TLDR

- ETH continues to defend the $2,000–$2,100 demand zone despite sustained bearish pressure.

- Descending resistance keeps rallies capped, with $2,400 needed to shift structure.

- Loss of rising support signals a structural reset rather than trend continuation.

- Liquidity clusters near $2,000 make this level critical for short-term direction.

Ethereum (ETH) price remains at a pivotal point as traders assess whether recent downside indicates exhaustion or further weakness. Technical analysts point to firm defense near $2,000–$2,100, while upside recovery depends on reclaiming higher resistance levels. Attention is centered on $2,400 and $2,700 as potential gateways back into a stronger market structure.

Ethereum Price Holds Key Support Below Macro Resistance

According to analyst Ted, the broader structure shows Ethereum price trending lower since rejection near the $3,800–$4,000 resistance zone. Each recovery attempt has been capped by descending resistance, confirming sustained seller control. Red-marked rejection zones highlight how former support continues to act as supply.

Most importantly, price has defended the $2,000–$2,100 zone despite heightened volatility. This zone aligns with prior consolidation and heavy trading volume, making it a logical demand zone. The hold suggests long-term participants remain active, limiting immediate downside acceleration.

However, Ted suggested that defense alone does not confirm recovery. Ethereum price must reclaim $2,400 decisively to re-enter the previous value area. Without acceptance above this level, rebounds risk remaining corrective within a broader bearish structure.

Rising Support Breakdown Signals ETH Price Structural Reset

Meanwhile, according to analyst Dami-Defi, Ethereum price lost a rising support trendline that guided late-2025 price action. The sequence of higher lows suggested resilience, but the eventual breakdown confirmed structural weakness. Once support failed, price declined sharply, validating downside risk.

The sell-off extended into the $2,150 demand zone, where historical buying interest is concentrated. Long downside wicks suggest forced liquidation rather than deliberate distribution. Such price behavior often reflects a liquidity-driven flush instead of trend continuation.

The analyst noted that holding $2,150 could lead to a rebuilding phase. This phase may involve range trading between $2,150 and $2,700. A structural bullish shift requires reclaiming $2.7k, followed by sustained acceptance above $2.85k.

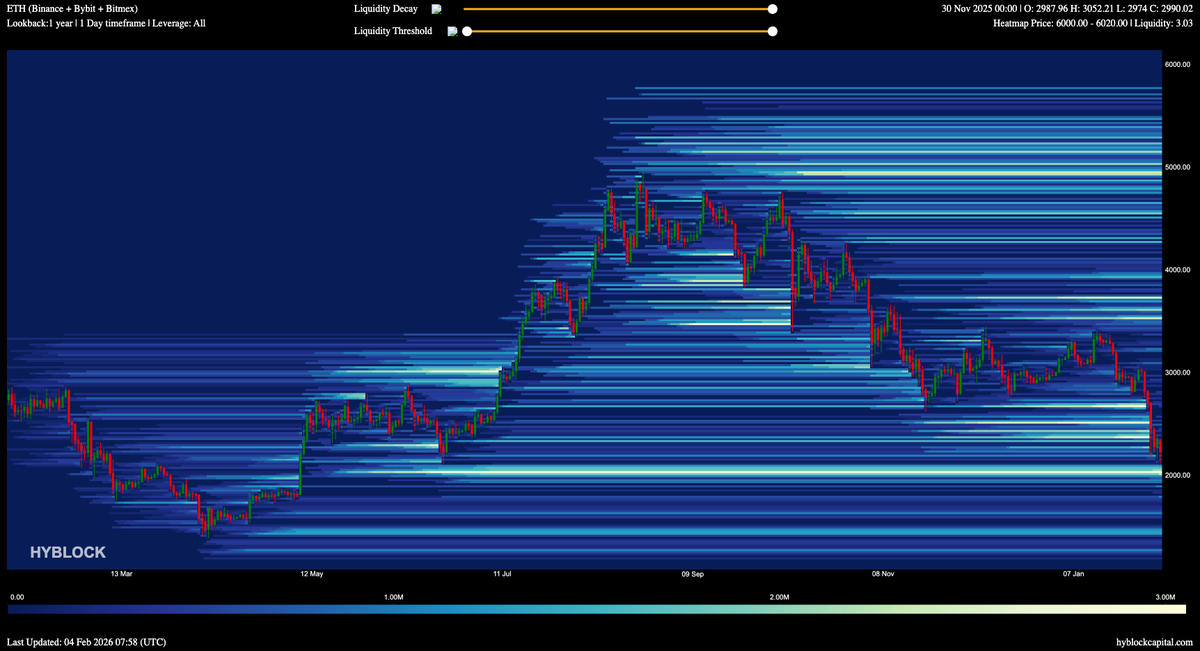

Liquidity Clusters Make $2,000 a Critical Threshold

Furthermore, analyst Ardi’s analysis highlights dense liquidation liquidity clustered near $2,000. One-year data shows substantial long exposure resting just below the current price. This concentration makes the level both a technical support and a major liquidity magnet.

From a market mechanics view, such clusters attract price during volatility. A decisive breakdown below $2,000 could trigger cascading liquidations, accelerating downside momentum. This is why the zone is described as an essential defense level.

Conversely, a successful hold above $2,000 suggests the recent decline was a controlled reset. It keeps shorts cautious and supports base formation. In this context, Ethereum price behavior around this threshold shapes near-term structure and positioning.