TLDR

- Bitcoin futures open interest stands at $43.81 billion with traders increasing leverage despite sideways price action between $62,000 and $71,000

- Three-month futures basis on major exchanges has widened from 1.5% to 4% since February 13, showing traders willing to pay premium for long positions

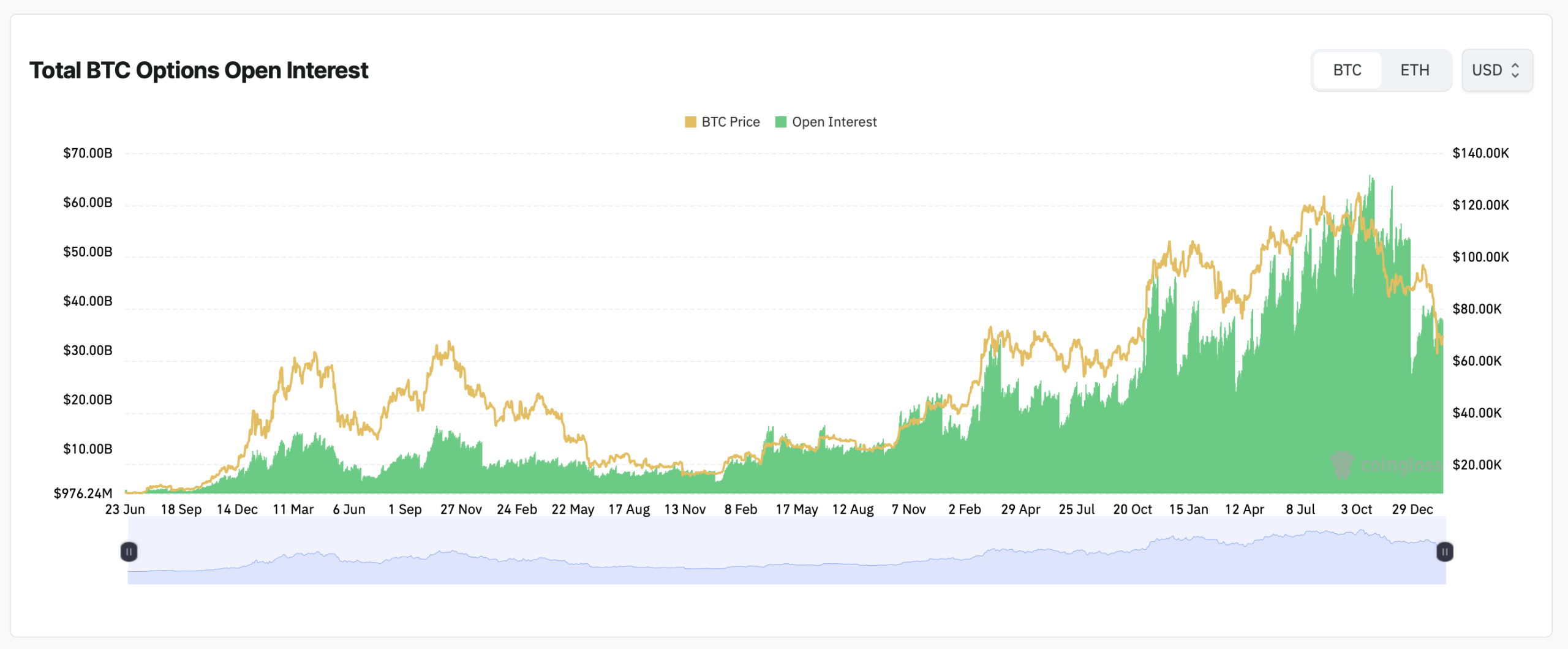

- Options markets show 56% of open interest in calls versus 44% in puts, with traders betting on prices reaching $80,000 to $120,000

- Coinbase CEO reports customers buying the dip with most maintaining or increasing their crypto balances compared to December

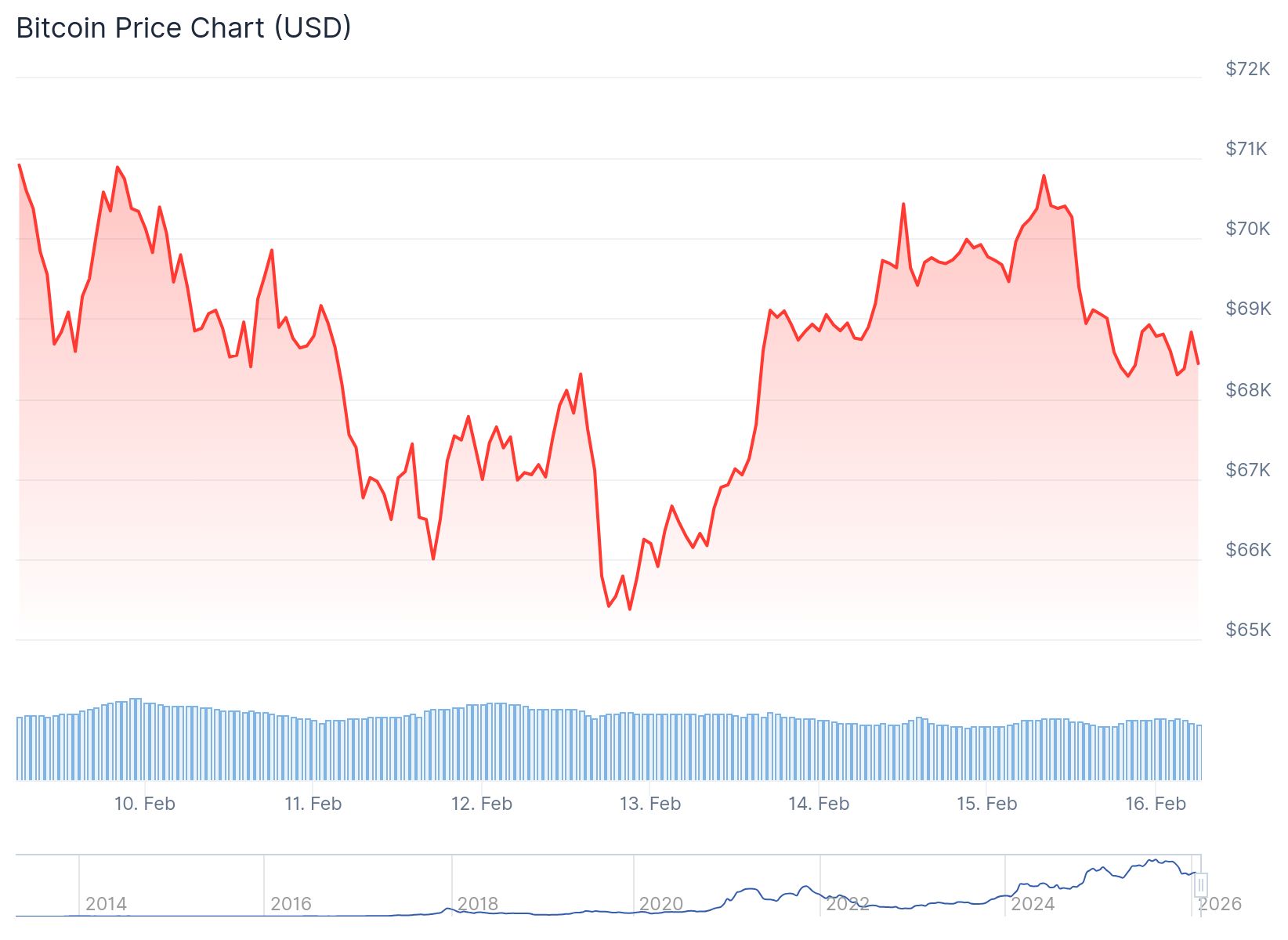

- Bitcoin currently trading at $68,300 after failing to hold above $70,000 level

Bitcoin traders are ramping up leverage as the cryptocurrency hovers around $68,300, despite weeks of sideways trading and no clear breakout direction. The top cryptocurrency has traded between $62,000 and $71,000 since February 6.

Futures markets are showing increased speculative activity. The annualized three-month futures basis on exchanges like Binance, OKX, and Deribit has grown from roughly 1.5% to 4% since February 13, according to Velo data. This metric measures the gap between derivatives and spot prices.

A wider gap means futures are trading above spot prices. This signals that traders are willing to pay extra for long exposure. Funding rates have also risen after February 13, showing that long-position traders are becoming more dominant in the market.

Nick Ruck, Director of LVRG Research, said the increase in retail activity signals growing speculation. This leverage buildup often comes before volatile price movements in crypto markets.

Total bitcoin futures open interest across exchanges sits at 639,780 BTC, valued at $43.81 billion. The Chicago Mercantile Exchange leads with 118,450 BTC in open interest worth $8.11 billion. Binance follows with 110,770 BTC valued at $7.58 billion.

Options Markets Signal Mixed Expectations

Options data reveals traders are preparing for big moves in both directions. Total bitcoin options open interest shows 56.21% in calls compared to 43.79% in puts. Over the past 24 hours, call volume reached 60.07%, representing 14,603 BTC compared to 9,707 BTC in puts.

The largest single options contract is a put expiring February 27 with a $40,000 strike price covering 7,409 BTC. This serves as insurance against a major price crash. On the bullish side, traders are betting on upside potential with a December 25 call at $120,000 strike totaling 5,930 BTC.

Another major position is a March 27 call at $90,000, representing 5,665 BTC. These positions show traders hedging against downside while maintaining exposure to potential rallies toward $80,000 or higher.

Retail users on Coinbase have been very resilient during these market conditions, according to our data:

– They’ve been buying the dip – we’ve seen a native unit increase for retail users across BTC and ETH

– They have diamond hands – vast majority of customers had native unit…

— Brian Armstrong (@brian_armstrong) February 15, 2026

Coinbase CEO Brian Armstrong tweeted Sunday that retail users have been resilient during current market conditions. He said investors have been buying the dip with the vast majority of customers seeing their crypto balances in February equal to or greater than December levels.

Technical Levels and Market Caution

The 25 Delta skew has moved from -10 to -4 since February 13, according to Deribit data. This improvement indicates reduced demand for downside protection. It could also show growing bullish conviction among options traders.

$BTC seems to be forming a bullish Adam and Eve pattern.

A close above $72,500 will confirm the breakout.

A breakdown below $67,000 will invalidate this bullish setup. pic.twitter.com/wsffXCeyz6

— Ted (@TedPillows) February 15, 2026

Bitcoin price failed to stay above $70,000 and started another decline. The cryptocurrency is now trading below the $68,800 level after dipping through support at $69,200. A bullish trend line with support at $69,500 was also broken on the hourly chart.

If Bitcoin holds above $68,000, it could attempt a fresh increase. Immediate resistance sits near $68,800 with key resistance at $69,500. A close above $69,500 might push prices toward $70,000 and potentially $72,000.

Ruck expects short-term potential for a leverage-driven rally and short squeezes, especially if broader risk assets remain steady. However, he warned that retail typically enters late and suffers most during market unwinds.

Ryan Yoon, senior analyst at Tiger Research, said current positive sentiment has not been supported by sufficient trading volume. This creates a high-risk environment where sudden downside could lead to mass selling pressure.

The analyst warned that investors are at their breaking point. Another forced liquidation could lead to a total exodus from the market. Max pain levels for options cluster between $70,000 and $85,000 depending on expiration dates, with March contracts gravitating toward $85,000 and September peaking near $90,000.

Bitcoin is down 2.5% over the past 24 hours and currently trades at $68,300.