exchange listings criteria.

Could SUBBD still get listed on Binance like Deepsnitch AI?

Yes, but its reliance on non-crypto adoption introduces delays, making it a slower narrative compared to trader-focused tools.