A Different Approach to Real-world Adoption

Maybe you’ve heard of cryptocurrency point of sale (POS) systems like the TenX & Monaco cards and thought they were the future of getting crypto in brick and mortar shops. Well, they still rely on Visa and other big name credit card companies to function.

While companies like these are still a step in the right direction for the mass-adoption of crypto, some POS systems take it one step further and put Bitcoin directly in the hands of merchants. They eliminate the need for credit card companies – one of Satoshi’s original dreams for Bitcoin. Who are they? Let’s find out.

[thrive_leads id=’5219′]

POS Systems

These systems facilitate the peer-to-peer transaction of cryptocurrency without the need of big credit card corporations like Visa, Mastercard, and American Express. Some offer the option to integrate credit cards but also have the option to use the POS systems without them. Keep in mind you’ll still need the appropriate cryptocurrency wallet for each POS system to use them.

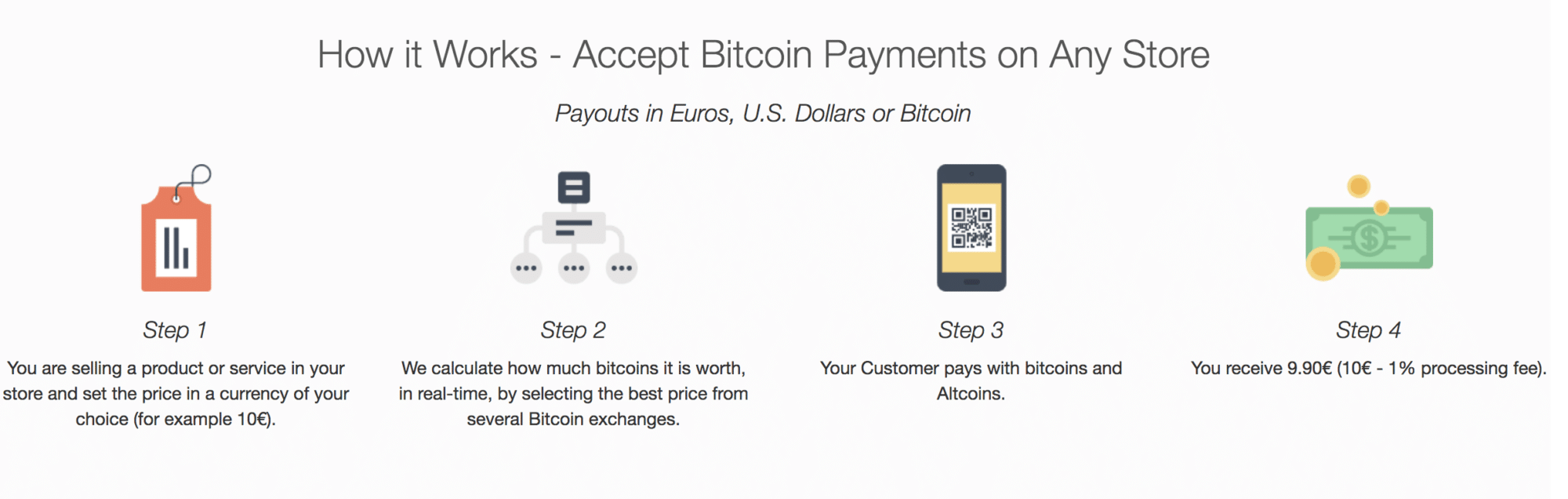

CoinGate

CoinGate offers a POS mobile app. On its site, it states that “credit card companies usually charge up to 3% of the transaction amount and there are various additional fees. With CoinGate you can accept Bitcoin payments for only 1% from the transaction amount and there are no monthly, registration, or support fees.”

Customers can pay with Bitcoin and over 50 altcoins from which Coingate automatically converts into its corresponding Bitcoin value. However, merchants are given the choice to receive payouts in Bitcoins, Euros or USD.

Fast Facts

- 1% flat fee for processed payments

- Plenty of cryptocurrencies payment options for customers

- Payout to merchants in Bitcoin, USD or Euro

Pundi X

Pundi X states it will “empower blockchain developers and token holders to transact cryptocurrency and services at any physical store in the world.” The team has plans on rolling out between 100,000 – 700,000 units in 3 years.

The “crypto to crypto to fiat” method outlined in the projects whitepaper allows merchants to sell items “without the use of the VISA or Mastercard service by going directly to the cryptocurrency blockchain to record transactions.” The company then receives the transactions report and ensures that the retailer is reimbursed by fiat money.

Fast Facts

- Smart Card: Pay for items with “X Pass” be given a receipt

- Mobile Wallet: Handles private and public keys making it easy to pay with crypto

- Software and Hardware products for interoperability

- Buyers can purchase cryptocurrency at any POS device merchant location

- Supports BTC, ETH, ERC20 tokens, PXS, XEM, QTUM, XLM, and more

- Reward system to encourage users to use PXS, its native cryptocurrency

- Offers merchants retail intelligence through POS product use

With the contactless X Pass payment card, you can purchase day-to-day items at venues with the Pundi X POS devices. All you need to do is tap it against the POS device. You’ll also be able to buy cryptocurrency at any of the locations at its real-time value with credit cards, which will be loaded onto your cryptocurrency wallet.

Pundi X is producing a wide variety of merchant POS products to accommodate the needs of different venues. These include desktop devices, mobile devices, scanners, printers, cash machines, and more.

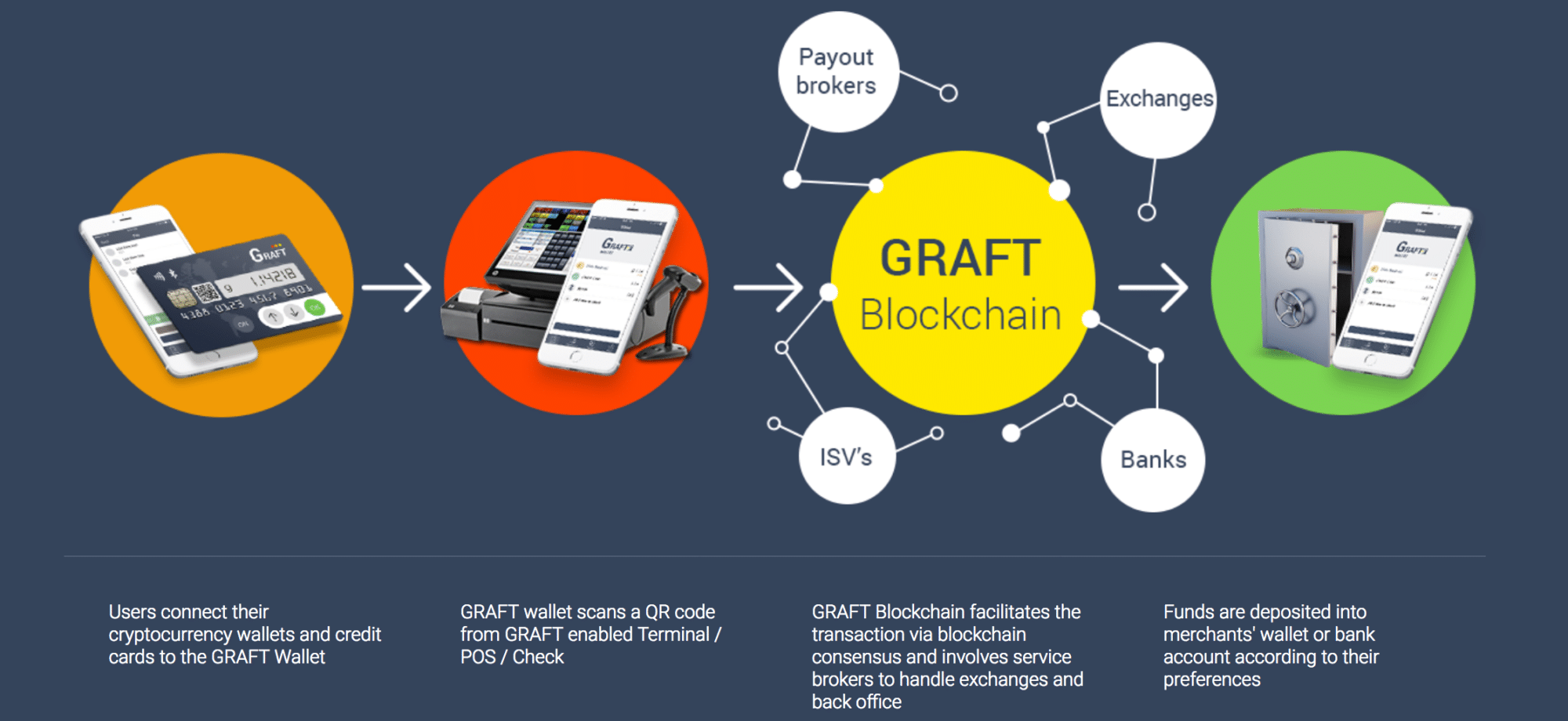

Graft

Graft is is a mobile app similar to Pundi X. It alows the merchant to accept both crypto and fiat.

Fast Facts

- Zero buyer fees, Graft only charges the merchant

- Instant transaction confirmation

- Buyers can pay with major cryptocurrencies and the Graft token (GRFT)

- Merchants can choose what they want to be paid in regardless of buyer payment choice

- Connects your crypto wallet to GRAFT wallet

- Extremely low fees (.01-1%) for merchants accepting the GRFT

Scenario 1: You purchase a cup of coffee with GRFT, and the merchant accepts GRFT. Virtually no fees associated with this transaction.

Scenario 2: You pay for the coffee with GRFT, but the merchant only accepts US dollars. The crypto is converted into the US dollar, but the merchant is responsible for the broker fees.

Scenario 3: You pay for coffee with Bitcoin, but the merchant only accepts US dollars.The merchant would need to pay the Bitcoin fees and the broker fees.

Scenario 4: You pay for the coffee with a credit card, but the merchant only accepts Bitcoin. The merchant would need to pay the credit card and Bitcoin fees.

There are many other scenarios that can occur with different currencies, but this should give an overview of how Graft works.

Opendime

Opendime is “a small USB stick that allows you to spend Bitcoin like a dollar bill.” You can load money as many times as you want on it and anyone can check the value that’s on it. The moment you break the seal to find out the private key, it should be discarded.

Fast Facts

- Functions like a read-only USB flash drive

- Balance can be verified without internet connection

- Like a paper wallet but more secure

- Bitcoins are locked until physically unsealed, revealing private key

- Reliable for 25-100 years

- “Bitcoin in your hands” without the confirmation delays or enormous fees

- The company boasts that you can “give an Opendime to anyone and they don’t need to worry that you can take back the funds later”

Scenario: You want to purchase a $10,000 car. You transfer $10,000 worth of Bitcoin on an Opendime by sending the Bitcoin to its wallets address. The car dealer checks the value on the Opendime and hands you the keys to the car. The car dealer then “breaks” the Opendime to reveal the private key which is needed to clear out the funds and transfer them to another wallet.

What Can Opendimes be used for?

- Give it as a present, sort of like a gift card.

- Load it with Bitcoin (you can load it with whatever value you want) and store it like a paper wallet.

- Sell it for its real-time value for fiat currency, trade it for an item of equivalent value, etc.

Conclusion

People are mostly using cryptocurrencies to purchase other cryptocurrencies. We all know there are much more useful aspects of the blockchain, but the technology is still relatively in its infancy. What we need is the world to see crypto more as a means for day-to-day payments and less like a speculation.

The things stopping us from getting there are beyond the average person’s control, but confirmation delays and high transaction fees that plague most cryptocurrencies don’t help with the cause. It’s obvious right now that most of these digital currencies in their current form can’t handle the scalability needed to function like a Visa credit card.

Visa states it can process 56,000 transactions per second (tps). Even Ripple as one of the cryptocurrencies with the highest throughput can currently only handle 1,500 tps. In comparison, Bitcoin is limited to a rate of 7 tps.

To put these high confirmation delays and high transaction fees into perspective, the average transaction fee for BTC is currently hovering around $4 with a block confirmation time of 10 minutes, Ethereum $0.75 at 25 seconds, LTC $.23 at about 2 minutes, and XRP less than a penny with near instant payments at a fraction of a second. Visa has a fee of 1.43% – 2.4% and is near instantaneous.

Finally, if you’re looking for venues that accept crypto, download apps like CryptoFind (unfortunately currently only covers Australia) available in GooglePlay and App Store. You’ll definitely be helping bring crypto to the dream Satoshi Nakamoto envisioned.