Crypto investors are prioritizing infrastructure over DeFi by a landslide, according to a fresh survey of 242 senior executives. Meanwhile, blockchain intelligence firm TRM Labs just closed a $70 million round at a $1 billion valuation, a moment of proof that institutions are placing their best on AI-powered crypto tools in no small way.

The DeepSnitch AI launch countdown is ticking down amid all this, and with above $1.48M raised at $0.0383 per token, this pre-launch moment is your last chance to buy early on a platform that’s already shipping the infrastructure investors are prioritising. It has sincere moonshot potential once it launches, and that launch is only days away.

Infrastructure dominates investor priorities

A CfC St. Moritz survey found 85% of respondents selected infrastructure as their top funding priority, ahead of DeFi, compliance, cybersecurity, and user experience. Liquidity constraints and market depth were flagged as the main barriers keeping institutional capital on the sidelines.

And TRM Labs shows what succeeding looks like in this environment, as Goldman Sachs, Citi Ventures, and Galaxy Ventures backed the platform at a $1 billion valuation. CEO Esteban Castaño said the funding will expand AI solutions protecting critical systems from cybercrime.

AI infrastructure isn’t a nice-to-have anymore. In fact, it’s where smart money is headed, and for good reason. The Deepsnitch AI launch countdown is on, and if you want to be at the front of that trend, you’ll be in the running for the best gains of a 1000x run early in the year.

RNDR and LINK search for footing while DeepSnitch AI prepares for takeoff

1. DeepSnitch AI

To understand the powerful utility of DeepSnitch AI, start by thinking about how most people approach crypto. Some scroll Twitter, catch wind of something pumping, and buy in after the move has already happened. Others, in more dire straits, may find a token that looks promising but turns out to be a honeypot with hidden sell taxes or locked liquidity designed to trap them.

DeepSnitch AI is built to defuse both of those scenarios. The platform runs on five interconnected AI agents, all of which will be live come launch, but many of which are already internally live and available to early holders to use.

SnitchFeed acts as your radar, surfacing global alerts and trending tokens before they hit mainstream feeds. Token Explorer gives you the full picture on any asset, displaying holder distribution, liquidity depth, and risk flags.

AuditSnitch is the practical one, allowing you to paste a contract address and get a CLEAN, CAUTION, or SKETCHY verdict based on ownership patterns, tax structures, and known exploit signatures. And SnitchGPT pulls it together with a conversational interface, where you can ask it anything and get answers that are useful and clear.

These tools are live right now, so presale holders are already testing, learning, and building intuition with the system. And because staking is active with uncapped dynamic APR, rewards grow as participation grows.

Currently priced at $0.0383, these are the last few days before launch and the last chance to buy early. DeepSnitch AI has utility-driven moonshot potential, so this is the moment to buy in, with the presale ending soon.

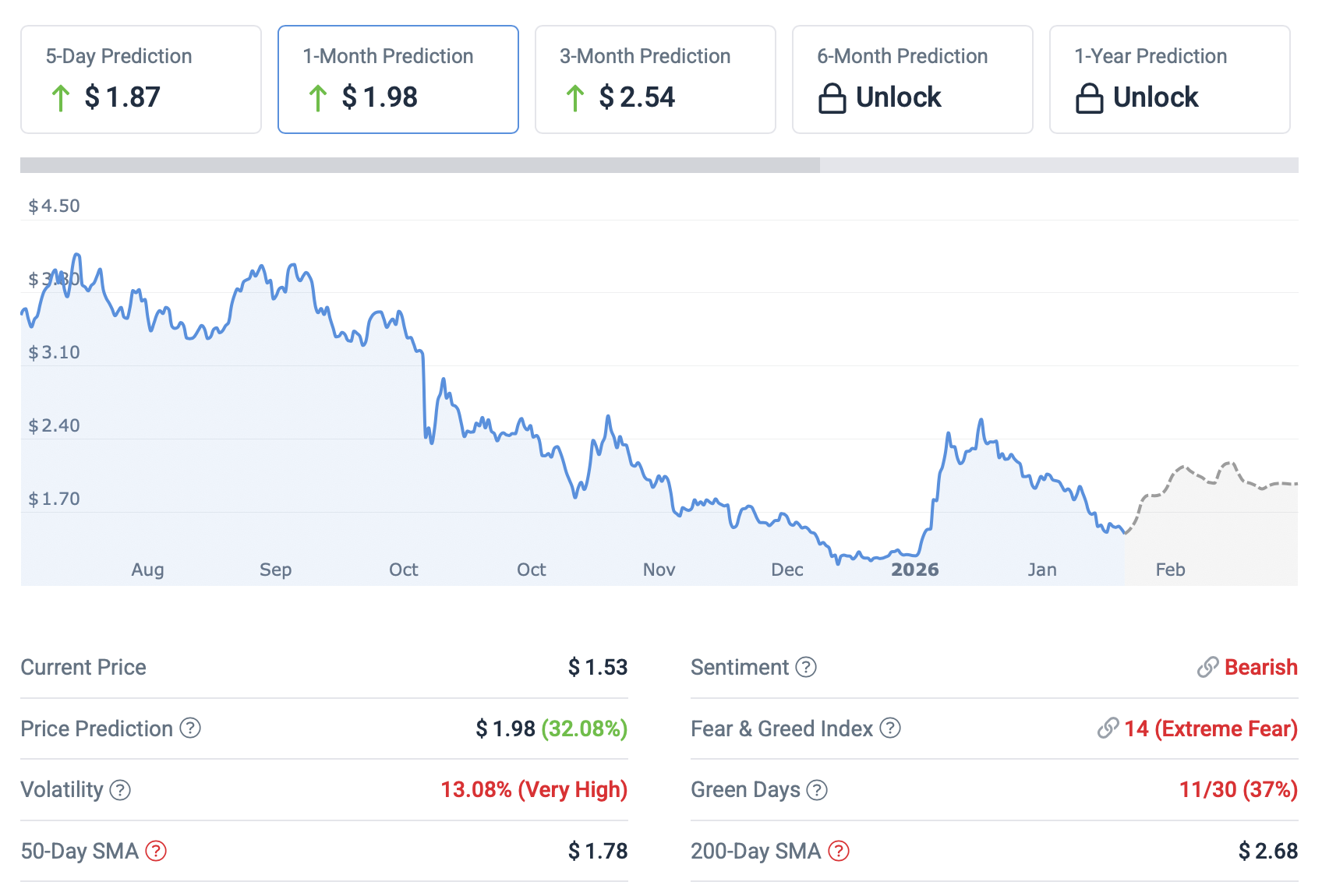

2. Render

Render’s been sliding without much to grab onto. Now down 1.8%, at about $1.54, it’s extended a 21% weekly decline that’s left it well below key moving averages as of 5 February. Some analysts are framing this as an accumulation zone, but price action instead suggests that sellers remain in control.

Render could make its way back up slightly to $1.74 over the year to come, which works out to roughly 13% upside from here. That’s okay for a hold, and for anyone seeking something slight but steady as far as rewards go. But it’s definitely not the kind of asymmetry that changes your portfolio, so if that’s what you’re keen on instead, DeepSnitch AI is a far better choice.

3. Chainlink

Chainlink’s infrastructure thesis remains one of the strongest in crypto, but the chart doesn’t care about fundamentals right now, while LINK trades at about $9.36. It’s down below the 20-day EMA with bearish momentum indicators flashing red.

A relief rally could push toward $12-$13, but sellers have been defending those levels aggressively. Predictions target above $23 by end of 2026 (over 145%), so patience could pay off. But the dividends won’t be as high as a 1000x run from an early-stage presale, and the DeepSnitch AI launch countdown is on.

Final say

If infrastructure is the narrative, AI is the execution layer. DeepSnitch AI combines both at presale pricing that established players structurally can’t match, and full launch is days away now, not months.

Buying in now, you’re betting on a system that’s already live, yet pricing doesn’t reflect that maturity because it hasn’t hit exchanges yet. Plus, there are bonus codes available right now, so if you commit to buying tokens, you can compound your position in major ways. Combined with uncapped dynamic APR staking, this is the last chance to buy early, so act fast because DeepSnitch AI ($DSNT) is days away from launch.

Secure your allocation at the official website before the presale closes, and follow X and Telegram for more updates.

FAQs

When is DeepSnitch AI launching?

Full launch is imminent and a major announcement is expected any day now, so this is the last chance to get in on a presale that has sincere 1000x potential for Q1 of 2026, flying high on its utility.

Why should I buy before DeepSnitch AI launches?

Current pricing doesn’t reflect DeepSnitch AI’s live functionality or upcoming exchange listings. Post-launch, you can buy tokens but can’t buy the head start presale holders have. This is genuinely your last chance to buy early, before a post-launch moonshot run.

Is Render a good infrastructure token compared to DeepSnitch AI?

RNDR is down 21% weekly with modest upside forecasts of about 13% by year-end. But DeepSnitch AI’s presale ending soon offers stronger asymmetry with live tools already shipping, utility with an edge that is razor-sharp, and 1000x potential on the table.