TLDR

- Bitcoin dropped below $80,000 to $78,678, while Ethereum fell to $2,400 as the crypto market lost over $183 billion in value

- Donald Trump nominated Kevin Warsh as next Federal Reserve Chair, raising concerns about future hawkish monetary policy despite recent pro-crypto statements

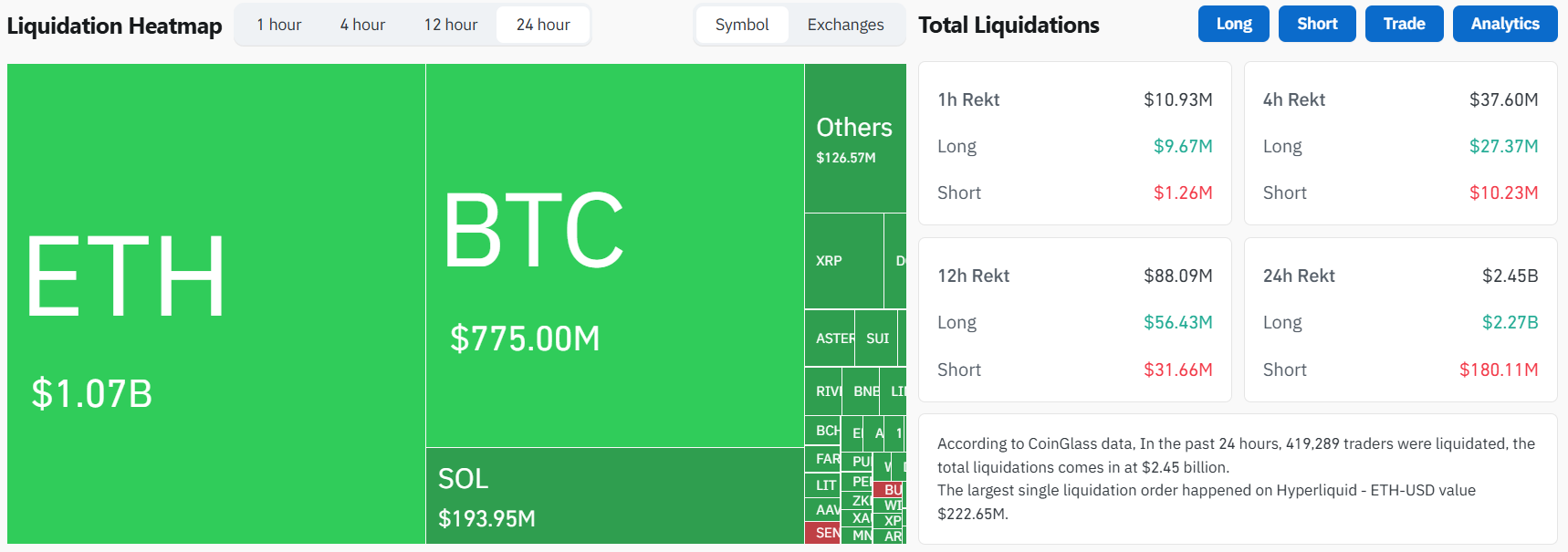

- Crypto liquidations surged 348% to $2.5 billion in 24 hours, with Ethereum seeing $1.1 billion and Bitcoin $785 million in position liquidations

- Rising tensions between the US and Iran contributed to market weakness as Bitcoin failed to act as a safe-haven asset

- US Treasury sanctioned Iranian crypto exchanges Zedcex and Zedxion for processing billions in transactions tied to the IRGC

The cryptocurrency market experienced a sharp decline over the weekend. Bitcoin fell below the $80,000 threshold for the first time in months, trading at $78,678 on Sunday.

The drop represented a steep decline from Bitcoin’s all-time high of $126,300. Ethereum crashed to $2,400, while Binance Coin fell to $770.

The total crypto market capitalization decreased by over 5.80% in 24 hours. The market value settled near $2.63 trillion after losing approximately $183 billion.

Trump’s Federal Reserve nomination triggered concern among crypto investors. Donald Trump selected Kevin Warsh to replace Jerome Powell as Federal Reserve Chair when his term ends in May.

Warsh has recently voiced support for the crypto industry. Analysts believe this position was strategic to secure the Federal Reserve Chairman role.

Warsh previously criticized cryptocurrencies and maintained hawkish views on monetary policy. He voted against interest rate cuts and quantitative easing in 2011.

His opposition to quantitative easing has remained consistent throughout his career. Market observers expect Warsh to maintain restrictive monetary policies similar to Powell’s approach.

Record Liquidations Hit Crypto Traders

Liquidations across crypto markets jumped 348% in 24 hours to over $2.5 billion. This marked the biggest increase in months and intensified selling pressure.

Ethereum saw the highest liquidations at over $1.1 billion. Bitcoin liquidations reached $785 million during the same period.

Solana positions worth $197 million were liquidated. XRP traders lost $61 million in positions.

Futures open interest dropped 10% to $113 billion in 24 hours. The decline showed reduced market participation and trader confidence.

The liquidation event recalled October 10 when over $20 billion in positions were wiped out. That crash followed Trump’s tariff threats against China.

Geopolitical Tensions Add Pressure

Rising tensions between the United States and Iran contributed to market instability. Trump threatened military action against Iran following recent protests in the country.

🇺🇸🇮🇷The US continues to build up forces in preparation for a possible operation in #Iran.

▪️ F-35A Lightning II fighter jets from the 158th Fighter Wing of the US Air Force arrived at Lajes Air Base in the Azores, Portugal, supported by two KC-46A Pegasus aircraft.

▪️ Six… pic.twitter.com/bqsGhfQEN2

— Commentary: Trump Truth Social Posts On X (@TrumpTruthOnX) January 30, 2026

Potential conflict with Iran could impact energy markets. Brent crude oil jumped to $70 for the first time in months.

Bitcoin’s status as a safe-haven asset came into question. Investors moved to traditional safe havens like the Swiss franc and gold instead.

The US Treasury sanctioned two Iranian crypto exchanges on Saturday. Zedcex and Zedxion were targeted for processing billions in transactions tied to Iran’s Islamic Revolutionary Guard Corps.

This marked the first time the Office of Foreign Assets Control sanctioned crypto exchanges within Iran’s financial sector. Officials warned of further action against sanction-evasion networks.

Technical analysis showed Bitcoin formed a rising wedge pattern on weekly charts. The cryptocurrency also created a bearish flag pattern and dropped below the 50-week Exponential Moving Average.

Bitcoin breaking below $80,000 confirmed a wider corrective phase. The next support level sits around $78,363, with a projected downside target of $75,850.