TLDR

- Ether ETFs attracted $71 million in fresh capital after breaking a three-day outflow streak, with assets under management stable at $13 billion

- Weekly decentralized exchange volumes on Ethereum doubled to $20 billion from $9.8 billion one month prior

- Ethereum’s staking ratio reached a record high of 30% of total supply for the first time

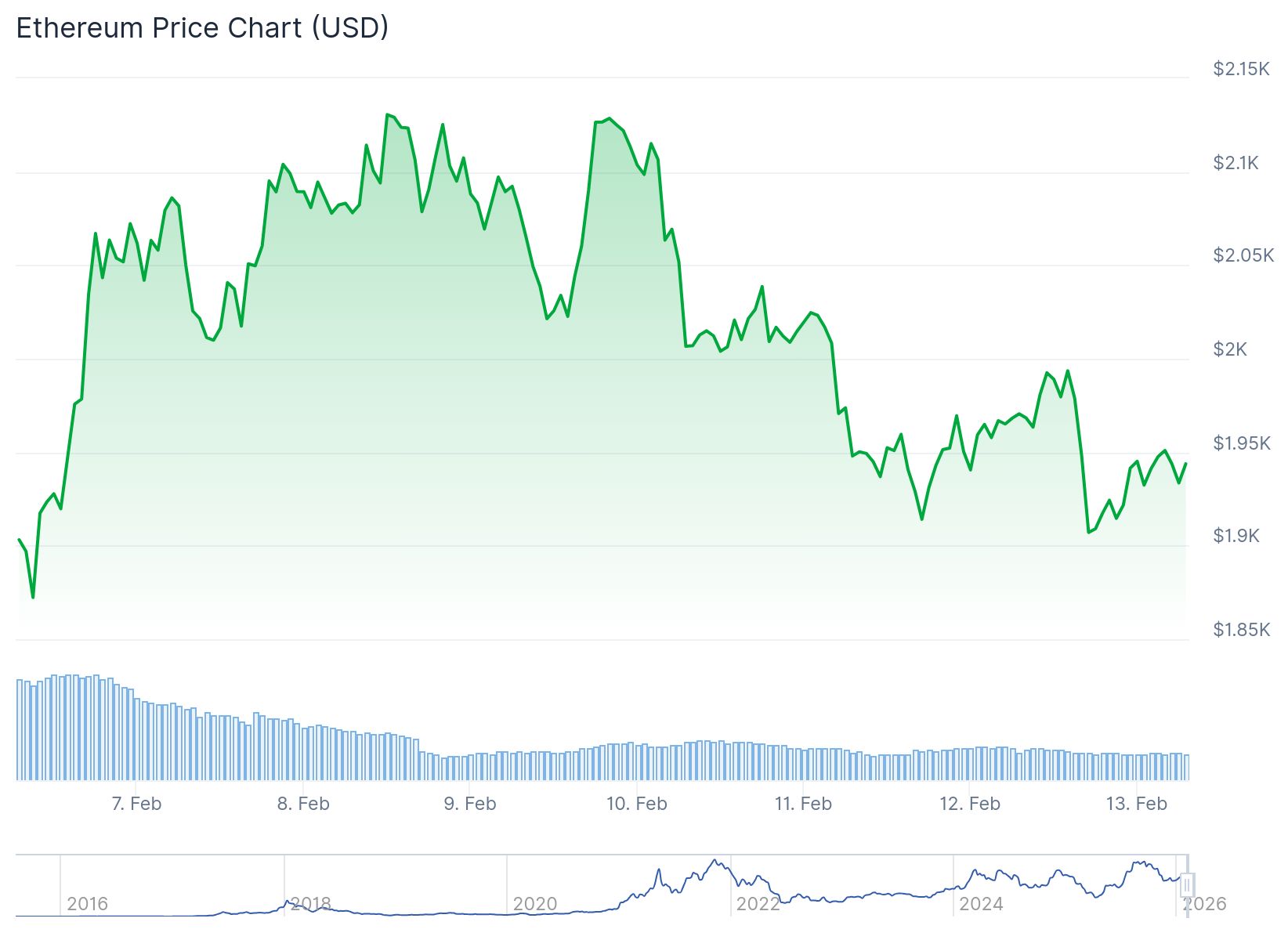

- Ether price dropped to $1,985, down 60% from its all-time high, with the Relative Strength Index approaching oversold levels

- Despite price weakness, derivatives markets show resilience with futures basis rate stabilizing at 3%

Ether price failed to hold above $2,000 on Thursday. The second-largest cryptocurrency dropped to $1,985, marking a 60% decline from its peak in August.

The drop came as the broader crypto market weakened ahead of the US consumer inflation report. Ether has now posted four consecutive weeks of losses.

Spot ETH ETFs shed over $129 million in assets on Wednesday alone. Monthly outflows have reached $224 million, marking the fourth straight month of withdrawals.

Cumulative net inflows for Ether ETFs stand at $11.75 billion since launch. Trading volume remains strong at over $1.65 billion daily.

US-listed Ether ETFs recently broke a three-day outflow streak. The funds attracted $71 million in fresh capital between Monday and Tuesday.

Assets under management have stabilized at $13 billion. This level of liquidity enables participation from major institutional investors and hedge funds.

The daily trading volume for Ether ETFs matches that of the State Street Energy Select Sector SPDR ETF. That fund tracks a combined $2 trillion market cap across major energy companies.

$ETH is struggling to reclaim the $2,000 level now.

This is an important zone for Ethereum, which will trigger some rallies.

If ETH fails to reclaim this soon, expect a full retrace towards the $1,700-$1,800 level. pic.twitter.com/iyQBFhQcSY

— Ted (@TedPillows) February 12, 2026

Network Activity Shows Growth

Weekly decentralized exchange volumes on Ethereum surged to $20 billion. This represents a jump from $9.8 billion recorded one month earlier.

The increased activity pushed DApps revenue to $26.6 million for the seven days ending February 8. Solana still leads with $31.1 million in weekly DApps revenue, but the gap is narrowing.

Ethereum’s Total Value Locked dropped to $54.2 billion from $71.2 billion one month prior. Lower deposits in smart contracts reduce chain fees and native staking yields.

Futures open interest fell to $23 billion from last year’s high of over $70 billion. Falling open interest typically signals declining investor demand.

The annualized premium of ETH futures remained below the 5% neutral threshold on Wednesday. The basis rate has stabilized at 3% despite Ether hitting its lowest level in nine months.

Staking Metrics Hit Records

Ethereum staking recently crossed 30% of total supply for the first time. More than 4 million ETH tokens currently sit in the staking queue.

71 days, 11hrs.

That's how long you'd wait to stake $ETH right now.

Ethereum staking recently hit 30% of total supply, meaning 36.8M $ETH ($72B at current prices) is now locked up.

Nearly 1 million validators are securing the network.

The obvious impact: This is a massive… pic.twitter.com/GXwFxXQg9u

— Milk Road (@MilkRoad) February 11, 2026

Less than 25,000 tokens are waiting to exit the staking system. The growing queue suggests holders are choosing to lock up their assets long-term.

The Relative Strength Index is nearing the oversold level of 30. This marks its lowest reading since April of last year.

The Average Directional Index dropped from 33 in July to 21 now. This decline suggests the downtrend is losing momentum.

Ether has formed an inverted head-and-shoulders pattern on the weekly chart. This pattern typically signals a bullish reversal in technical analysis.

The price crashed below the support level at $2,112, which was its lowest point in August 2024. Analysts watching these patterns suggest Ethereum may be approaching a bottom, with potential movement toward $2,400 if current trends continue.