TLDR

- XRP Ledger daily active addresses jumped to over 295,000, up from typical 35,000-40,000 over past three months

- Whale wallets holding 1+ million XRP reached record high of 2,700+ for first time in network’s 12-year history

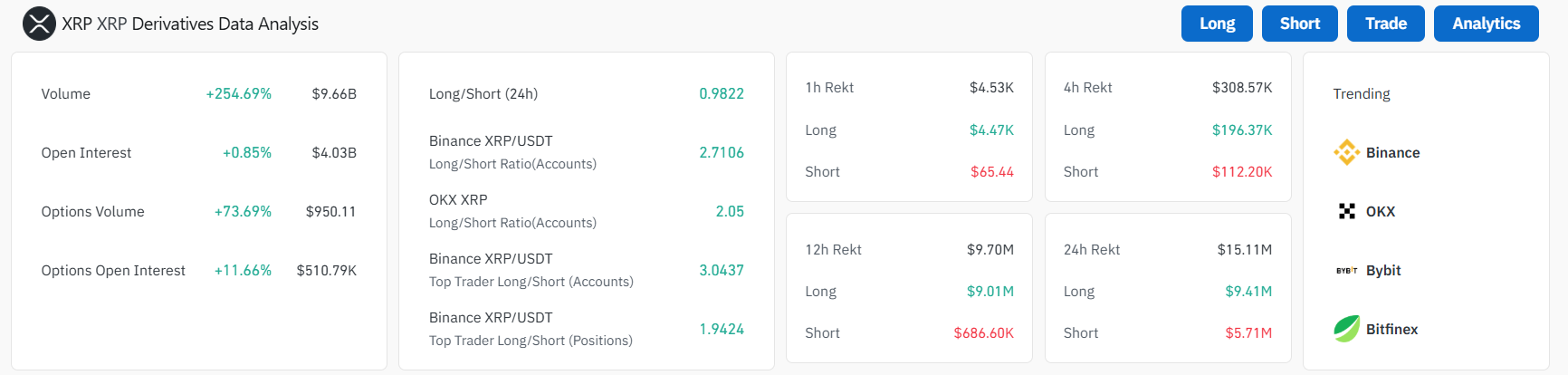

- XRP trading volume increased 248-300% with derivatives volume hitting $9.57 billion

- Price currently consolidating around $2.31, up 6.43% in past 24 hours

- Key resistance level at $2.35 could determine next major price movement

XRP has experienced a sharp increase in network activity over the past week. Blockchain analytics firm Santiment reported that daily interacting XRP addresses averaged over 295,000 in recent days.

📊 The XRP ledger is showing serious signs of growth, from both a usage and key stakeholder perspective.

📈 The amount of interacting $XRP addresses has averaged over 295K per day over the past week. Its normal daily average over the past 3 months was approximately 35-40K.

— Santiment (@santimentfeed) June 16, 2025

This represents a major jump from the typical range of 35,000 to 40,000 addresses seen over the previous three months. The surge indicates growing user engagement with the XRP Ledger network.

Whale activity has also reached new heights. For the first time in the network’s 12-year history, more than 2,700 wallets now hold at least one million XRP tokens.

This increase in large holders suggests institutional and high-net-worth investors are accumulating positions. The whale accumulation pattern often signals increased confidence in a cryptocurrency’s future prospects.

XRP is currently trading at $2.31, representing gains of 6.43% over the past 24 hours. The token has been moving within a range between $2.10 and $2.32 over the last seven days.

Trading activity has surged across multiple metrics. XRP registered a 248% increase in trading activity according to one source, while another reported volume increases of 182.43%.

Market Data Shows Mixed Signals

Derivatives markets are showing intense activity. Coinglass data reveals that open interest has grown by 3% to $4.02 billion.

Derivatives volume has increased by nearly 300% to $9.57 billion. This suggests traders are entering and exiting positions rapidly rather than building long-term positions.

The current market capitalization stands at $135.65 billion. XRP’s market dominance has risen to nearly 4%, reflecting increased investor interest in the token.

From a technical analysis perspective, XRP presents mixed signals. The token continues to trade above key short-term moving averages including the 10-day and 20-day exponential moving averages.

However, longer-term indicators like the 50-day and 100-day EMAs continue to show bearish trends. The Relative Strength Index sits at 50.19, indicating neutral momentum.

Technical Outlook Remains Uncertain

The 200-day exponential moving average is providing support around the $2 level. The 50-day EMA shows slight bullish divergence above the $2.25 mark.

Volume has increased and the price is consolidating near the middle of its Bollinger Bands. This positioning could lead to a stronger directional move if either buyers or sellers gain control.

Key resistance levels to watch include $2.35 as the immediate target. If XRP breaks above this level, the next resistance zones lie at $2.57 and $3.00.

A successful break above these levels could potentially drive XRP toward its all-time high of $3.40. However, technical indicators remain mixed on the probability of such a move.

On the downside, support levels exist at $2.20, $2.14, $2.08, and $2.00. A drop below $2.20 might test the lower support zones.

The Awesome Oscillator remains in negative territory, while other momentum indicators like MACD and Stochastic RSI show limited volatility. These mixed signals reflect the current consolidation phase.

Market participants are closely watching whether XRP can break above the $2.35 resistance level, as this could determine the next major directional move for the cryptocurrency.