[Editor’s note: This article was updated on 7.9.2018 to reflect updates on the project.]

What is Bitcoin Gold?

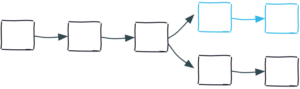

Only a few months after the Bitcoin Cash hard fork, the Bitcoin blockchain experienced another community-driven hard fork known as Bitcoin Gold (BTG).

Bitcoin Gold hopes to change the paradigm around mining on the Bitcoin blockchain. According to the founders, the Bitcoin blockchain has become too centralized. Large companies with huge banks of mining computers now mine the vast majority of Bitcoin. For the founders of Bitcoin Gold, having large companies control the Bitcoin network defeats the purpose of a decentralized ledger and peer-to-peer currencies.

In response, they’ve initialized the Bitcoin Gold project. It’s an alternate fork of the Bitcoin blockchain that implements changes that make mining more equitable. The goal of Bitcoin Gold is to create a network where anyone can become a miner with only basic hardware. As a result, Bitcoin Gold mining would be spread among many miners, instead of a few large companies.

In this guide, we cover all things Bitcoin Gold such as:

- Decentralizing the Bitcoin Blockchain

- SHA-256 vs Equihash

- Who Received Bitcoin Gold?

- How to Mine Bitcoin Gold

- When Did It Go Live?

- Is Bitcoin Gold a Competitor to Bitcoin?

- Bitcoin Gold vs Bitcoin, Bitcoin Cash, & SegWit2x

- Replay Protection After a Fork

- What People are Saying About Bitcoin Gold

Decentralizing the Bitcoin Blockchain

In the very early days of Bitcoin, ordinary computers verified and completed the proof of work needed to power the Bitcoin blockchain. However, the past several years have seen rapid development in the hardware used to mine Bitcoin.

What started as normal computers on the original Bitcoin network soon graduated to specialized rigs with graphics processing units (GPUs) installed to hash the proof of work faster.

Today, the hardware has advanced even further. Application-specific integrated circuits (ASICs) now perform nearly all of the mining on the Bitcoin blockchain. These are devices built specifically for Bitcoin mining that are 1,000,000 times better at mining than your home computer. Buying, installing, and running ASICs has a high startup cost, making it difficult for the average user to get involved.

[Editor’s note: The more expensive mining becomes, the fewer people can actually do it. This means that the mining network becomes that much more centralized. The argument Bitcoin Gold wants to make is to make mining Bitcoin something everyone can do, therefore keeping the mining as decentralized as possible.]

In addition, most successful Bitcoin mining operations today involve entire rooms or warehouses full of ASICs running 24/7. Small-time miners simply can’t compete.

Bitcoin Gold’s motto, “Make Bitcoin Decentralized Again,” is a tongue-in-cheek reference to Donald Trump’s election campaign slogan. However, it also references Satoshi’s original vision for Bitcoin of a peer-to-peer network where anyone could take part in the mining process. In order to change Bitcoin mining into something more equitable, Bitcoin Gold proposes changing the blockchain to eliminate ASIC mining.

SHA-256 vs Equihash

The fundamental change in Bitcoin Gold is choosing a different hashing algorithm that makes proof of work more difficult for ASICs. This is accomplished when a hashing algorithm requires more memory (RAM) to complete. Since ASICs are about pure processing power, requiring more memory bottlenecks their processing ability. This makes small-time mining on GPUs competitive once again.

The current, ASIC-driven Bitcoin blockchain uses a hashing algorithm known as SHA-256 for its proof of work. The founders of Bitcoin Gold instead use another algorithm known as Equihash. Alex Biryukov and Dmitry Khovratovich developed Equihash as an ASIC-resistant algorithm, and it has already seen success powering other cryptocurrencies, the most famous of which is Zcash.

Ultimately, changing to Equihash would make Bitcoin mining more distributed, and that’s really the only change that Bitcoin Gold proposes for the network. While mining centralization is an issue on the Bitcoin blockchain, with miners blacklisting some users or giving preference to certain transactions, there’s a limit to how much power these central miners can wield. It’s not clear that mining centralization has had an overly negative impact on Bitcoin.

If it ever did, the Bitcoin core developers could implement Equihash themselves, essentially firing all the current ASIC miners on the Bitcoin blockchain. The prospect of losing the hundreds of thousands of dollars they invested in their mining hardware with an algorithm change is enough to keep most miners on the network honest.

Who Received Bitcoin Gold?

Since Bitcoin Gold is a fork of the original Bitcoin blockchain, everyone who owned BTC before the fork received the same amount of BTG, at a 1:1 ratio. You didn’t need to do anything special to receive the BTG, but claiming it may have gotten tricky depending on how you had your wallet set up.

You’re able to trade BTG on nearly 20 exchanges. The most popular options are HitBTC, OKEx, Bitfinex, and Binance.

How to Mine Bitcoin Gold

If you’re interested in how to mine Bitcoin Gold, we’ve got good news. The set-up process is relatively simple, and you mine with just a GPU – no ASICs required.

First, you need to join a mining pool. You’ve got over ten to choose from with pool.gold as one of the most popular options. Next, download the mining software from the pool that you joined. Pool.gold has mining software available for NVIDIA and Radeon.

If you don’t have a BTG wallet, set one up. Your options include BTGWallet.online, the Bitcoin Gold Core Wallet, or any exchange that supports BTG.

Continuing with pool.gold as the example, you have separate instructions based on your GPU:

- NVIDIA: Edit the start.bat file to include your Bitcoin Gold wallet address followed by the worker name.

- Radeon: Edit the config.txt file to include your Bitcoin Gold wallet address followed by the worker name.

Finally, double-click “start.bat” and begin mining.

When Did It Go Live?

The Bitcoin Gold hard fork occurred on October 24, 2017, with block 491,407 on the Bitcoin blockchain. When that happened, Bitcoin Gold took a snapshot of all the balances and transactions on Bitcoin up to that point. The new blockchain began from there.

Is Bitcoin Gold a Competitor to Bitcoin?

Although Bitcoin Gold is a hard fork of the original Bitcoin blockchain, it’s not really a competitor to Bitcoin. While other hard forks, like Bitcoin Cash, cannibalized some miners from the Bitcoin network to work on the new blockchain, Bitcoin Gold’s anti-ASIC algorithm means virtually none of Bitcoin’s current miners will want to switch to mining BTG.

Instead, Bitcoin Gold competes with other anti-ASIC cryptocurrencies like Ethereum for mining power. Mining on such networks comes in the form of smaller-scale GPU mining. The problem for Bitcoin Gold is those other anti-ASIC cryptocurrencies have a longer history and are more predictable for miners. It’s not clear why a miner would want to switch to BTG, unless the price per BTG surges.

The one advantage that Bitcoin Gold has is wide dispersal. Everyone on the Bitcoin network received will receive BTG, so there’s potential for widespread adoption.

Bitcoin Gold vs Bitcoin, Bitcoin Cash, & SegWit2x

With so many forks on the Bitcoin blockchain in such quick succession, it can be confusing to keep track of the differences. Here’s a table to help you out:

| Bitcoin | Bitcoin Gold | Bitcoin Cash | SegWit2x (cancelled) | |

| PoW Type | ASIC | ASIC-resistant (GPU) | ASIC | ASIC |

| Block Time | ~10 mins | ~10 mins | ~10 mins | ~10 mins |

| Difficulty adjustment | ~2 weeks | Each block | ~2 weeks | ~2 weeks |

| SegWit | Yes | Yes | No | Yes |

| Replay Protection | – | Yes | Yes | No |

| Total Coin Supply | 21 million | 21 million | 21 million | 21 million |

Bitcoin Gold is the only Bitcoin fork to date to implement a new ASIC-resistant proof of work algorithm. Along with that new hashing algorithm, Bitcoin Gold implements a new difficulty adjustment with every block, gradually increasing the difficulty based on past block times. Finally, Bitcoin Gold is one of the only Bitcoin forks to support both Segregated Witness (SegWit) technology and replay protection. SegWit increases the number of transactions possible per block and replay protection prevents fraudulent parallel transactions on two forks.

Replay Protection After a Fork

Replay protection is critical when implementing a fork of an existing blockchain. The shared code and wallet addresses between BTC and BTG make it possible to implement a replay attack. Basically, if you want to conduct a transaction on both BTC and BTG at the same time, you’re fine. However, if you want to pay someone in BTC and keep your BTG, you’re open to an attack. An attacker could send a false signal between the forks that causes you to lose both currencies when you only meant to send one.

Bitcoin Gold offers full replay protection on BTG to prevent such attacks. The solution involves a SIGHASH_FORK_ID mechanism that rehashes transactions, meaning they can’t be transferred across from BTC to BTG.

What People are Saying About Bitcoin Gold

Most new cryptocurrencies involve ASIC-resistant hashing algorithms, and it’s becoming something of an industry standard to promote decentralization. In that respect, Bitcoin Gold holds a lot to be excited about. At its core, it’s about transitioning the Bitcoin network to more decentralized mining.

However, as we saw above, there’s not much evidence that the current Bitcoin mining system is broken. There have been some small complaints, and it’s not ideal that the network is so centralized. Nevertheless, miners on Bitcoin have a lot to lose if they wield their power too aggressively. There are also new entrants to the Bitcoin mining community that are decentralizing control from a few key ASIC farms.

The general consensus from Bitcoin experts is there’s not enough new in Bitcoin Gold to warrant an independent investment. While it certainly doesn’t hurt to hold onto your free BTG that you receive as a result of the fork (if you owned Bitcoin before Oct 24), wait until the dust settles before deciding whether to buy more.