TLDR

- CryptoQuant estimates Bitcoin’s ultimate bear market bottom sits around $55,000, which is still 25% below current trading levels

- Bitcoin holders realized $5.4 billion in daily losses on February 5, but monthly cumulative losses remain far below historical bear market capitulation levels

- Key valuation indicators like MVRV ratio and NUPL have not entered extreme zones typically seen at bear market bottoms

- Long-term holders are selling near breakeven rather than at the 30-40% losses seen at previous cycle lows

- CryptoQuant’s Bull-Bear Market Cycle Indicator remains in Bear Phase rather than Extreme Bear Phase, suggesting months of price base formation ahead

Bitcoin has not reached its true bear market bottom yet, according to onchain analytics firm CryptoQuant. The firm’s latest analysis suggests the cryptocurrency still has further to fall before forming a structural base.

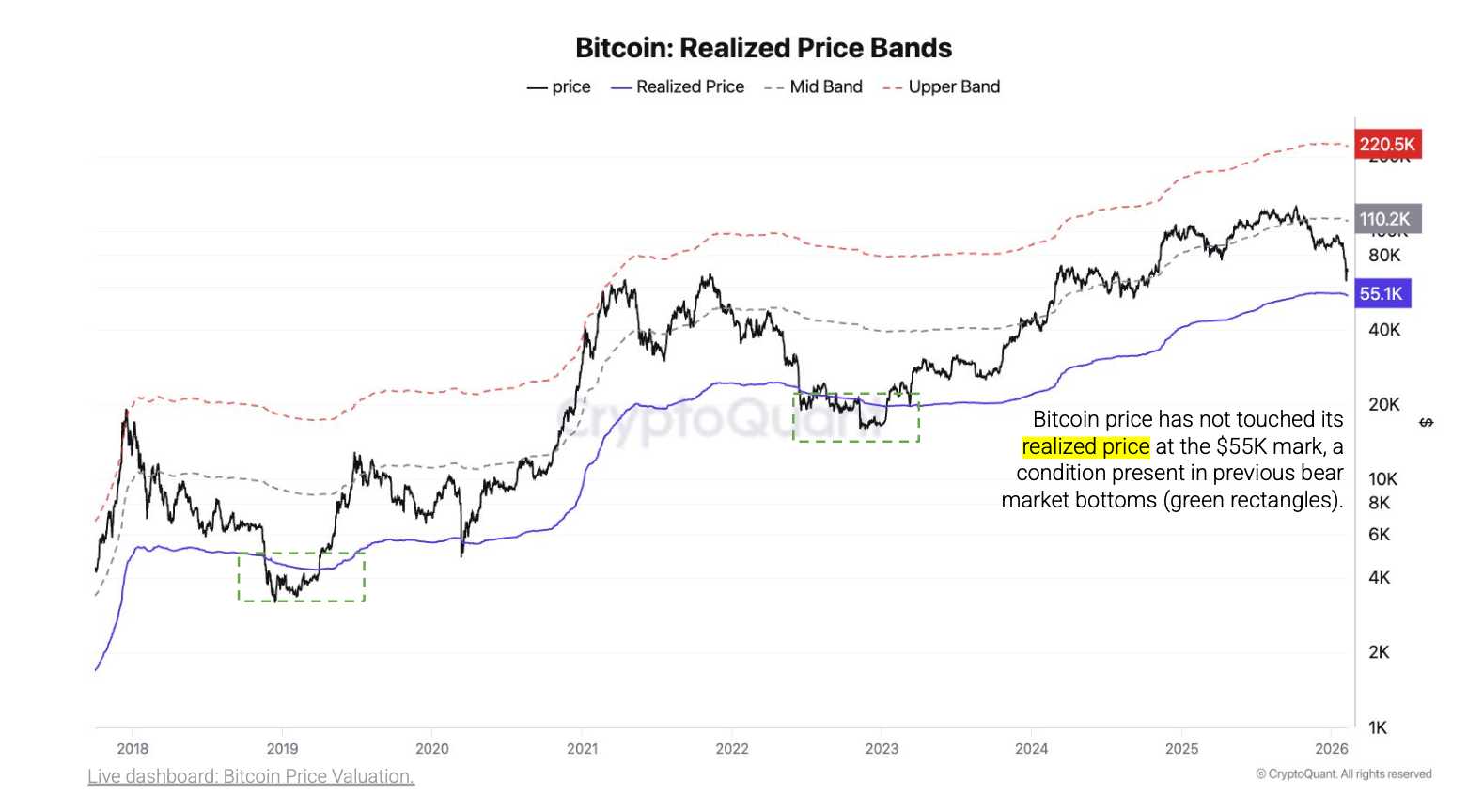

CryptoQuant estimates Bitcoin’s ultimate bear market bottom at around $55,000. This level represents Bitcoin’s realized price, which has historically served as major price support during previous downturns. Bitcoin currently trades more than 25% above this critical threshold.

The firm analyzed historical bear market patterns to support its assessment. After the FTX collapse, Bitcoin prices fell 24% below the realized price. During the 2018 bear cycle, prices dropped 30% below this level.

Once these extreme levels were reached, Bitcoin typically spent four to six months forming a base before recovery began. This pattern suggests bear market bottoms develop over extended periods rather than through single capitulation events.

LATEST: 📊 Bitcoin price is not done capitulating yet, argues CryptoQuant, which says BTC's ultimate bear market bottom is around $55,000 and may take months to form. pic.twitter.com/l9G3s7yUBy

— CoinMarketCap (@CoinMarketCap) February 14, 2026

Bitcoin holders realized $5.4 billion in daily losses on February 5 when the price fell 14% to $62,000. This marked the largest daily realized losses since March 2023, when losses reached $5.8 billion. The figure also exceeded the $4.3 billion in losses recorded days after the FTX collapse in November 2022.

Capitulation Metrics Below Historical Levels

Despite the scale of recent losses, CryptoQuant said a price bottom is not near yet. Monthly cumulative realized losses in Bitcoin terms currently stand at 0.3 million BTC. This compares to 1.1 million BTC at the end of the 2022 bear market.

The MVRV ratio, which compares Bitcoin’s market value to its realized value, has not entered the extreme undervalued range that historically marked bear market bottoms. The Net Unrealized Profit and Loss metric also has not reached the roughly 20% unrealized loss level seen at prior cycle lows.

Long-Term Holder Behavior

Long-term holder behavior provides additional evidence that full capitulation has not occurred. These holders are currently selling around breakeven prices. This contrasts with the 30% to 40% losses they historically endured at previous bear market bottoms.

About 55% of the Bitcoin supply remains in profit. This compares to the 45% to 50% range typically seen at cycle lows. The relatively high proportion of profitable supply indicates holders have not yet experienced the pain that characterizes true bear market bottoms.

CryptoQuant’s Bull-Bear Market Cycle Indicator currently remains in the Bear Phase rather than the Extreme Bear Phase. The Extreme Bear Phase historically marks the start of the bottoming-out phase for prices. This phase typically lasts several months.

Earlier this week, Standard Chartered cut its near-term crypto outlook. The bank said Bitcoin could fall to $50,000 before bouncing back by year end.