What if the real mistake in 2026 is not missing the presale but choosing the wrong platform to join it? That is why this guide focuses on how buyers can compare the top crypto presales by where they launch, how sales are structured, and what can be verified before money is sent. In the landscape of Crypto presale platforms 2026, the safest edge often comes from clear terms, visible tokenomics, and proof-backed updates.

One project that keeps appearing in early-stage discussions is IPO Genie ($IPO). It links presales to a private-market angle and promotes a low entry point starting from $10. Its mission is to widen access beyond the small group (1%) that historically had private market entry. While using on-chain activity as part of the transparency story.

Ranked Platform Types For Presales in 2026

| Rank | Platform type | Best for | What to check before buying |

| 1 | Project-run presale portals | Direct access to a specific thesis | Official domain, published tokenomics, audit proof, clear bonus terms |

| 2 | Major exchange launchpads | Curated sales with exchange screening | KYC rules, allocation method, listing plan, vesting terms |

| 3 | IDO crypto launchpads | Wider variety of new IDOs | Vetting method, audit links, liquidity lock, vesting schedule |

| 4 | Compliance-first sale platforms | Regulated-style token sales | Region limits, KYC, delivery schedule, legal terms |

| 5 | Permissionless launchpads | Many listings and fast access | Extra caution: contract review, team info, liquidity lock evidence |

1) Project-Run Presale Portal- IPO Genie ($IPO)

Private-market access angle plus presale incentives

Live presale: ipogenie.ai

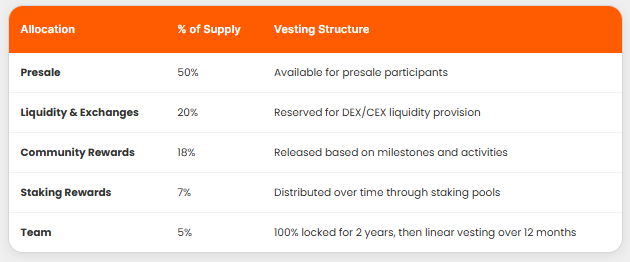

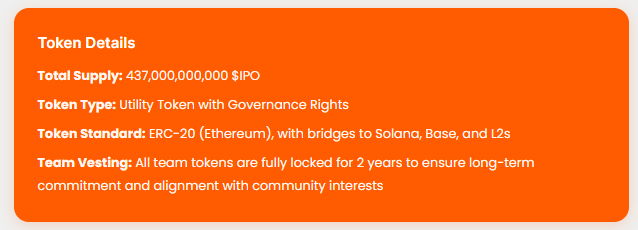

IPO Genie positions $IPO as a utility token tied to access tiers, staking, and governance across its ecosystem. Its tokenomics page lists a 437B total supply and a distribution that includes 50% for presale. Moreover, its allocations for liquidity, community rewards, staking rewards, and team tokens have a lock and vesting schedule. IPO Genie smart contract audit on the SolidProof and CertiK, and security custody on Fireblocks.

It also builds its story around a common private-market barrier. Private deals often come with large minimum checks ($250,000) and long hold times (lock-up for 7-10 years). Thus, IPO Genie provides the pre-IPO opportunity for “retail investors (99%)” to access the private market at a low entry level ($10) and exit anytime (no lock-in). IPO Genie’s highlights how private investing has traditionally favored a “small slice of participants (1%)”, while retail often arrives late.

For incentives, one item is easy to verify: IPO Genie’s referral program states that when a new user completes a $20+ buy, both wallets receive 15% extra $IPO.

Also, they mention they offer a 20% welcome bonus. That should be confirmed on official pages at the time of purchase because bonus terms can change.

For real-world visibility, IPO Genie published content around a Dubai Misfits Boxing VIP giveaway tied to Misfits Mania Dubai 2025, and it also lists the event on its events hub.

Seasonal promos have appeared in official and media coverage, too. IPO Genie posted a Black Friday event describing a 30% bonus window, and multiple outlets reported a Christmas campaign with a 25% bonus during the holiday period.

2) Major Exchange Launchpads

Stricter Screening, Simpler Flow

For many investors, the cleanest entry is an exchange launchpad. The main benefit is screening and smoother onboarding. Most of these sales require KYC. As a result, they often reduce random contract risk compared to unknown listings.

Still, exchange launchpads can be highly competitive. Allocations may depend on holding the exchange token or meeting trading volume targets. Region limits are common, which also matters for interested early participants who want to compare crypto presale platforms of 2026 for investment.

3) IDO Crypto Launchpads

Wider choice, more homework

IDO platforms and crypto launchpads can give access to more early-stage tokens. That appeals to people who like variety and whitelist campaigns. However, the trade-off is extra diligence.

Key checks matter here. First, confirm an audit link, not just an audit name. Next, look for liquidity lock proof. Then, read vesting rules because token unlock schedules can shape price action.

4) Compliance-First Token Sale Platforms:

Strict rules, clearer paperwork

Some platforms focus on compliance-heavy token sales with tight KYC and region gating. These can be a fit for buyers who prefer formal terms, even if access is narrower.

The practical upside is clarity. The buyer usually sees a defined sale agreement, token delivery schedule, and lockup terms. On the other hand, the buyer may face longer verification steps and fewer open sales.

5) Permissionless Launchpads

Fast access, highest caution

Permissionless launchpads list many Web3 projects quickly. That speed attracts hunters, yet it also raises the need for careful checks.

For these listings, contract review becomes key. Also, investors should confirm the official project domain, social links, and whether liquidity is locked. If the team is anonymous, risk rises even more.

The Safety Checklist That Separates Strong Presales From Noise

If you are looking for the best plaforms then you have to follow these steps before investing. People searching for “best platforms” usually want a simple process. Here is the process that supports investing in early-stage cryptocurrencies without guessing:

- Verify the official domain and match it to the project’s official social links.

- Read tokenomics for supply, allocation, and team vesting.

- Check audits and look for the report source.

- Confirm vesting and unlock schedule so token release timing is clear.

- Watch for proof of progress, such as product updates, partnerships, or dated milestones.

The Real “Best Platform” Test in 2026

In 2026, the best presale platform is not the loudest one. It is the one that makes key facts easy to verify. That includes tokenomics, audits, vesting, and clear rules.

For investors comparing top crypto presales, IPO Genie fits the list because it pairs a presale portal with private-market access, publishes its token allocation details, and keeps building public visibility through events and structured promotions. Also, it have the strong fundamental, which is why experts say it is the most promising token that deliver highest return in Q1 2026.

So, if you want to invest in a legitimate early-stage crypto, then IPO Genie is the best platform among the top cryptos to buy now in February 2026. Because it’s a bridge between the blockchain & pre-IPO private market, it helps you to invest through the IPO Genie at a low entry level without a lockup.