TLDR

- US spot Bitcoin ETFs recorded $145 million in inflows on Monday, following $371 million on Friday, marking the first back-to-back inflows in nearly a month

- Total inflows of $616 million have not yet offset the $318 million in outflows from last week or the $1.9 billion in year-to-date redemptions

- Bitcoin ETF assets under management have only dropped 6-7% despite BTC prices falling over 40% from October highs above $126,000

- Early Bitcoin investors are taking partial profits rather than fully exiting positions, with most remaining invested alongside new institutional buyers

- Ethereum ETFs saw $57 million in inflows and XRP ETFs gained $6.3 million on Monday as altcoin products also rebounded

US spot Bitcoin exchange-traded funds recorded consecutive inflows for the first time since mid-January. The funds attracted $471 million on Friday followed by $145 million on Monday.

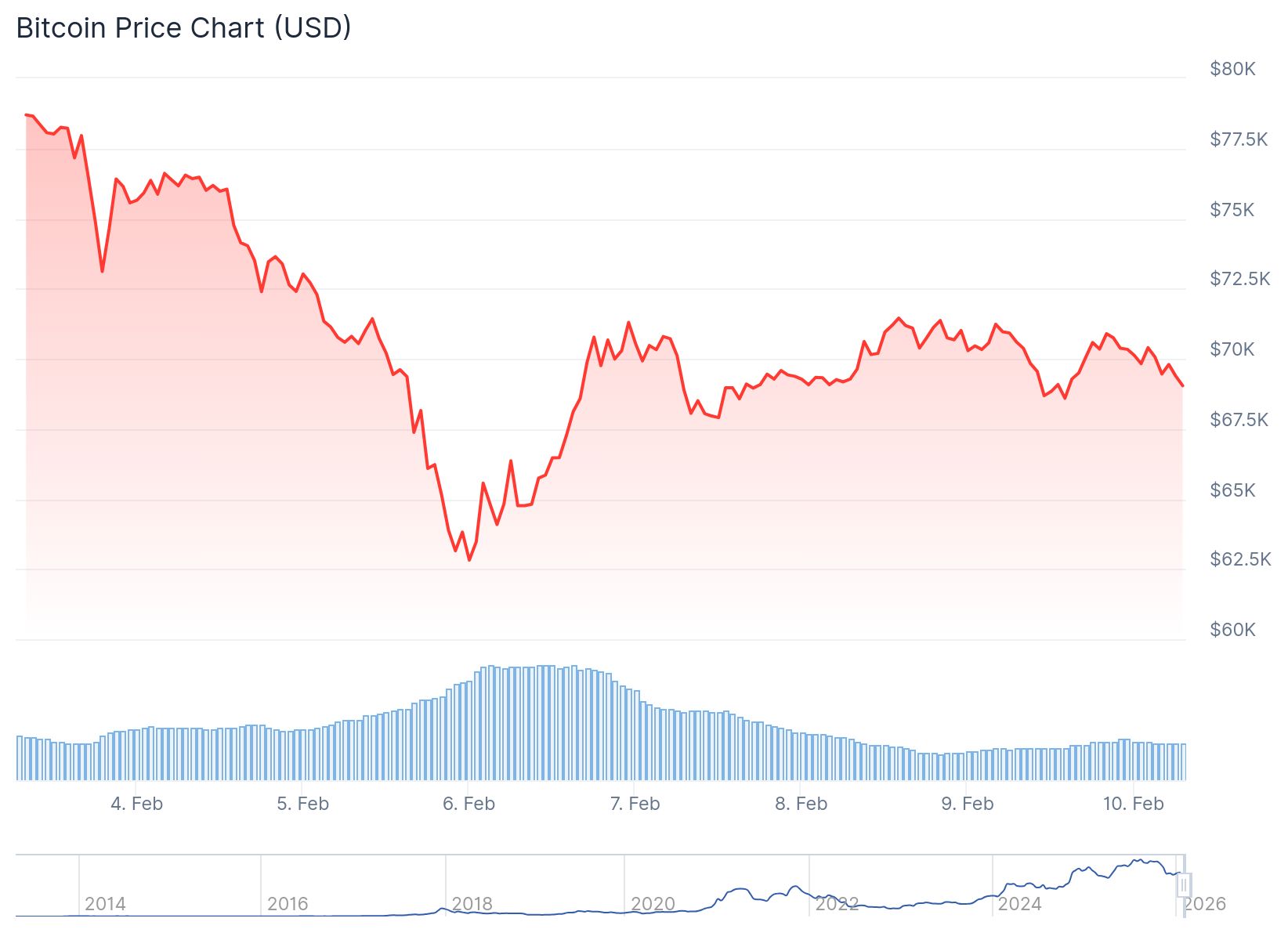

The two-day total of $616 million represents a shift from weeks of sustained selling. Bitcoin was trading around $70,000 during Monday’s inflows.

The recent gains have not reversed the broader outflow trend. Year-to-date redemptions still total $1.9 billion across Bitcoin ETF products.

Last week alone saw $318 million in net outflows before Friday’s reversal. The slowing pace of losses may signal a potential change in direction.

CoinShares head of research James Butterfill noted that outflows slowed to $187 million despite price pressure. He said the deceleration in flows has historically signaled potential inflection points.

ETF Holdings Remain Stable Despite Price Drop

Bitcoin ETF assets under management have shown resilience during the recent price decline. Total BTC held in the 11 funds has decreased only 6-7% since early October.

Holdings fell from 1.37 million BTC to 1.29 million BTC during that period. Bitcoin prices, however, dropped over 40% from record highs above $126,000 in October.

The cryptocurrency bounced back from Thursday’s low of $60,000 to current levels near $70,000. Bitcoin had peaked near $98,000 in mid-January after rallying from $87,000.

The subsequent sell-off prompted millions in redemptions from spot ETFs. The divergence between price performance and fund holdings suggests investors maintain long-term confidence.

Early Bitcoin Holders Trim Rather Than Exit

Bitwise chief investment officer Matt Hougan said early Bitcoin investors are not leaving the market. Many original holders are taking partial profits after large gains.

I asked @Matt_Hougan on ETF IQ today about my one (slight) worry re Bitcoin which is are OGs still into it(bc clearly the ETFs and MSTR are), or are they cashing out bc they don’t like that it’s mainstream a la how kids left Facebook when their parents joined? His answer: pic.twitter.com/xLgHrmPghE

— Eric Balchunas (@EricBalchunas) February 9, 2026

Hougan acknowledged some early supporters may be uncomfortable with institutional influence. He described this group as a “shrinking minority.”

Most early investors remain in their positions while new institutional buyers enter. Hougan said investors who put in thousands early now hold millions in value.

The vast majority stay invested rather than exit completely. They are being joined by new institutional participants in the market.

Hougan said the narrative that original crypto investors are abandoning the space does not match reality. This assessment is based on conversations with investors working with Bitwise.

Altcoin ETFs Join the Rebound

Ethereum ETFs recorded $57 million in inflows on Monday alongside the Bitcoin gains. XRP ETFs attracted $6.3 million in fresh capital the same day.

The altcoin product inflows followed the same pattern as Bitcoin ETF flows. Spot altcoin funds also posted gains after weeks of redemptions.