TLDR

- Bitcoin remains stuck below $70,000 for 10 straight days while total crypto market cap dropped $48 billion to $2.33 trillion

- Strategy plans to convert $6 billion in convertible bond debt to equity, with its $49 billion Bitcoin holdings able to cover debt even if BTC drops to $8,000

- Apollo Global Management agreed to buy up to 90 million MORPHO tokens (9% of supply) over four years to support on-chain lending infrastructure

- Bitcoin ETF outflows and whale selling added pressure, with over $2 billion in leveraged positions liquidated earlier this month

- Chaikin Money Flow indicator shows continued capital outflows from Bitcoin markets, signaling weak investor demand

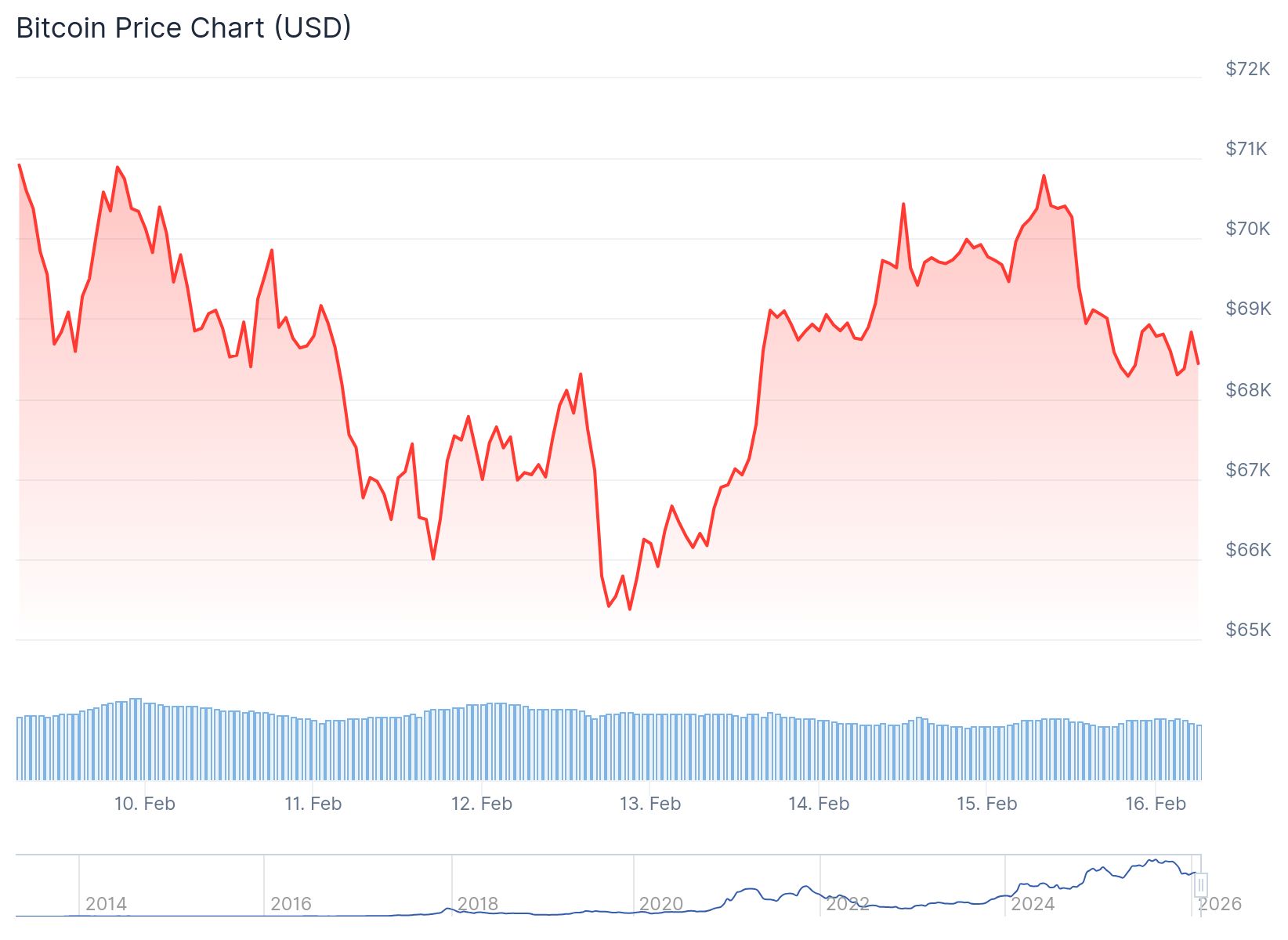

Bitcoin is trading at $68,700 as cryptocurrency markets face continued pressure. The total crypto market capitalization declined by $48 billion to $2.33 trillion.

The drop came after another failed attempt to break through the $2.37 trillion resistance level. This barrier has blocked upside momentum for several weeks across Bitcoin, Ethereum, and major altcoins.

Bitcoin has remained below the $70,000 level for 10 consecutive days. This psychological barrier continues to influence trader behavior and market sentiment.

The Chaikin Money Flow indicator shows a downtick and remains below the zero line. This signals ongoing capital outflows from Bitcoin markets.

Weak capital inflows could limit upside momentum in the near term. The pattern reinforces resistance at the $70,000 level for Bitcoin.

Bitcoin ETF outflows have added to market pressure in recent weeks. Spot BTC ETFs saw multi-billion dollar redemptions over the past several weeks.

Large holders have been taking profits or reducing risk. This includes state-related entities like Bhutan moving Bitcoin to exchanges.

Earlier in February, more than $2 billion in leveraged positions were liquidated. The washout occurred as prices broke through key technical levels.

The market is still working through this deleveraging process. Forced selling accelerated the decline across cryptocurrency markets.

Strategy’s Bitcoin Holdings and Debt Plan

Strategy announced plans to convert $6 billion in convertible bond debt into equity. The move will reduce balance sheet debt but could dilute existing shareholders.

The firm stated its $49 billion Bitcoin holdings can withstand a drop to $8,000 per BTC. At that price level, the holdings would still fully cover outstanding debt.

Apollo Partners with Morpho

Apollo Global Management partnered with Morpho in a deal for on-chain lending. The agreement involves acquiring up to 90 million MORPHO tokens over four years.

This represents 9% of Morpho’s total token supply. The deal aims to support and expand Morpho’s on-chain lending infrastructure.

Specific details about the collaboration were not disclosed. The partnership reflects institutional interest in decentralized finance protocols.

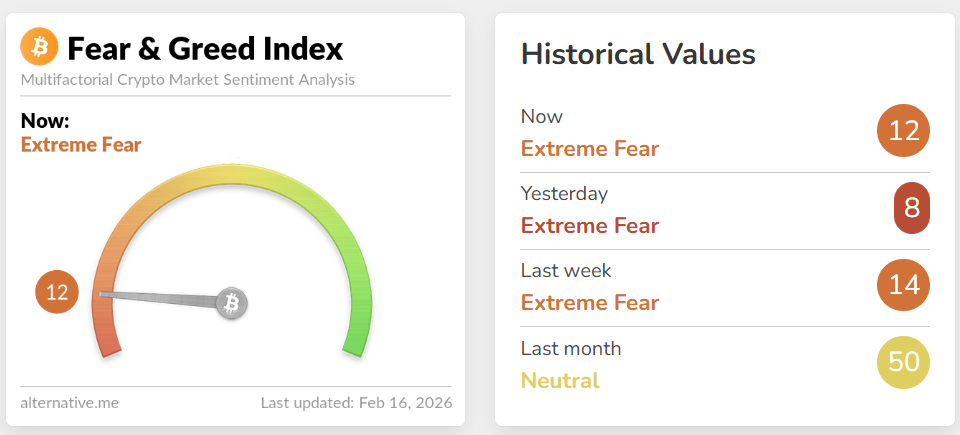

Market sentiment indicators show fear levels remain high. Fear-and-greed gauges are near “extreme fear” territory.

Altcoins like Solana and meme coins have underperformed with double-digit declines. Many traders have shifted to capital preservation mode.

On-chain data shows multi-billion dollar realized losses for Bitcoin. Some miners have moved large amounts of BTC to exchanges.

High policy rates and a strong dollar keep pressure on risk assets. The dense macro calendar with Fed communications adds to market uncertainty.

Without strong external catalysts, the crypto market may consolidate above $2.30 trillion. This level reflects a balance between defensive buyers and short-term sellers.

A decisive move above $2.37 trillion would signal potential breakout momentum. Sustained buying pressure could push the total market cap toward $2.45 trillion.

For Bitcoin, a confirmed breakout above $70,000 could drive prices toward $72,294. Continued weakness may increase the risk of BTC sliding back toward the $65,000 support zone.