TLDR

- EMJ Capital CEO Eric Jackson predicts Bitcoin could reach $50 million per coin by 2041

- Jackson believes Bitcoin will become “neutral global collateral” that financial systems borrow against

- He compares Bitcoin’s potential role to gold’s historical position in global finance

- The prediction is based on Bitcoin potentially replacing the Eurodollar system as foundational collateral

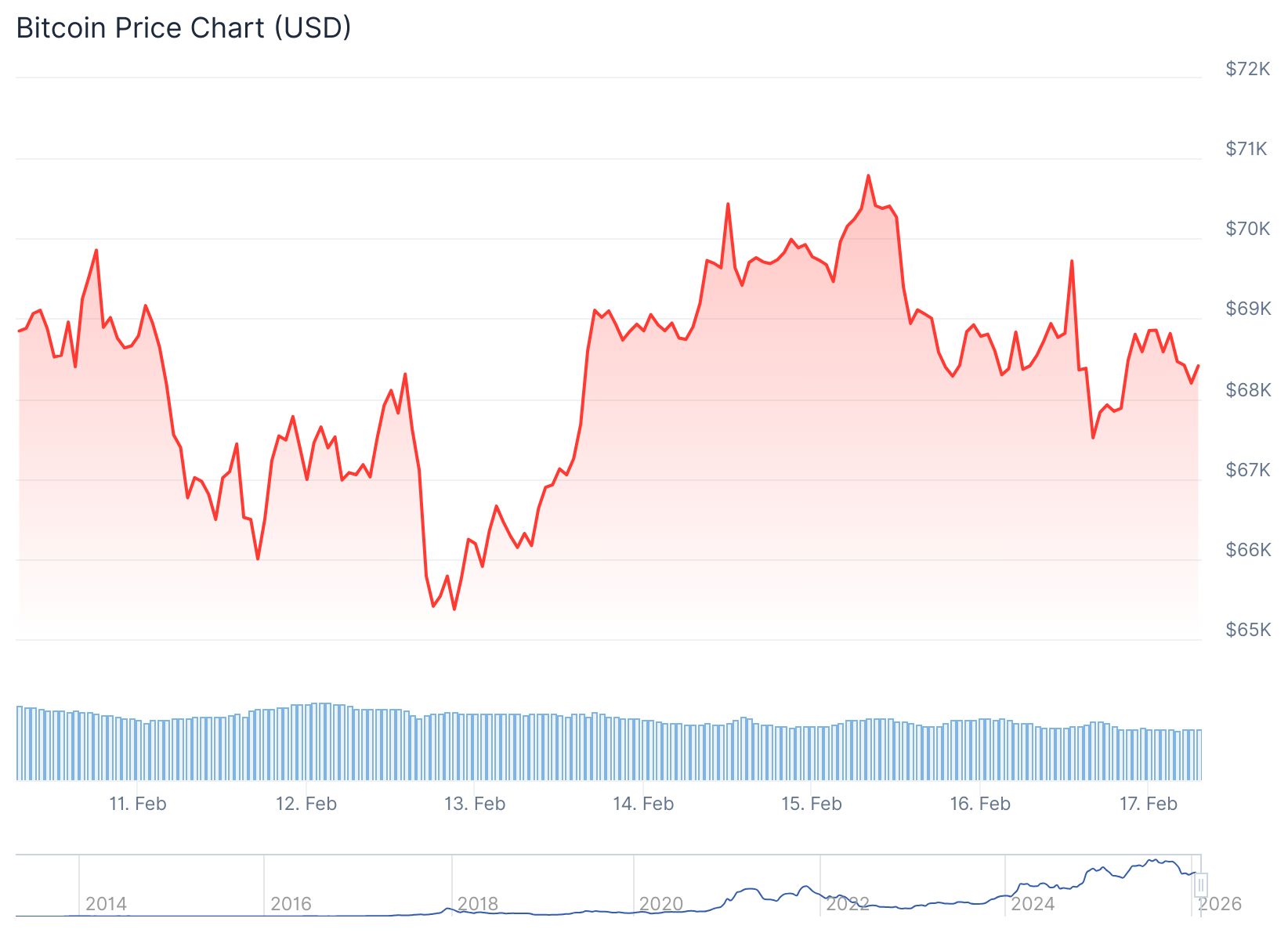

- Bitcoin currently trades around $67,000-$68,000, down from its October 2024 peak of $124,000-$126,000

EMJ Capital CEO Eric Jackson has made one of the most extreme long-term price predictions for Bitcoin. He believes the cryptocurrency could reach $50 million per coin by 2041.

EMJ Capital CEO Eric Jackson Outlines $50 Million #Bitcoin Vision for 2041. pic.twitter.com/Y6hTU3olFQ

— TheCryptoBasic (@thecryptobasic) February 16, 2026

At current prices around $67,000, this would represent a 74,527% increase over the next 15 years. Jackson shared his forecast in an interview with financial journalist Phil Rosen.

The hedge fund manager’s prediction is not based on typical market analysis. Instead, he focuses on what he calls a “long-term collateral transformation” in global finance.

Jackson argues that Bitcoin could evolve into what he describes as “neutral global collateral.” This means the cryptocurrency would serve as a foundational asset that global markets borrow against.

“This isn’t just digital gold, this isn’t some Beanie Babies,” Jackson said. “It is actually going to be a dominant way that we borrow against to do things.”

The prediction assumes Bitcoin will maintain its apolitical character. Jackson believes the cryptocurrency needs to function as a neutral reserve asset for his vision to work.

He does not think Bitcoin will replace existing financial systems. Rather, it would operate beneath them as foundational infrastructure.

The Historical Context

Jackson pointed to gold’s role in global finance as a comparison point. Central banks and sovereign governments around the world hold gold as a reserve asset.

“Could Bitcoin be as big as gold one day? That seems like a safe assumption,” Jackson said. Bitcoin shares several characteristics with gold including scarcity and independence from political control.

However, Bitcoin offers advantages that gold cannot. The cryptocurrency is fully digital and programmable.

Jackson traced the evolution of financial systems from gold-backed monetary regimes to the Eurodollar system. The Eurodollar market consists of U.S. dollar deposits held in banks outside the United States.

These deposits are not subject to U.S. banking regulations or Federal Reserve oversight. The Eurodollar market became a major source of offshore dollar liquidity over time.

Bitcoin as Future Collateral

Jackson believes Bitcoin could eventually replace the Eurodollar as neutral collateral underpinning global borrowing. He described Bitcoin as “much superior” collateral because it is digital, scarce, and apolitical.

The cryptocurrency operates outside central bank control. Jackson clarified that this shift would not displace the U.S. dollar or Treasury bonds directly.

Bitcoin would function alongside existing systems as a foundational reserve asset. His “Vision 2041” framework is built around the size and structure of global sovereign debt markets.

Today, governments rely heavily on sovereign bonds to finance operations and maintain liquidity. Jackson sees vulnerabilities in this structure.

He believes these weaknesses create an opening for a neutral, digitally native reserve asset. The immense scale of global sovereign debt markets underpins his $50 million price target.

Jackson applies the same contrarian investment philosophy to Bitcoin that guided his earlier successes. He pointed to Carvana as an example.

In 2022, Carvana’s stock collapsed from roughly $400 to about $3.50. Jackson believed the company’s core platform remained valuable despite the decline.

He now sees similar emotional extremes influencing Bitcoin. Both critics and advocates contribute to distorted expectations according to Jackson.

Bitcoin currently trades around $67,000 to $68,000. The price is down from its October 2024 peak of approximately $124,000 to $126,000.