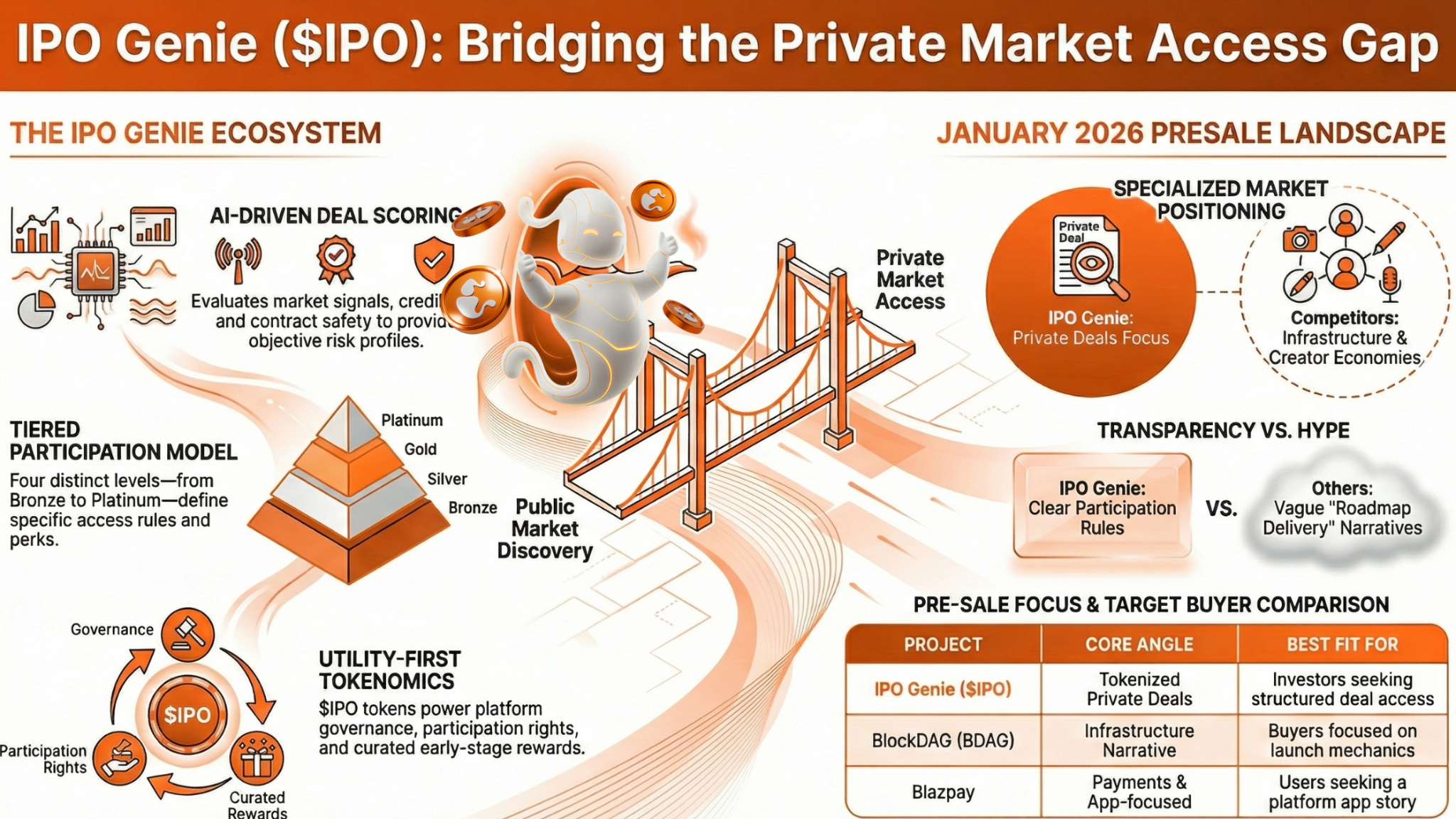

What if the biggest gains usually happen before the public ever hears the name of a company? That is the logic behind private rounds, seed deals, and pre IPO access. However, most retail investors only get a chance after the story is already popular. IPO Genie ($IPO) is built around changing that access gap with a structured, token-based model.

In January, several presales compete for attention with AI, trading apps, or infrastructure claims. Still, readers looking for clarity often ask a simple question: what does the token do after purchase, and what rules control access? IPO Genie publishes a clear answer through tiers, token utility, and an AI scoring approach tied to deal selection.

Key Takeaways

- IPO Genie frames $IPO as the access token for curated venture-style opportunities, with tiers that change eligibility and benefits.

- Some competing presales are strong narratives, but they vary in how clearly they explain post-presale utility and participation rules.

- Presale incentives can increase token allocation, yet they do not remove volatility, liquidity risk, or execution risk.

| Do you want to invest in the best crypto presale in January 2026 to maximize your return?

Then, don’t worry, here is the solution for you. Grab this Opportunity Now Before You Regret, As You Missed the Early-stage BTC Entry! |

Comparison of Crypto Presales to Watch this January 2026

January lists tend to group projects with very different goals. Therefore, a comparison works best when it focuses on use case, transparency, and how buyers are expected to participate after the buy. The table below keeps that focus.

| Project | Core angle | What buyers are really betting on | Best fit for |

| IPO Genie ($IPO) | Tokenized private deal participation plus AI scoring and tiered access | Deal sourcing, scoring quality, and platform execution | Investors seeking a private-style deal structure |

| BlockDAG (BDAG) | Infrastructure narrative with presale rounds and launch framing | Roadmap delivery and post-presale liquidity | Buyers focused on launch mechanics |

| Blazpay | Payments and app-focused presale positioning | Product delivery and user adoption | Users who want a platform app story |

| ZKP | Zero-knowledge and infrastructure theme in recent coverage | Tech delivery and adoption in dev communities | Buyers interested in privacy and proof systems |

| SUBBD | Creator economy and AI platform narrative | Creator onboarding and platform traction | Community and creator-focused buyers |

Why IPO Genie Stands Out for Private Market Access

Live Presale with $0.0001174: buy.ipogenie.ai

IPO Genie positions itself as “Web3’s Wall Street”. And describes a model where the public can access curated early-stage opportunities without the usual gatekeeping or paperwork. Moreover, it presents $IPO as a utility token tied to participation, rewards, and governance rather than a token with a vague purpose.

That point matters because Private market access is not a marketing side note here. Instead, it is the central product claim. As a result, the pitch reads less like a meme cycle and more like a platform trying to productize early-stage access with rules.

The “Uber was private” problem, simplified

Uber and Airbnb once raised capital privately at early valuations, then later became global giants. However, most people could not buy at that early stage. IPO Genie’s messaging aims directly at that frustration by saying early entry should not require a huge check. And participation can start from small amounts shown in its presale flow.

AI Deal Scoring that tries to stay concrete

IPO Genie explains that its scoring approach looks at market signals, credibility checks, contract screening, and a final score with a risk profile. Therefore, the Web3 Platform attempts to turn early-stage selection into a repeatable method rather than pure hype.

Tier model that defines access rules

IPO Genie publishes tier thresholds and links them to access and benefits. The tokenomics page lists Bronze ($2,500), Silver ($12,000), Gold ($55,000), and Platinum ($110,000), each described with higher access and perks at higher levels. Meanwhile, this structure also makes it easier for readers to understand what they are buying into.

Incentives and Visibility That Investors Attract in Q1 2026

Presales often push bonuses, and IPO Genie mentions active 20% welcome and 15% referral incentives. However, a bonus is not a guarantee of value; it only changes token allocation. Investors should treat it as a perk, not proof.

IPO Genie also has marketing moments tied to an airdrop and seasonal campaigns in public coverage. According to the Crypto YouTuber:

“Michael Wrubel has described IPO Genie as a potential ‘game-changer’ in private market access, echoing a broader theme that’s shown up across recent influencer commentary.”

In addition, it has appeared in the January presale watchlist that highlights the project’s private market angle.

How Blazpay, ZKP, BlockDAG, and SUBBD Compare in January

- BlockDAG often shows up in roundups because it communicates presale stages and launch framing in a way that is easy to follow. Still, it is primarily an infrastructure narrative, so buyers should read the primary documentation and post-launch plan, not just the price talk.

- Blazpay promotes an all-in-one platform idea and publishes a live presale page describing a wallet-based start and fee-based transactions. Meanwhile, buyers should still confirm the team, audits, and token utility from primary sources before treating it as a long-term hold.

- ZKP is framed in recent coverage as an infrastructure and privacy-focused concept, with claims about building before opening public participation. ZKP does not automatically define the token’s future, but it is a clear reminder that reputational risk can be real and fast-moving in presales.

- SUBBD positions itself as an AI platform for creators and publishes a roadmap on its site. Therefore, it will likely appeal to buyers who want a creator economy use case rather than private deal participation.

For market watchers searching for the top cryptocurrency presale projects this month. Then the practical filter is simple: “Do the token’s real uses match the story, and are the rules clear?”

Join the Top Crypto Presale Before the End of January!

How to Join $IPO Presale

The flow diagram helps the interested buyer understand step-by-step how to join the $IPO presale without any confusion.

Why IPO Genie Is the One Many Investors Will Keep Watching

January is full of Crypto presales, but IPO Genie stands apart by centering a specific project: private deals, scored and structured, with a tiered participation model. Moreover, the project’s public materials outline how $IPO connects to access, rewards, and governance rather than relying only on price talk.

For readers tracking Crypto presales, the deciding factor often becomes usability. IPO Genie’s appeal is that it frames early-stage investing as a system with rules, tiers, and scoring that can be checked, rather than a vague promise. Still, the same rule applies: presales remain high risk, and discipline matters as much as timing.

If you want to join the top January token presale for 2026. Then, IPO Genie is the rank#1 among the biggest crypto presales in Q1 2026.

Join the Top Crypto Presale to Access the Private Market at a low entry point!

FAQs

What makes IPO Genie different from other presales?

IPO Genie centers on private-market style deal participation with tiers (Bronze-Platinum) and an AI scoring approach, rather than only a trading or meme narrative.

What should buyers check before joining a presale?

They should review token utility, vesting, audits, team identity, and realistic roadmaps, then assume high volatility and liquidity uncertainty.

Why do comparisons matter for January Crypto presales?

Because projects target different outcomes, buyers need to match the token’s real purpose to their risk level and time.