TLDR

- Ethereum price dropped below the realized price of accumulation addresses, with whales buying aggressively since June 2025 despite current losses

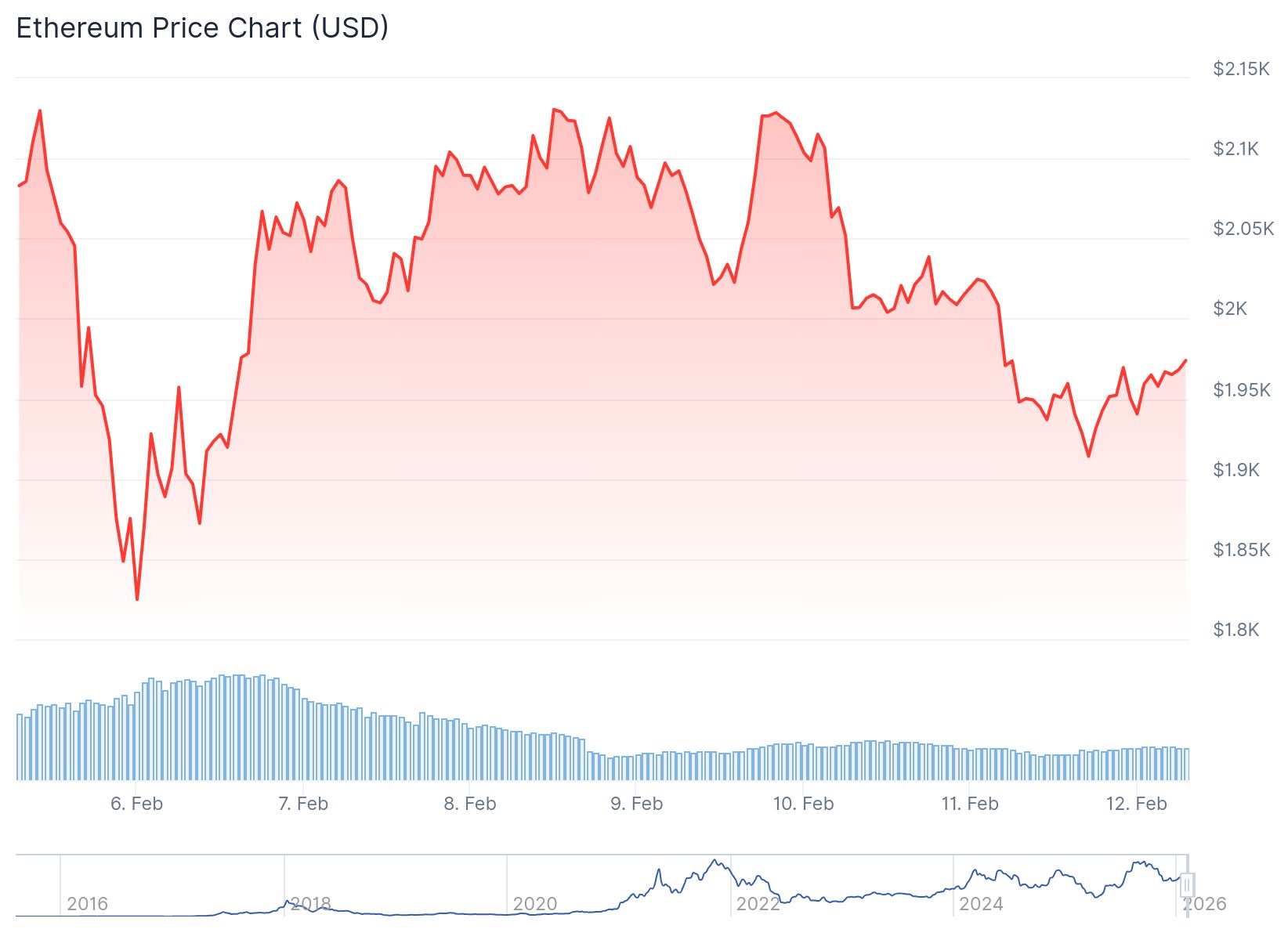

- ETH currently trades around $1,944, down 3.6% in 24 hours and 13.8% over the past week

- Ethereum staking ratio reached an all-time high above 30%, with over 30% of total ETH supply now locked in validators

- Companies like BitMine and SharpLink continue accumulating ETH, with BitMine adding 41,788 ETH recently

- Technical analysis shows ETH at risk of falling below $1,800 support level if current consolidation fails

Ethereum price has fallen below a key metric that tracks what large holders paid for their coins. Data from CryptoQuant shows the current price sits below the realized price of accumulation addresses.

Ethereum has Fallen Below the Realized Price of the Accumulation Addresses

“The current price is below the price at which they began accumulating. Furthermore, their accumulation is proceeding even more aggressively.” – By @CW8900

Link ⤵️https://t.co/CXLpY9rKzC pic.twitter.com/JbBlwSzKHT

— CryptoQuant.com (@cryptoquant_com) February 11, 2026

These addresses belong to whales who started buying heavily around June 2025. They have continued purchasing ETH in large volumes since then. Their average buy price has risen over time as they accumulated.

The current spot market price now sits below what these large holders paid on average. ETH trades at $1,944 with a market cap of $234.2 billion. The price fell 3.6% in the last 24 hours and 13.8% over the past week.

When price drops below the cost basis of strong holders, it often signals a potential bottom. Sellers get exhausted and weak hands exit the market. Meanwhile, conviction buyers see the lower prices as value.

The whales are treating the price drop as a buying opportunity. Their ETH inflows have reached multi-year highs. This buying behavior contrasts with the broader market selling pressure.

Staking Reaches New Record

The Ethereum staking ratio has crossed 30% for the first time. Over 30% of all circulating ETH is now locked in staking validators.

High staking reduces the amount of ETH available to sell on exchanges. This creates less selling pressure during price recoveries. The increased staking also shows long-term confidence in Ethereum’s future.

Joseph Young, an Ethereum narrator, pointed out this bullish development on X. Rather than selling during the price decline, holders are locking up their ETH for staking rewards.

ethereum staking ratio is at an all time high.

over 30% of eth is now staked.

while dats like BitMine and SharpLink accumulate with:

– balance sheet capital

– no debt

– long term conviction

– stake to earn modelbrutal market for crypto, but ethereum looks bright. pic.twitter.com/uVH59IWrAs

— Joseph Young (@iamjosephyoung) February 11, 2026

Companies are also getting involved in ETH staking. BitMine and SharpLink are accumulating and staking Ethereum. These firms hold ETH as a core balance sheet asset.

BitMine recently bought an additional 41,788 ETH. Chairman Tom Lee said the purchase followed stronger network signals despite falling prices.

Technical Support at Risk

Ethereum faces a technical challenge at the $1,800 level. This price point represents the highest volume of trading in the current range. The level has provided temporary support after recent selling.

However, the consolidation shows weak bullish volume. Price has moved sideways for several sessions without upward momentum. This pattern often appears before further declines rather than reversals.

The point of control near $1,800 is weakening. If Ethereum closes below this level on a daily basis, further downside could follow. The next target sits at the value area low, which aligns with Fibonacci extension levels.

Market Structure Analysis

Crypto trader Alejandro released a macro analysis of Ethereum’s price structure. According to the analysis, ETH has been in a broad corrective phase since 2019 to 2020.

The rally after the 2022 bear market looked like a new bull run. However, it fits better as a countertrend move within a larger correction. Price has failed to break and hold above the previous cycle high multiple times.

This repeated failure signals distribution rather than accumulation. Alejandro believes true bullish continuation will only begin after the current shakeout completes.

The current consolidation lacks the volume expansion typically seen in strong reversals. Buying interest has declined since price first bounced from $1,800. This imbalance suggests exhaustion rather than strength building.

ETH remains vulnerable to renewed selling pressure without clear volume expansion. The market structure resembles a pause within a broader corrective trend. A break below current support could trigger an acceleration lower as price seeks the next acceptance area.