Artificial intelligence has fundamentally changed how people invest their money. Tasks that previously took hours of manual research and complicated analysis now happen in seconds through AI-powered investment platforms. These advanced systems examine enormous amounts of data, spot patterns that human researchers miss, and deliver practical recommendations that support better investment choices.

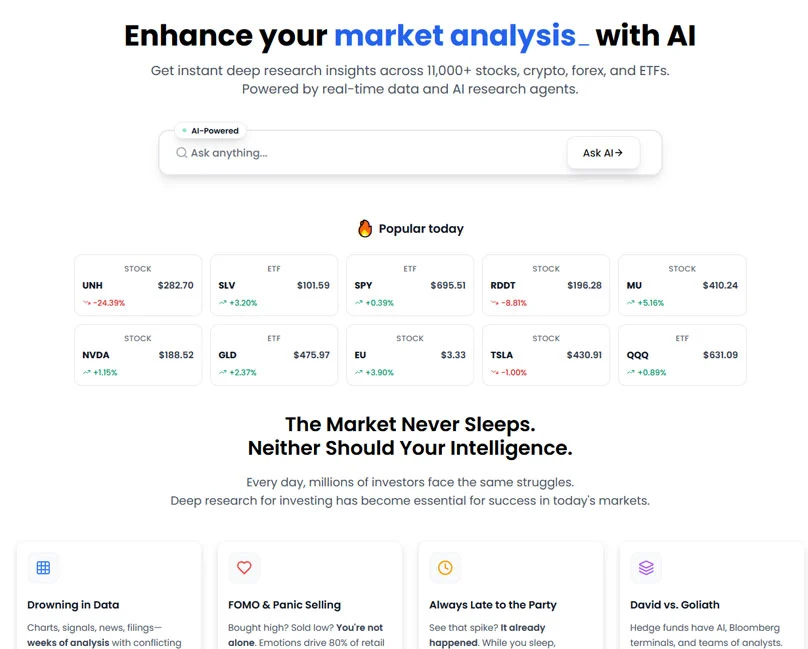

These AI platforms serve everyone from experienced traders refining their methods to newcomers needing market guidance. They range from complete portfolio tracking systems to specialized cryptocurrency trading automation.

The 2026 options showcase the latest advances in investment technology. This detailed guide examines leading AI stock selection platforms, evaluating their capabilities, advantages, and best applications to match you with the ideal solution for your financial objectives.

Top 5 AI Stock Picking Tools of 2026

- KnockoutStocks.com – Best Overall for Complete Investment Toolkit & Portfolio Management

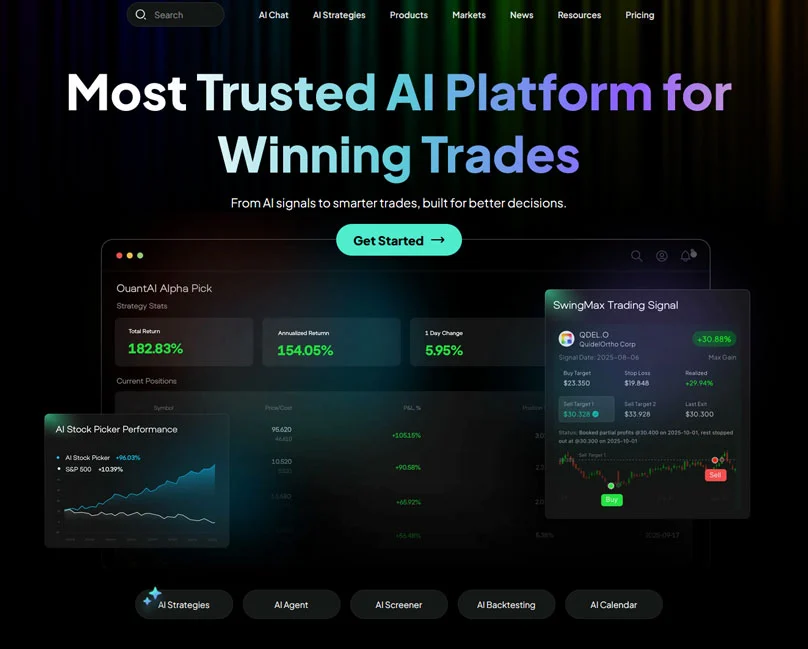

- Intellectia AI – Best for AI-Generated Daily Stock Recommendations with Event Tracking

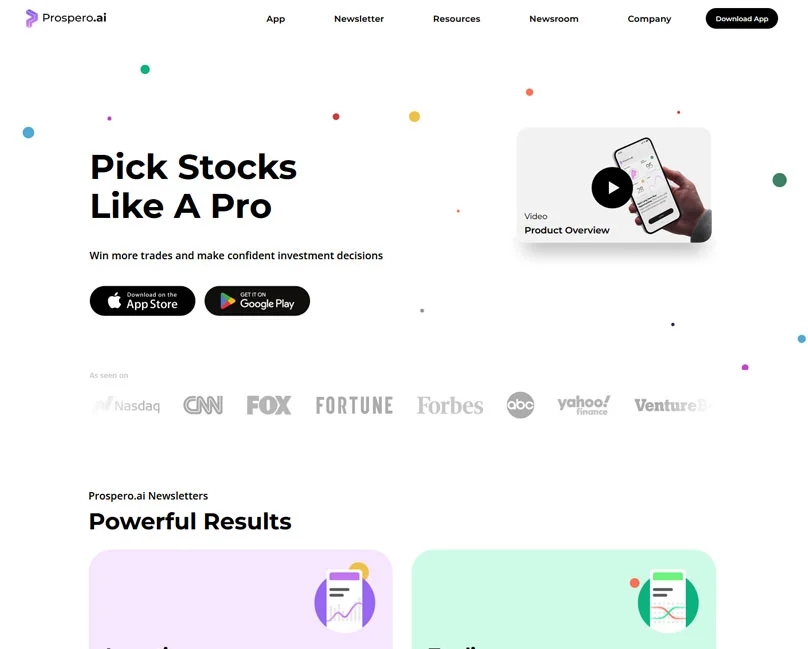

- Prospero.ai – Best for Practical Daily Market Insights & Easy-to-Use Platform

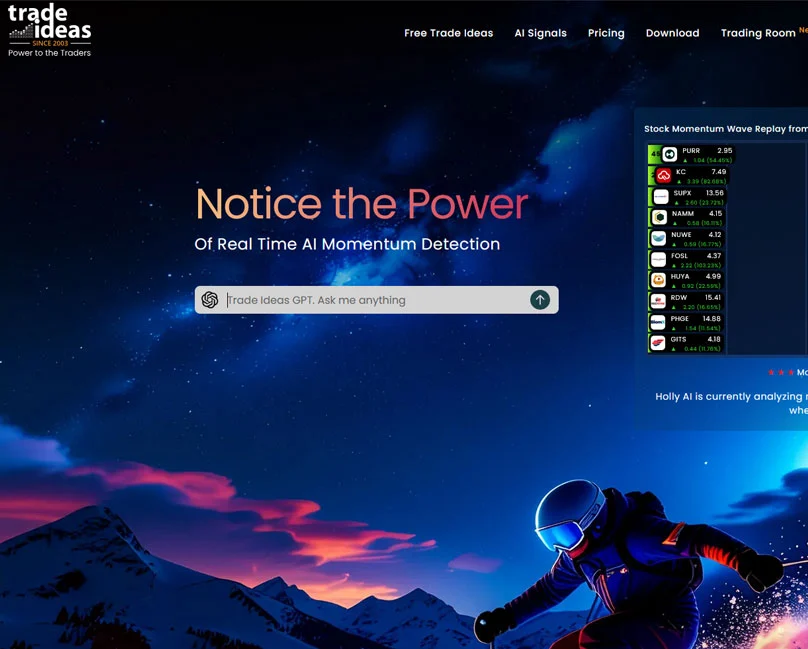

- Trade Ideas – Best for Technical Analysis & Automated Strategy Implementation

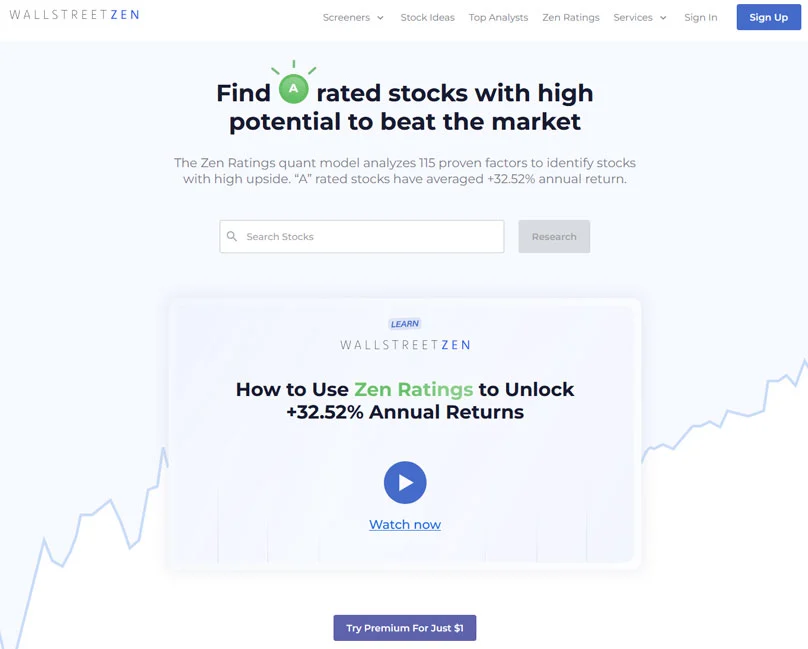

- Zen Investor – Best for Patient Investors Combining AI with Professional Analysis

Comparison Table: Top 5 AI Stock Picking Tools

| Platform | Starting Price | Free Plan | Key Strength | Market Coverage | Best For |

|---|---|---|---|---|---|

| KnockoutStocks.com | Free | 30-Day Money Back | KO Score Algorithm & Full Portfolio Tracking | US Stocks | Complete investment solution seekers |

| Intellectia AI | $23.96/month (yearly) | $1 Trial | Five Daily Picks with 120%+ Documented Returns | US Stocks | Active traders and short-term positions |

| Prospero.ai | Varies | Available | Professional Analytics Simplified | US Stocks | Everyday investors wanting daily recommendations |

| Trade Ideas | $89/month | Yes | Live Market Scanning & Automatic Trading | US Stocks | Active day trading and technical analysis |

| Zen Investor | $60/month | No | 32.52% Historical Average Since 2003 | US Stocks | Buy-and-hold investors |

Detailed Reviews of All AI Stock Picking Tools

KnockoutStocks.com

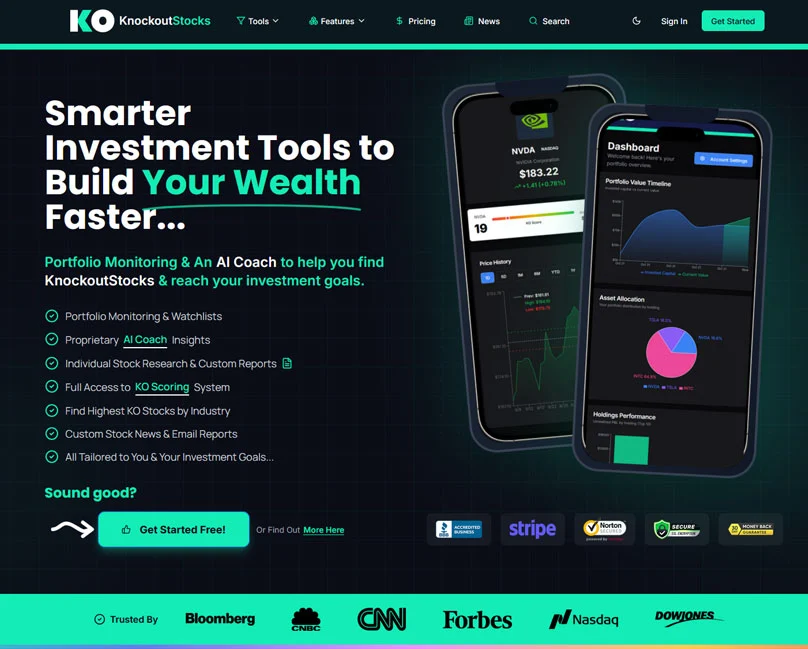

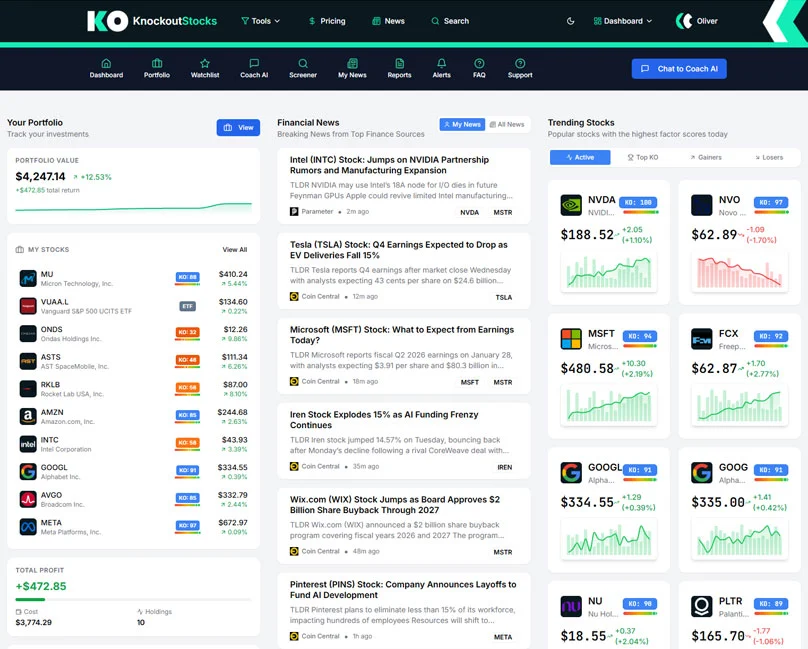

KnockoutStocks.com emerges as the most complete AI investment solution available in 2026, delivering an exceptional blend of portfolio tracking, proprietary stock evaluation, and customized AI guidance. The platform’s signature feature is its KO Score algorithm, which employs sophisticated analysis to assess stocks across numerous factors, helping investors spot winning opportunities before they become widely recognized.

Features Overview

| Feature | Description |

|---|---|

| KO Score Algorithm | Proprietary system evaluating stock performance potential |

| Portfolio Monitoring | Live tracking with detailed performance metrics |

| AI Coach | Voice and text investment guidance system |

| Stock Screener Tool | 20+ filtering criteria including fundamentals and technicals |

| Automated Email Updates | Daily market summaries, recommendations, and custom alerts |

| On-Demand Research | AI-created detailed stock analysis reports |

| Watchlist Manager | Create unlimited custom stock lists |

| Organized Stock Categories | 22 sector-based collections with KO Score rankings |

KnockoutStocks.com excels through its comprehensive investment approach. Beyond simply recommending stocks, the platform teaches and equips investors through its AI Coach capability, delivering immediate insights using OpenAI and proprietary technology. The Coach examines your complete portfolio, responds to questions about particular stocks, and delivers customized suggestions matching your financial objectives.

The platform’s screening tool balances sophistication with accessibility, letting investors filter thousands of stocks using advanced parameters without requiring financial expertise. Whether searching for explosive growth technology companies, reliable dividend providers, or underpriced value plays, the screener produces accurate results immediately. Information updates continuously during trading hours, guaranteeing current data for decisions.

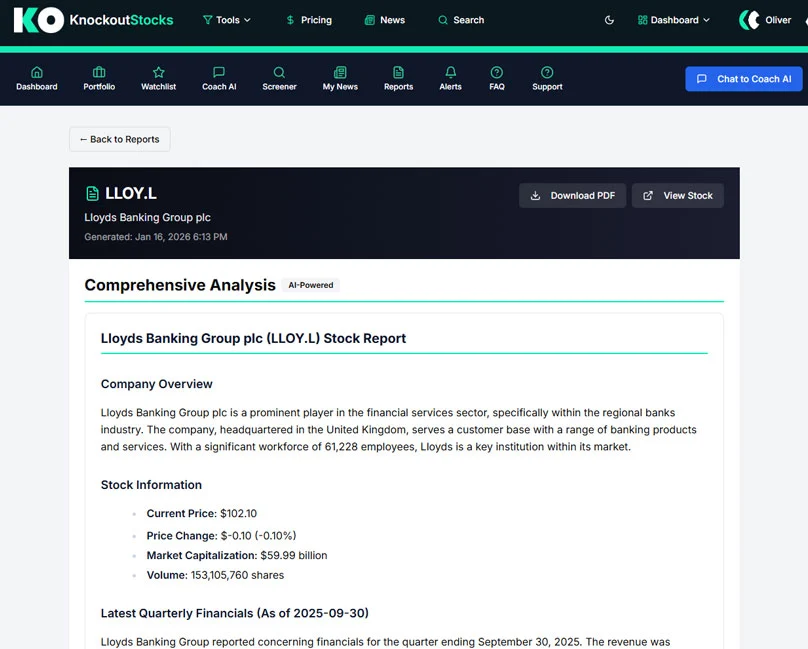

KnockoutStocks.com also prioritizes personalization. The on-demand research feature creates thorough AI-powered evaluations covering company fundamentals, financial stability, and recent news from the previous day. These reports appear in your dashboard or download as PDFs for offline review, making them essential for thorough research before significant investment choices.

Pros:

- Complete unified platform eliminating multiple tool requirements

- Exclusive KO Score delivers competitive advantage

- Voice-activated AI Coach for premium members offers exceptional ease

- Live data throughout market hours maintains current information

- BBB accreditation with robust security infrastructure

- 30-day refund policy eliminates trial risk

- Featured by major financial outlets including Bloomberg, CNBC, and Forbes

Cons:

- Advanced capabilities require upgraded membership

- Voice coach access limited to Heavyweight tier

Intellectia AI

Intellectia AI has rapidly gained popularity among active investors wanting data-backed daily stock suggestions. With verified annual returns exceeding 120% through November 2025, the platform proves that advanced AI analysis translates into actual profits when correctly applied.

Features Overview

| Feature | Description |

|---|---|

| Five Daily Selections | Refreshed each morning at 8:00 AM ET |

| Catalyst Identification | Spots stocks with event-driven opportunities |

| Clear Trade Guidance | Explicit buy/sell signals with position sizing |

| AI Assistant | Immediate responses to investment queries |

| Continuous Surveillance | Ongoing market observation |

| Cryptocurrency Coverage | Beyond stocks to digital assets |

| Morning Notifications | Email alerts with AI suggestions |

The platform’s methodology is refreshingly simple: each morning before markets open, subscribers get five carefully chosen stock recommendations supported by AI evaluation. Each selection includes clear direction (bullish or bearish) and suggested position sizing, usually recommending 20% of trading capital per holding. This systematic method eliminates uncertainty and emotional choices from investing.

What separates Intellectia AI from competitors is its catalyst-focused analysis. The AI doesn’t just examine past patterns; it spots upcoming catalysts like earnings reports, product releases, or regulatory actions that might affect stock prices. This anticipatory approach positions investors ahead of market-moving developments.

The AI Assistant operates as a personal investment consultant, immediately responding to questions about particular stocks, market situations, or portfolio enhancement. It combines information from news outlets, financial documents, and live data to deliver contextual insights rather than generic answers. This makes the platform especially useful for investors wanting to grasp the reasoning behind each suggestion.

Pros:

- Outstanding verified performance with 120%+ annual returns

- Accessible interface suitable for newcomers

- Wide coverage including stocks and cryptocurrencies

- Budget-friendly $1 trial permits risk-free evaluation

- Straightforward, executable daily suggestions remove decision paralysis

- Continuous monitoring prevents missing opportunities

Cons:

- Presently restricted to US market coverage

- Daily trading focus may not fit long-term buy-and-hold approaches

Prospero.ai

Prospero.ai connects professional-level analytics with retail investor usability. The platform provides quick, dependable stock recommendations without requiring users to examine dense financial documents or master complicated technical evaluation. Its AI system processes trend indicators, technical measurements, and live market information to build daily stock collections matched to various investment purposes.

Features Overview

| Feature | Description |

|---|---|

| Curated Daily Lists | AI-chosen opportunities using multiple signals |

| Momentum Measurements | Quantifies price movement intensity |

| Volume Indicators | Detects abnormal trading activity |

| Relative Performance | Compares results against market standards |

| Goal-Based Filtering | Sort by income, growth, or value targets |

| Learning Resources | Materials for developing investors |

| Advanced Screener | Detailed tools for skilled users |

Prospero.ai’s primary advantage comes from making sophisticated evaluation approachable. The interface displays complex information through clear visualizations and plain explanations, letting investors quickly understand why particular stocks reached the recommendation list. This openness creates confidence and helps users build their own market understanding progressively.

The platform acknowledges that different investors pursue different targets, which explains its goal-based filtering. Whether you’re pursuing steady dividend income, aggressive growth possibilities, or undervalued stocks trading below true worth, Prospero.ai can customize suggestions to match your approach. This adaptability makes it appropriate for investors at different stages of their development.

Beyond stock recommendations, Prospero.ai supplies learning materials that help newer investors grasp market operations, investment fundamentals, and risk control strategies. This educational element transforms the platform from a basic tool into a learning asset that develops with you. As your understanding grows, the advanced screener provides deeper analytical functions for more detailed research.

Pros:

- Excellent balance of simplicity and analytical power

- Professional-grade measurements made accessible to everyday investors

- Adaptable filtering matches suggestions with personal targets

- Learning materials support investor growth

- Clean interface minimizes mental strain

- Appropriate for beginners and experienced investors

Cons:

- Some advanced capabilities may need time to completely grasp

- Pricing details not explicitly provided in available materials

Trade Ideas

Trade Ideas has positioned itself as the leading platform for active traders demanding live data and automated execution functions. Its proprietary AI system, called “Holly,” operates millions of simulated trades daily to spot high-probability opportunities across various market situations. This systematic approach to opportunity detection provides day traders and swing traders a substantial advantage in fast-moving markets.

Features Overview

| Feature | Description |

|---|---|

| Holly AI System | Proprietary AI executing millions of trade simulations |

| Live Market Scanning | Immediate identification of trading chances |

| Automatic Execution | Execute trades following AI recommendations |

| Strategy Testing | Validate approaches using historical information |

| Position Sizing | Smart risk calculations for trade sizing |

| Chart Pattern Detection | Recognizes breakouts and technical formations |

| Multiple Timeframe Review | Assesses opportunities across different periods |

| Personalized Bots | Build customized automated trading methods |

What distinguishes Trade Ideas is its concentration on technical evaluation and chart pattern detection. The platform automatically spots stocks breaking resistance points, developing bullish chart structures, or responding to earnings announcements. These automated scans operate continuously throughout trading hours, notifying users to opportunities as they emerge rather than after movement has finished.

The strategy testing capability lets traders confirm approaches before risking actual capital. You can examine how a specific method would have performed across different market conditions, adjusting parameters to enhance outcomes. This evidence-based approach to strategy creation helps traders develop confidence and prevent expensive errors.

For traders comfortable with automation, Trade Ideas provides the capability to build custom trading algorithms that execute trades automatically when specified conditions occur. This removes emotional interference and guarantees consistent execution of validated strategies. The platform’s position sizing tools help traders allocate capital appropriately, protecting against devastating losses while maximizing potential profits.

Pros:

- Outstanding live scanning functions

- Automated execution removes emotional decision-making

- Thorough strategy testing validates approaches before implementation

- Free tier permits testing before financial commitment

- Extensively customizable to individual trading preferences

- Solid reputation among active trading community

Cons:

- Significant learning curve may challenge beginners

- Premium capabilities require higher subscriptions ($178/month for top level)

- Best matched for active traders rather than long-term investors

Zen Investor

Zen Investor stands apart by merging artificial intelligence with human knowledge from veteran market analyst Steve Reitmeister, who contributes over 40 years of investment experience to the platform. This combined approach captures AI’s analytical strength while keeping the subtle judgment that only experienced professionals can offer. The outcome is a service especially suited for long-term investors pursuing steady portfolio expansion.

Features Overview

| Feature | Description |

|---|---|

| Zen Rating Method | Evaluates stocks using 115 validated factors |

| Curated Portfolio | Up to 30 professionally chosen stocks |

| Monthly Reports | Market analysis and strategy updates |

| Monthly Live Sessions | Interactive Q&A with Steve Reitmeister |

| Top-Rated Stocks | Highest picks averaging 32.52% yearly returns since 2003 |

| Four-Phase Selection | Merges AI filtering with professional evaluation |

| Regular Updates | Ongoing rebalancing and enhancement |

The platform’s performance history speaks clearly: top-rated stocks have averaged 32.52% annual returns since 2003, substantially outperforming typical market gains over identical periods. This consistency across multiple market cycles proves the strength of the Zen Investor approach. The system doesn’t pursue short-term trends; instead, it recognizes fundamentally solid companies positioned for sustainable expansion.

Zen Investor’s four-phase selection method starts with AI filtering through 115 validated factors covering fundamentals, technicals, and market sentiment. This quantitative evaluation reduces the stock universe to those meeting strict quality standards. Steve Reitmeister then applies his knowledge to choose final portfolio positions, weighing factors like industry positioning, management caliber, and competitive strengths that algorithms might overlook.

The educational element significantly increases the service’s worth. Monthly reports supply market context and clarify the logic behind portfolio choices, helping subscribers build their own market comprehension. Monthly live sessions provide chances to ask questions directly and gain perspectives into current market conditions. This educational method empowers investors rather than building dependence.

Pros:

- Outstanding long-term performance with verified results

- Distinctive blend of AI accuracy and human expertise

- Consistent educational material develops investor understanding

- Managed portfolio method simplifies decision-making

- Direct interaction through live sessions adds worth

- Appropriate for investors preferring less frequent trading

Cons:

- No free trial offered, requires initial commitment

- Higher entry price at $60/month than some alternatives

- Restricted to US stock market

Magnifi

Magnifi adopts a search-based approach to AI investing, operating as an intelligent financial consultant that answers conversational queries. Instead of moving through complicated menus or filters, investors simply pose questions like “What technology stocks have robust earnings growth and minimal volatility?” and get instant, data-supported responses with clear visualizations.

Features Overview

| Feature | Description |

|---|---|

| Conversational Search | Pose investment questions naturally |

| Holdings Evaluation | Reviews diversification and cost structure |

| Account Connection | Links with existing brokerage accounts |

| Zero-Commission Trades | Execute transactions without fees |

| Clear Data Presentation | Complex information displayed simply |

| Risk Identification | Spots concentration dangers |

| Cost Analysis | Reveals hidden portfolio expenses |

The platform excels at portfolio enhancement, linking directly with brokerage accounts to examine your current positions. It assesses diversification, recognizes concentration dangers, reveals hidden costs, and recommends improvements to match your portfolio with your investment targets. This complete perspective helps investors grasp their overall position rather than concentrating on individual stocks separately.

Magnifi’s AI handles questions across multiple dimensions simultaneously, weighing fundamental strength, technical patterns, valuation measurements, and risk elements. The answers include supporting information and explanations, helping investors comprehend not just what to purchase but why certain opportunities match their standards. This educational component makes the platform valuable for building investment abilities.

Pros:

- Natural conversational interface removes learning obstacle

- Thorough portfolio evaluation spots improvement possibilities

- Zero-commission trading maintains low expenses

- Perfect for long-term investors concentrating on enhancement

- Effective data visualization supports comprehension

- Account integration delivers seamless experience

Cons:

- May lack sophistication for highly technical traders

- Emphasis on portfolio evaluation rather than daily trading chances

Public Alpha

Public Alpha signifies the advancement of accessible investing, merging conversational AI with combined research and trade execution. The platform lets investors move from discovery to action without switching between multiple tools or platforms. Alpha’s context-recognition technology remembers previous conversations, improving suggestions based on your stated preferences and past queries.

Features Overview

| Feature | Description |

|---|---|

| Conversational Interface | Natural language for market research |

| Context Recognition | Recalls past queries to improve suggestions |

| Combined Execution | Trade directly from research discoveries |

| Sector Tracking | Monitor top-performing market segments |

| Earnings Summaries | Quick overviews of company results |

| Unified Platform | Research and execution integrated |

Public Alpha excels in delivering clarity rapidly. Questions about recent earnings outcomes, sector trends, or specific company developments get brief, actionable responses without overwhelming technical language. This approach especially benefits investors who want to stay informed without dedicating hours to research daily.

The combination of research and execution simplifies the investment process substantially. When Alpha spots an opportunity matching your standards, you can act immediately rather than moving to another platform or application. This seamless experience reduces friction and helps investors take advantage of time-sensitive opportunities.

Pros:

- Extremely accessible for investors of all experience levels

- Context-recognition AI improves progressively

- Seamless combination of research and trading

- Clear, simple explanations

- Quick access to market-moving information

- Part of established Public investing platform

Cons:

- May not satisfy highly technical traders needing deep analysis tools

- AI capabilities still evolving compared to specialized platforms

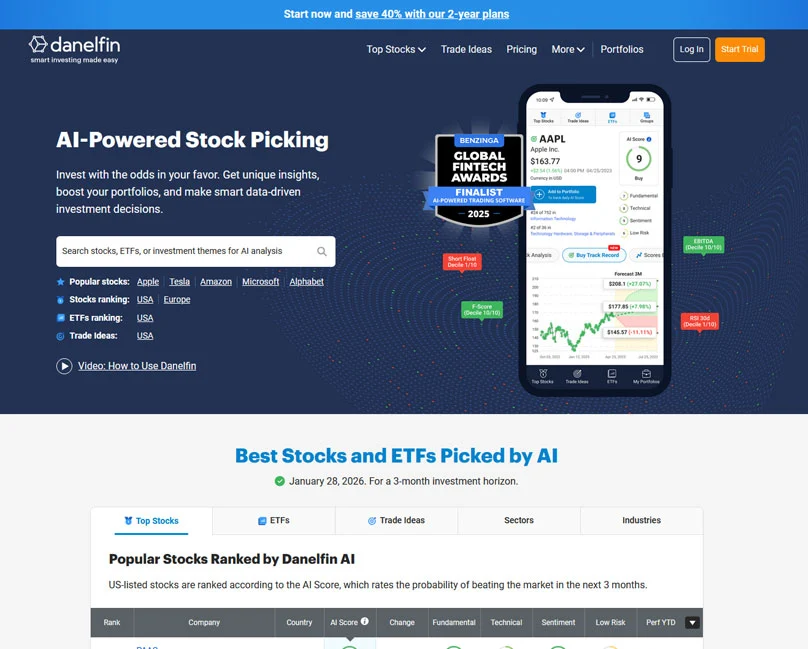

Danelfin

Danelfin adopts a quantitative method to stock selection, using AI to produce scores estimating each stock’s likelihood of outperforming the market over the following three months. The platform ranks thousands of US and European stocks using a blend of technical indicators, fundamental measurements, and sentiment evaluation. This data-focused methodology appeals to investors who favor objective rankings over subjective views.

Features Overview

| Feature | Description |

|---|---|

| AI Scoring Method | Probabilistic rankings for 3-month outlook |

| Component Transparency | View individual elements of each score |

| Visual Data Support | Charts backing each suggestion |

| Regular Recommendations | Free tier includes consistent picks |

| US & European Access | Wider geographic reach than many competitors |

| Analysis Dashboard | Premium access to comprehensive tools |

Danelfin’s openness distinguishes it from “black box” AI systems. Investors can examine the specific elements contributing to each stock’s score, along with supporting charts and historical information. This clarity helps users grasp the AI’s logic and builds confidence in its suggestions. It also creates learning chances as investors recognize which elements correlate with successful results.

The platform’s three-month prediction timeframe strikes a practical balance. It’s extended enough to bypass day-to-day fluctuations but short enough to remain actionable for active investors. This duration works well for swing traders and momentum investors who pursue opportunities beyond daily volatility but aren’t committing to multi-year holding periods.

Pros:

- Clear methodology builds user confidence

- Free tier delivers value without financial obligation

- Covers both US and European markets

- Objective rankings eliminate bias

- Three-month outlook suits active investing

- Individual factor visibility creates learning chances

Cons:

- Premium capabilities require subscription for complete functionality

- Three-month concentration may not match long-term investment strategies

RockFlow

RockFlow merges AI portfolio enhancement with social and institutional-quality investing tools, building a bridge between professional-level analysis and user-friendly accessibility. The platform supports cryptocurrencies alongside traditional markets, providing investors exposure to diverse asset types through a single interface. Its AI system continuously discovers new opportunities while enhancing existing positions for better risk-adjusted returns.

Features Overview

| Feature | Description |

|---|---|

| AI Portfolio Enhancement | Continuous rebalancing for improved returns |

| Multiple Asset Support | Stocks, ETFs, crypto, and more |

| Intelligent News Curation | AI-selected relevant market information |

| Sentiment Evaluation | Tracks market mood and investor psychology |

| Mobile-Optimized Design | Built for on-the-go investing |

| Accessible Interface | Suitable for investors at any level |

| Opportunity Discovery | AI surfaces opportunities matching your profile |

The platform’s portfolio enhancement goes beyond simple allocation recommendations. RockFlow’s AI examines correlation between assets, recognizes redundant positions, and proposes adjustments that improve diversification without sacrificing returns. This active management method helps investors maintain optimal positioning as market situations change.

RockFlow’s news evaluation function cuts through information excess, presenting only stories and data points relevant to your positions and interests. The AI filters thousands of news outlets to surface actionable insights rather than overwhelming you with every market headline. This selection saves time while guaranteeing you don’t miss important developments.

Pros:

- Comprehensive multiple asset coverage under one platform

- AI enhancement improves portfolio performance progressively

- Mobile-optimized design enables investing anywhere

- Free to use with optional premium capabilities

- Accessible without sacrificing advanced functions

- Smart news selection reduces information excess

Cons:

- Newer platform with shorter performance history than established competitors

- Premium capabilities not clearly specified in available information

AInvest

AInvest leverages AI for predictive analytics and automated execution with strong emphasis on ease of use. The platform’s “AI Radar” capability helps investors anticipate market shifts before they fully materialize, providing opportunities to position ahead of major moves. Supporting crypto alongside stocks and ETFs, AInvest caters to investors seeking diversified exposure through a single, streamlined interface.

Features Overview

| Feature | Description |

|---|---|

| AI Radar | Predictive tool for market shift anticipation |

| Multiple Asset Support | Crypto, stocks, and ETFs |

| Automated Advisory | Automated portfolio management |

| Automatic Rebalancing | Maintains optimal asset allocation |

| Simple Setup | Streamlined account setup and usage |

| Contemporary Mobile App | Sleek interface for mobile investing |

| Passive Strategy Focus | Perfect for hands-off approaches |

The AI Radar represents AInvest’s most innovative capability, using pattern detection and predictive modeling to spot market inflection points before they become obvious. This forward-looking function gives investors time to adjust positions proactively rather than reacting after moves have already happened. The tool proves particularly valuable during transitional market periods when traditional indicators provide mixed signals.

AInvest’s automated advisory component manages portfolio construction and maintenance automatically based on your risk tolerance and targets. The system continuously monitors positions, rebalancing when allocations drift from targets and replacing underperforming positions with better opportunities. This hands-off approach suits investors who want AI working for them without constant attention.

Pros:

- Predictive AI Radar delivers early warning of market shifts

- Strong automated advisory reduces need for constant oversight

- Multiple asset support enables proper diversification

- Affordable entry point at $25/month premium tier

- Free version available for testing

- Contemporary, intuitive interface

Cons:

- Passive approach may not satisfy active traders

- Newer platform with limited historical performance data

Tickeron

Tickeron emphasizes pattern detection and historical testing, making it particularly valuable for technical traders who base decisions on chart patterns and market structure. The platform’s AI scans markets continuously for setups matching historically successful patterns, alerting users to opportunities as they develop. Virtual trading capabilities permit strategy testing without financial risk.

Features Overview

| Feature | Description |

|---|---|

| AI Pattern Detection | Recognizes chart patterns automatically |

| Price Forecasting | Predicts likely price movements |

| Multiple Asset Signals | Crypto, stocks, and options coverage |

| Virtual Testing | Practice strategies risk-free |

| Community Strategies | Access AI-generated public portfolios |

| Thorough Historical Testing | Validate approaches completely |

| Continuous Scanning | Ongoing market observation |

Tickeron’s pattern detection goes beyond simple chart evaluation. The AI weighs volume characteristics, momentum indicators, and historical context to assess each pattern’s reliability. Not all head-and-shoulders formations or breakouts are equally likely to succeed; Tickeron ranks opportunities based on probability of follow-through, helping traders concentrate on highest-quality setups.

The community aspect adds significant worth through shared learning. Investors can review AI-generated portfolios built by other users, comprehend their logic, and adopt strategies that match personal targets. This collaborative approach accelerates skill development and exposes users to diverse methods they might not have considered independently.

Pros:

- Advanced pattern detection spots high-probability setups

- Thorough historical testing validates strategies completely

- Virtual trading permits risk-free learning

- Community portfolios deliver strategy ideas

- Covers multiple asset classes

- Free trial enables platform assessment

Cons:

- Premium tiers can reach $250/month

- Technical concentration may overwhelm fundamental analysts

- Requires understanding of technical evaluation concepts

Streetbeat

Streetbeat uses AI and data from Wall Street institutional strategies to power its investment system, essentially permitting everyday investors to follow in the footsteps of professional money managers. The platform provides curated strategies based on live market data and has expanded into cryptocurrency, providing exposure to digital assets alongside traditional investments.

Features Overview

| Feature | Description |

|---|---|

| Institutional Strategy Access | Follow professional-quality approaches |

| AI Curated Portfolios | Pre-built strategies for different targets |

| Live Professional Data | Insights from professional managers |

| Multiple Asset Coverage | Stocks, ETFs, and crypto |

| Zero-Commission Trading | No transaction costs |

| Automated Execution | Strategies implement automatically |

| Subscription Pricing | Affordable access from $9.99/month |

The platform’s connection to institutional information provides distinctive worth. Rather than depending solely on its own evaluation, Streetbeat incorporates signals from hedge fund positioning, analyst suggestions, and institutional order flow. This access to “smart money” indicators helps everyday investors comprehend where professional capital is moving before the broader market catches on.

Streetbeat’s curated portfolios remove the burden of security selection and allocation choices. Each strategy serves a specific purpose—whether growth, income, or risk mitigation—and automatically adjusts positions as situations change. This turnkey approach makes sophisticated investing accessible to those without time or knowledge for active management.

Pros:

- Access to institutional-quality strategies and information

- Extremely affordable entry point at $9.99/month

- Zero-commission trades reduce expenses

- Automated execution removes emotional interference

- Multiple asset coverage including crypto

- Pre-built portfolios simplify decision-making

Cons:

- Less control for investors preferring individual stock selection

- Dependence on institutional signals may lag during rapid market changes

Incite

Incite concentrates on making sophisticated trading tools accessible to everyday investors through sentiment-focused AI suggestions. The platform examines market sentiment, price trends, and macroeconomic signals to recommend trades across crypto and traditional markets. Its emphasis on actionable insights and portfolio notifications helps investors stay ahead of significant market moves.

Features Overview

| Feature | Description |

|---|---|

| Sentiment Evaluation | Tracks investor psychology and mood |

| Trade Suggestions | AI-generated buy/sell recommendations |

| Position Notifications | Alerts for significant events |

| Multiple Asset Coverage | Crypto, stocks, and indices |

| Smart Automation | Reduces manual monitoring burden |

| Learning Tools | Resources for skill development |

| Free Basic Access | Core capabilities available without cost |

Incite’s sentiment evaluation function provides an advantage in grasping market psychology. By tracking social media, news outlets, and trading patterns, the AI measures whether investors are becoming overly optimistic (potential selling opportunity) or excessively fearful (potential buying opportunity). This contrarian indicator helps spot inflection points other approaches might miss.

The platform’s notification system guarantees you don’t miss important developments. Whether an earnings announcement, technical breakout, or sudden sentiment shift, Incite notifies you promptly so you can assess and respond appropriately. This monitoring service proves particularly valuable for investors managing responsibilities outside of constant market watching.

Pros:

- Distinctive sentiment evaluation provides psychological market advantage

- Free basic access enables risk-free trial

- Position notifications reduce need for constant monitoring

- Learning resources support investor development

- Covers both crypto and traditional markets

- Smart automation simplifies investing process

Cons:

- Newer platform with limited historical performance record

- Mobile and web platform capabilities may be developing

- Advanced capabilities not clearly specified in available information

Kavout

Kavout provides sophisticated AI-powered stock scoring through its proprietary “Kai” system, which ranks investment opportunities using quantitative models similar to those employed by institutional investors. While focused primarily on equities, the platform has expanded to include crypto filtering and strategy construction, making it valuable for systematic traders and institutions pursuing data-driven advantages.

Features Overview

| Feature | Description |

|---|---|

| Kai Scoring System | AI-based ranking of stocks and crypto |

| Quantitative Filtering | Systematic opportunity identification |

| Custom Modeling | Build proprietary scoring systems |

| Institutional-Quality Tools | Professional-level evaluation capabilities |

| Multiple Asset Coverage | Equities, crypto, and ETFs |

| Scaled Pricing | Options from retail to enterprise |

| Systematic Method | Data-driven investment methodology |

The Kai Score represents Kavout’s core value proposition, distilling complex multi-factor evaluation into a single, actionable number. This score incorporates technical momentum, fundamental quality, relative valuation, and risk factors to estimate each security’s expected performance. The transparency of component factors permits investors to comprehend what drives each suggestion.

Kavout’s quantitative method appeals to systematic traders who prefer removing subjective judgment from investment choices. By defining clear standards for position entry and exit, the platform enables disciplined execution even during volatile market periods when emotional interference typically sabotages performance. This methodology has proven effective across various market environments.

Pros:

- Sophisticated Kai Score delivers institutional-quality evaluation

- Quantitative approach removes emotional bias

- Appropriate for both retail and institutional investors

- Custom modeling enables proprietary strategy development

- Multiple asset coverage increases opportunity set

- Strong foundation in proven quantitative methods

Cons:

- May require quantitative background to utilize fully

- Scaled pricing can reach enterprise levels

- Concentration on systematic approaches may not suit discretionary traders

Conclusion

The platforms reviewed here each provide distinctive strengths, from KnockoutStocks.com’s comprehensive portfolio monitoring to WunderTrading’s specialized cryptocurrency automation. The connecting thread is accessibility: AI has equalized the playing field, enabling everyday investors to access insights and execution capabilities that match professional managers.

However, technology alone doesn’t ensure success. The most productive method combines AI’s analytical capabilities with human judgment, proper risk control, and a clear understanding of your personal financial targets. Use these tools to enhance your process rather than replace critical thinking. Begin with one platform that matches your strategy, learn its capabilities thoroughly, and let data inform—but not control—your choices.

The future of investing is already here. Whether you’re taking your first steps in the market or refining decades of experience, AI-powered tools provide opportunities to invest more intelligently, quickly, and with greater assurance than ever before.

Frequently Asked Questions

Q: Do AI stock pickers genuinely generate profits?

Yes, numerous AI stock selection platforms have verified performance histories showing substantial returns. For instance, Intellectia AI has shown over 120% annual returns, while Zen Investor’s top-rated stocks have averaged 32.52% annually since 2003. However, historical performance doesn’t guarantee future outcomes, and profitability depends on proper risk control, strategy alignment, and consistent application of the tools’ insights.

Q: Do I need investment knowledge to use AI stock selection tools?

Not necessarily. Platforms like KnockoutStocks.com, Prospero.ai, and RockFlow are built with accessible interfaces appropriate for beginners. Many include learning resources and AI coaching to help you learn while investing. However, understanding basic investment concepts like risk tolerance, diversification, and time horizon will help you use any tool more productively.

Q: What do AI stock selection platforms cost?

Pricing varies significantly. Some platforms like Incite and Trade Ideas provide free basic tiers, while others like Intellectia AI offer affordable entry points ($1 trial, then $23.96/month). Premium services like Zen Investor begin at $60/month, and advanced platforms like Tickeron can reach $250/month for complete capabilities. Many provide trial periods or refund guarantees to test before committing.

Q: Can AI stock pickers handle cryptocurrency investments?

Yes, several platforms specialize in or include cryptocurrency coverage. ChainGPT and WunderTrading concentrate exclusively on crypto, while platforms like Intellectia AI, RockFlow, and AInvest incorporate cryptocurrencies alongside traditional stocks and ETFs. If crypto investing interests you, verify the platform’s specific digital asset capabilities before subscribing.

Q: Should I use AI stock pickers for day trading or long-term investing?

It depends on the platform. Trade Ideas, TrendSpider, and Intellectia AI excel for active traders and day trading with live analysis and signals. Zen Investor and Streetbeat better serve long-term investors through curated portfolios and buy-and-hold strategies. KnockoutStocks.com and Prospero.ai offer adaptability for both approaches. Match the platform’s design to your preferred investing timeline.

Q: Do AI stock pickers replace financial advisors?

AI tools complement but don’t fully replace human financial advisors, especially for comprehensive financial planning involving taxes, estate planning, and complex personal situations. However, for stock selection and portfolio enhancement, AI platforms can effectively handle evaluation and suggestions that once required advisor input. Many investors successfully combine AI tools for investment choices with occasional advisor consultations for broader planning.

Q: How do AI stock pickers actually work?

AI stock pickers use machine learning algorithms to examine vast datasets including fundamental measurements (earnings, revenue, debt), technical indicators (price patterns, volume, momentum), and alternative information (news sentiment, social media, economic indicators). They spot patterns correlating with future stock performance and generate suggestions based on these learned relationships. The best platforms continuously refine their models as new information becomes available.

Q: Are AI stock selection tools regulated?

The tools themselves generally aren’t regulated as investment advisors unless they provide discretionary portfolio management. However, reputable platforms partner with regulated broker-dealers for trade execution and implement security measures to protect user information. When choosing a platform, verify it uses established financial infrastructure and maintains transparent terms of service. Some platforms like KnockoutStocks.com are BBB accredited, providing additional credibility.