Crypto exchanges in Malta have processed over $40 billion in digital currency. According to a report published by CryptoCompare, Malta posted the highest number of cryptocurrency trades in the world during the month of December.

OKEX and Binance are credited for processing a huge chunk of it. Both are listed on the Maltese Stock Exchange (MSX), an aspect that is believed to have heightened their appeal. With a population of just over 400,000, Malta has managed to beat Hong Kong, Samoa, Seychelles and the United States of America in crypto trade volume.

Embracing the Cryptocurrency Industry

While many nations have repudiated the crypto sector as perilous and discouraged investors from partaking in digital asset investments, Malta has opened its doors to industry players. It has been able to handle regulation by laying out a comprehensive regulatory framework that also covers blockchain technology.

This is a rare undertaking even among popular hubs. Last year the island nation enacted three regulatory laws covering cryptocurrencies, blockchain, and Distributed Ledger Technology (DLT).

They were named, the Innovative Technology Arrangements and Services Law, the Malta Digital Innovation Authority Law, and the Virtual Financial Assets Law. They currently form the cornerstones of crypto regulation in the country and were designed to govern companies operating in the space.

The Malta Digital Innovation Authority Law provides for the protection of investors and users and maintains the integrity of the industry. It also highlights that the government, through the Malta Digital Innovation Authority, will promote development and innovation in the country.

The Innovative Technology Arrangements and Services Law governs the use of technologies in the industry and ensures that they meet set benchmarks to qualify for approval.

The Virtual Financial Assets Law governs digital asset projects, including ICOs and white paper requirements. It also issues guidelines on how promotion of cryptocurrency projects should be carried out and makes certain that false information is not included in advertisements. These policies boost investor confidence and help maintain industry standards. They contribute greatly to Malta’s position as a leading crypto center.

Malta also has a favorable taxation system that covers both crypto companies operating on the island and enthusiasts. Companies are, for example, exempted from paying Value Added Tax on digital asset holdings. For EU citizens, fiat-crypto transactions and withdrawals from exchanges attract zero tax. This has led to more crypto enthusiasts in Europe moving to the island nation to enjoy its tax benefits.

Samoa Crypto Regulation

In Samoa, crypto regulation is a bit different in comparison to Malta. Cryptocurrency companies that wish to operate in the country must abide by stringent anti-money laundering laws similar to those imposed upon financial institutions. The country classifies cryptocurrency exchanges as financial institutions and requires them to obtain institutional licenses from relevant government agencies.

Unlike the Maltese administration, the Samoan administrative authority has been unswerving about directly supporting or encouraging the growth of the sector. The administration openly discourage any investments in the industry, which it refers to as “high risk.”

In an official statement by the Central Bank of Samoa cryptocurrencies are not considered to be legal tender. However, the Central Bank has openly admitted that blockchain technology is revolutionary and could have a great impact on the country’s financial sector.

As opposed to crypto legislation in Malta, the Samoan government does not directly regulate technology matters, especially those involving blockchain innovation and development. This aspect is especially crucial when implementing safeguards for investors. The result is legal uncertainty for investors.

Regulation in Hong Kong

Hong Kong’s administration has taken unique steps to regulate the cryptocurrency sector in the past year. In November, the country’s crypto regulatory body, the Securities and Futures Commission (SFC) issued a stern warning to fund managers after a rise in fraud cases.

The agency noted that a lack of proper regulation had led to a spike in fraudulent activity within the sector, forcing it to implement more robust measures against such acts. A growing number of crypto exchange users complained about being hoodwinked after depositing funds. Many were unable to cash out.

A new set of regulations was drawn targeting fund distributors and portfolio managers and was mostly drafted to protect investors. According to the published statement, crypto exchanges in the country would be able to obtain a license after being placed in the SFC Regulatory Sandbox.

This would allow the regulatory body to assess whether an exchange’s practices are in compliance with the set guidelines. According to the agency, the strategy would also offer insight on the level of investor protection needed and what forms of regulations would be effective.

Following the announcement of the new requirements, some companies opted to move to areas with more crypto-friendly rules. Just a few days ago, Xapo announced that it would be moving its operations from Hong Kong to Switzerland due the “opaque” regulatory environment.

Xapo President Ted Rogers expressed, with regard to Hong Kong, that although it was once considered to be the “holy grail of crypto regulations”, things have since changed. He described Swiss regulators as more accommodating, smart and interested in developing financial markets.

Malta Faces Growth Challenges

Of course, supporting the crypto industry also means having to deal with issues that have dogged the sector since its advent. They range from money laundering to hacking and fraud cases.

The lot is thought to be an insurmountable hurdle by nations averse to the crypto movement and some have outrightly outlawed cryptocurrency dealings as a result. Malta has had to adopt a gritty mindset in dealing with these issues, some of which have made headlines.

Recent Incidences and the IMF Statement

Just a few days ago, the Malta Financial Services Authority (MFSA) asked investors to beware of an ongoing scam involving a company called the Bitcoin Revolution. The scam had been using advertisements on social media and other online platforms to lure unsuspecting investors into depositing funds. The fictitious firm touted itself as a highly profitable crypto company.

According to the MFSA, the company was apparently using the names of celebrities and the agency without consent to draw investors. According to the agency, the firm had not been registered with any authorized body in the country.

The news comes in the wake of another crypto scam perpetrated by a company called FXNobels. Users who deposited funds on its platform had their digital holdings stolen. The company was believed, at some point, to have run its operations using a call center in Bulgaria.

Due to rising cases of related incidents, the International Monetary Fund (IMF) has asked the Maltese government to ensure that cryptocurrency and blockchain companies abide by legislated Know Your Customer requirements.

According to the Times of Malta, the IMF also called upon the government to apply adequate sanctions against parties found to have breached the law. The agency pointed to the rapid development of new products and a fast evolving market as areas of concern. It highlighted that they could put significant pressure on the Malta Financial Services Authority.

The government’s Citizen-by-Investment program was also singled out as a potential money laundering loop-hole. It allows non-EU citizens to acquire citizenship so long as they invest a minimum of $250,000 in the country’s bonds or equities.

The Financial Intelligence Analysis Unit suggested a 50-point action plan. The plan has been hailed as one way of effectively maintaining compliance with international and EU anti-money laundering regulations.

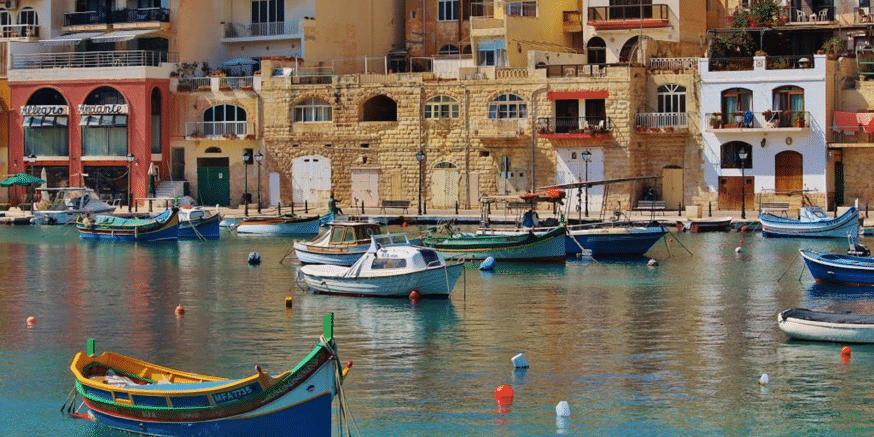

(Featured Image Credit: Pixabay)

[thrive_leads id=’5219′]