TLDR

- Ethereum whales accumulated $2.5 billion worth of ETH last weekend, the largest single-day purchase since 2018

- ETH ETFs saw over $450 million in net inflows over the past week, marking the third-largest weekly inflow since August 2024

- A golden cross pattern is forming where the 50-day moving average approaches crossing above the 200-day moving average

- ETH remains above $2,500 support but faces resistance at $2,675-$2,700 level

- Tokenized real-world assets on Ethereum have grown to over $4 billion with major institutional adoption

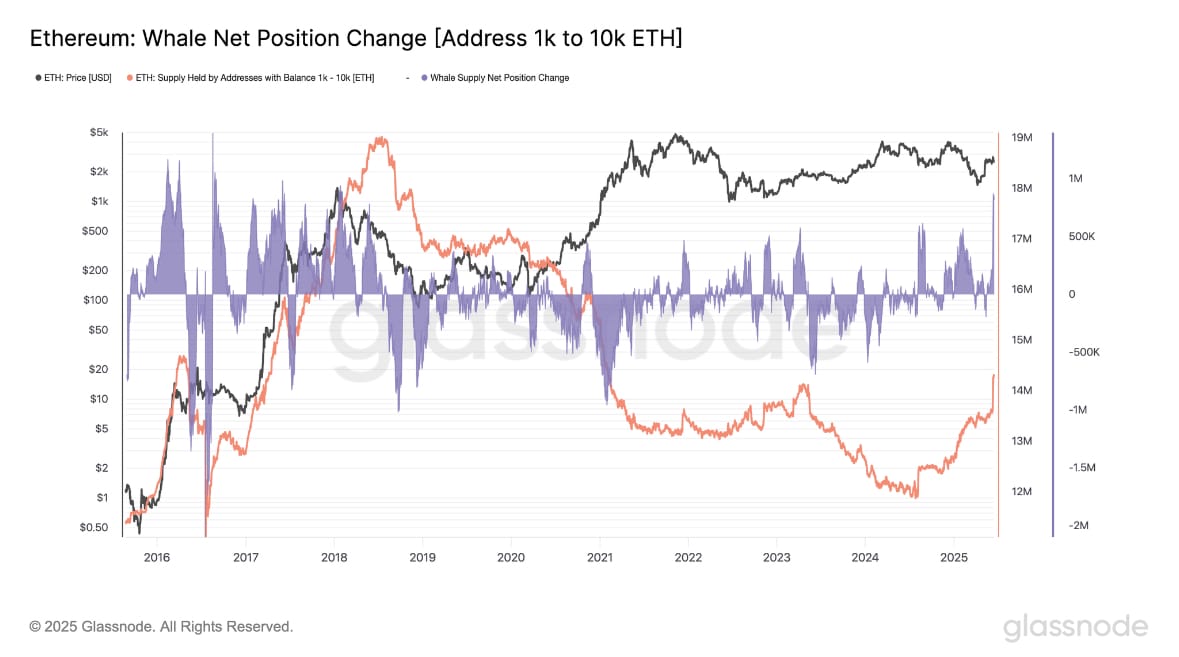

Ethereum whales made their largest single-day purchase since 2018 last weekend. Data from Glassnode shows these large holders accumulated approximately $2.5 billion worth of ETH.

The whale accumulation involved holders with 1,000 to 10,000 ETH tokens. This buying activity represents the highest net position change for this group in nearly seven years.

Whale supply levels quickly moved back above 14 million ETH after showing a multi-year decline. The accumulation occurred while ETH price was declining, suggesting whales were buying during a period of lower retail interest.

Historical patterns show similar whale accumulation phases have preceded major price rallies for Ethereum. The 2017 accumulation period was followed by a significant bull run for the cryptocurrency.

ETF Inflows Drive Institutional Interest

Ethereum spot ETFs recorded net inflows of over $450 million in the past week. This marks the third-largest weekly inflow since August 2024.

The surge in ETF inflows reflects growing institutional buying interest. Banks and institutional investors often accumulate during quieter market periods.

March and April 2025 saw bearish ETF outflows from Ethereum products. However, May and June brought two consecutive weeks of strong inflows, signaling a shift in market sentiment.

The renewed interest comes as ETH price hovers near key support levels. Rising inflows during price consolidation often indicates bullish divergence in cryptocurrency markets.

Token Terminal data shows tokenized assets under management on Ethereum have risen parabolically since early 2025. Major institutions including BlackRock, PayPal, and Franklin Templeton have contributed to this growth.

Ethereum now anchors over $4 billion in tokenized real-world assets. This establishes the blockchain as an increasingly important financial infrastructure platform.

Technical Analysis Points to Potential Breakout

Ethereum currently trades above the $2,500 support level despite recent market volatility. Geopolitical tensions between Israel and Iran have created uncertainty across global markets.

ETH faces resistance at the $2,675-$2,700 level, which has acted as a barrier multiple times in recent weeks. A breakout above this zone could trigger momentum toward $3,000.

Technical analyst Ted Pillows notes Ethereum is approaching a golden cross formation. This occurs when the 50-day moving average crosses above the 200-day moving average.

$ETH golden cross is approaching.

Last time it happened, ETH pumped 35% in a few weeks.

ETH big pump is coming. 🚀 pic.twitter.com/WeVF9629zh

— Ted (@TedPillows) June 16, 2025

The last golden cross pattern for Ethereum resulted in a 35% price surge over the following weeks. This technical indicator historically precedes strong upward trends for ETH.

Ethereum has traded in a range for more than six weeks, reflecting indecision among market participants. The $2,500 level has repeatedly served as support during this consolidation period.

To regain upward momentum, ETH must break above the $2,750-$2,800 resistance area. This zone has proven to be a major barrier since early May 2025.

The 4-hour chart shows ETH recently tested resistance but failed to sustain momentum above $2,675. Price pulled back toward the 200 EMA and 200 SMA around $2,575.

Volume has declined during the consolidation phase, indicating the market awaits a catalyst for the next directional move.