TLDR

- U.S. ISM Manufacturing PMI jumped to 52.6% in January, beating expectations of 48.5% and marking the highest reading since August 2022

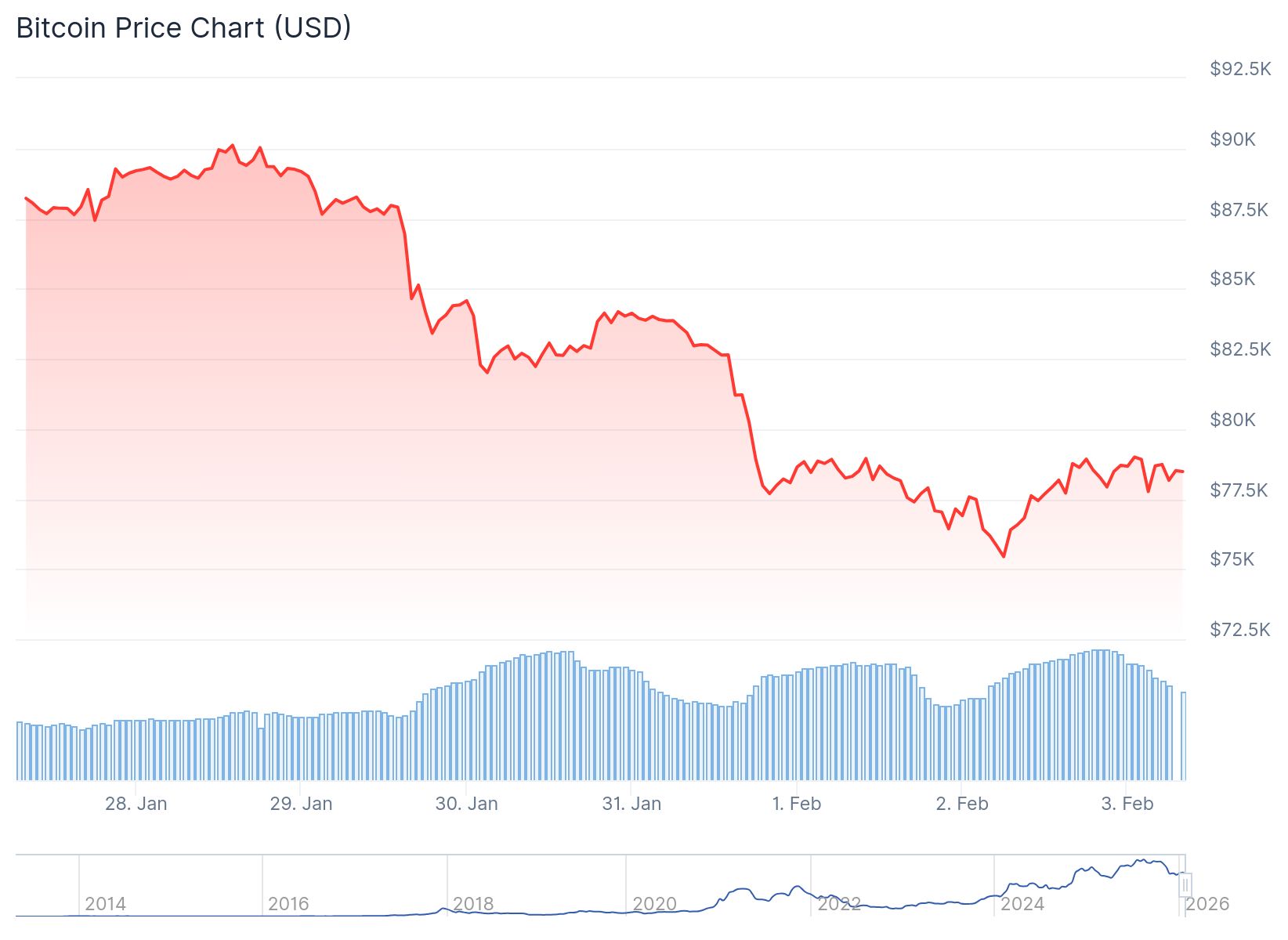

- Bitcoin price climbed 2.76% following the PMI release after hitting a yearly low of $75,000 the previous day

- The PMI score ended 26 consecutive months of contraction in U.S. manufacturing activity

- New Orders Index soared to 57.1% from 47.4% in December, while Production Index reached 55.9%

- Some analysts believe the PMI reversal historically signals improved conditions for Bitcoin and risk assets

The U.S. manufacturing sector posted its strongest performance in over two years. The Institute for Supply Management Manufacturing PMI reached 52.6% in January 2025.

ISM PMI comes in at 52.6

Bullish macro reflation expansion

Highest reading since August 2022 pic.twitter.com/55bT2PfgbK

— quantdata21 (@bitcoindata21) February 2, 2026

The reading beat market expectations by a wide margin. Analysts had predicted a score of 48.5%.

Bitcoin traded at $78,565 following the economic data release. The cryptocurrency gained 2.76% in 24 hours after the PMI announcement.

The ISM score marks the first expansion in manufacturing activity after 26 months of contraction. Any reading above 50 indicates economic expansion.

The last time the index reached this level was August 2022. That period coincided with different market conditions for Bitcoin.

The New Orders Index jumped to 57.1% from December’s 47.4%. This represents the highest level since February 2024.

Production activity continued its growth streak for the third month. The Production Index stood at 55.9% in January.

Bitcoin Price Movement Follows Economic Data

Bitcoin had dropped to $75,000 on the previous day. This marked a new low for 2025.

The cryptocurrency recovered after the manufacturing data release. Trading data from TradingView confirmed the price movement.

Susan Spence chairs the ISM committee. She attributed the recovery to improved demand conditions across the manufacturing sector.

The Prices Index reached 59.0% in January. This indicates elevated input costs for U.S. manufacturers.

Supplier deliveries fell to 54.4%. This pattern typically appears when demand increases.

Employment in manufacturing remained in contraction territory at 48.1%. However, this showed improvement from December’s 44.8%.

Some market analysts noted historical patterns between the PMI and Bitcoin. The manufacturing index movements from mid-2020 through 2023 tracked similar patterns to Bitcoin price changes.

Joe Burnett serves as vice president of Bitcoin strategy at Strive. He pointed out that Bitcoin rallied following PMI reversals in 2013, 2016, and 2020.

Other analysts expressed caution about drawing direct connections. Benjamin Cowen founded Into The Cryptoverse and noted that Bitcoin doesn’t always move with the manufacturing index.

Bitcoin has declined nearly 38% from its October high. The cryptocurrency reached $126,080 before the recent downturn.

Financial markets reacted quickly to the manufacturing data. Risk assets saw increased activity following the announcement.

The ISM report showed all five subindexes improved in January. This broad-based improvement reflected stronger conditions across the manufacturing sector.