TLDR

- PUMP token has dropped 55% from its July 14 launch price of $0.0054 to an all-time low of $0.0024

- Pump.fun’s market share has declined to under 40% as competitor LetsBonk now controls over 60% of the sector

- The platform has implemented a 100% daily revenue buyback program to support the token price

- Promised airdrops have been delayed indefinitely, causing community frustration and selloffs

- Platform revenue has fallen to a 10-month low despite processing $250 million in daily trading volume

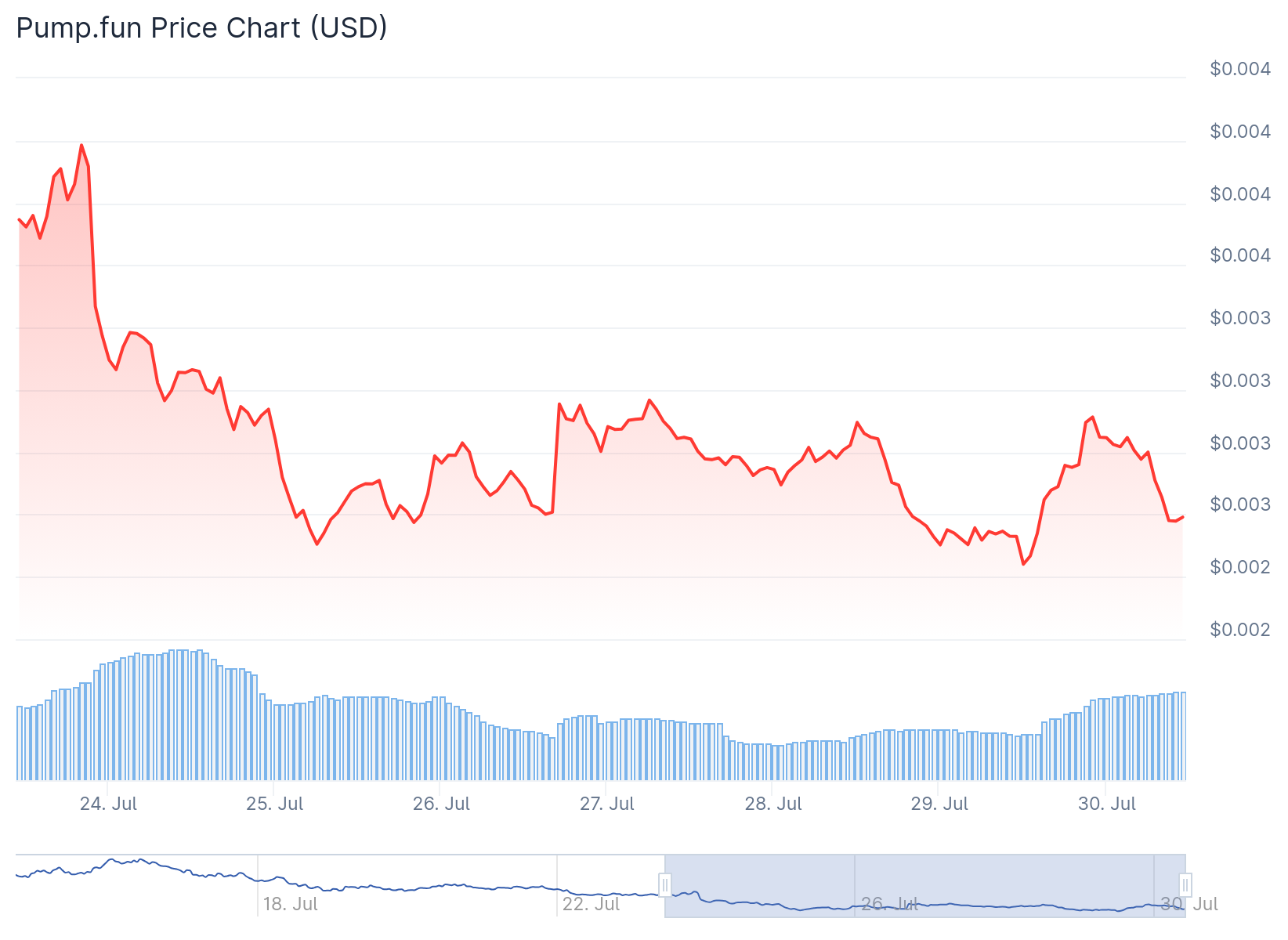

Pump.fun’s native PUMP token has experienced a dramatic decline since its July 14 launch. The token now trades at $0.0024, representing a 55% drop from its initial price of $0.0054.

The ICO launch initially appeared successful, selling out in under 12 minutes and raising nearly $600 million. However, the positive momentum was short-lived as various issues began to emerge.

Communication problems have plagued the platform since the token launch. The team has provided limited updates about the token’s roadmap and future development plans.

GM GM.

So it's been almost a week with 0 tweets and 0 communication both from Alon and pump official account.

0 news, 0 info about $pump airdrop, 0 initiatives, nothing. Pump losing all credibility and volume.

Next step- probably deactivate the pump X account 🤣

. @letsCatapult pic.twitter.com/qt116LkqxC— Jessu.Sol (@clowns_Solana) July 29, 2025

Airdrop delays have particularly frustrated the community. Co-founder Alon Cohen confirmed on the ThreadGuy podcast that promised token distributions “will not be taking place in the near future.”

The PUMP price dropped following Cohen’s podcast appearance. His non-committal stance on airdrop timing contributed to the token’s inability to recover above $0.003.

Competition has intensified in the Solana launchpad space. LetsBonk now commands over 60% of the sector, while Pump.fun’s market share has fallen below 40%.

Market Performance and Trading Activity

Despite the price decline, PUMP maintains high trading volume. The token processes approximately $250 million in 24-hour spot volume while its market cap has dropped to $850 million.

Liquidation data reveals bearish sentiment among traders. CoinGlass reports $2.34 million in liquidations over 24 hours, with $2.08 million in long liquidations compared to just $236,000 in short liquidations.

Platform revenue has reached a 10-month low. This decline coincides with increased competition and the loss of market dominance in the meme coin launchpad sector.

Nearly 12 million tokens have been launched through Pump.fun. However, approximately 95% of these tokens experience rapid price collapses within 24 hours of launch.

Recovery Efforts and Future Outlook

Pump.fun coin has responded to the price decline with a major buyback initiative. The platform now dedicates 100% of daily revenue to purchasing PUMP tokens from the market.

A brief rally occurred on July 26 when buyback news circulated. Pump. Fun coin price increased from $0.0025 to $0.00294 but failed to sustain the momentum.

The platform maintains a reported $2 billion treasury. These funds could potentially support marketing efforts, additional buybacks, and other recovery initiatives.

Some traders anticipate further declines below $0.001 before a bottom forms. This would represent approximately 80% losses from the launch price.

Regulatory challenges have affected operations. The platform excludes US and UK residents from participation, likely due to compliance requirements.

Community speculation centers on whether PUMP will follow the PENGU token pattern. PENGU dropped 90% from launch before experiencing a 900% recovery run.

The platform faces ongoing competition from newer launchpads like LetsBonk. Competitor platforms have gained market share while offering alternative features and token economics.

Current trading data shows PUMP down an additional 12% on the day, continuing the bearish trend that has persisted since launch.