TLDR

- Total crypto market cap dropped $83 billion to $3.65 trillion due to tariff announcement uncertainty and weak US economic data

- Bitcoin failed to break $115,000 resistance and could fall to $111,187 support level

- Bitcoin ETFs saw $196.2 million outflows while Ethereum ETFs gained $73.3 million inflows

- Major altcoins like Ethereum (-2.43%) and XRP (-4%) posted sharp declines

- August historically shows seasonal weakness for crypto markets with lower trading volumes

The cryptocurrency market experienced a broad selloff on August 6, 2025, with the total market capitalization falling by $83 billion to $3.65 trillion. The decline came as investors reacted to upcoming tariff announcements and weaker-than-expected US economic data.

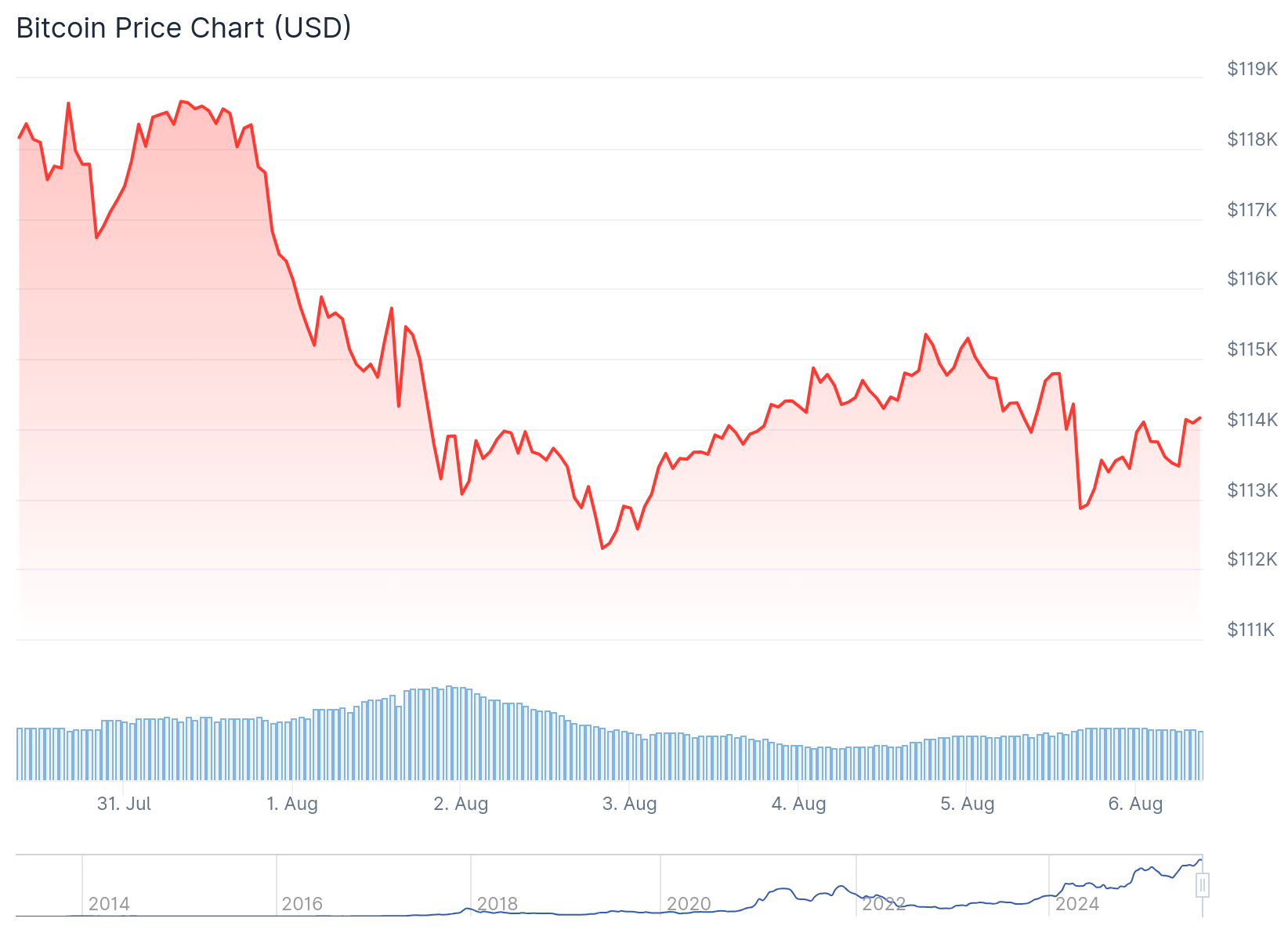

Bitcoin currently trades at $113,476, unable to break through the $115,000 resistance level over the past 24 hours. The world’s largest cryptocurrency faces downward pressure, with technical indicators suggesting further declines may be ahead.

The Parabolic SAR indicator sits above Bitcoin’s price candlesticks, signaling a potential downtrend. If selling pressure continues, analysts expect Bitcoin could drop to the $111,187 support level, marking a monthly low.

Market sentiment turned cautious following the release of weaker US ISM Non-Manufacturing PMI data. This economic indicator raised concerns about stagflation, a condition combining high inflation with stagnant economic growth.

The Federal Reserve’s decision to keep interest rates unchanged has strengthened the US dollar and reduced appetite for risk assets. This monetary policy stance has drained liquidity from speculative investments, including cryptocurrencies.

Institutional Activity Shows Mixed Signals

Bitcoin exchange-traded funds recorded outflows of $196.2 million, indicating institutional investors may be taking profits or reducing exposure. This contrasts with Ethereum ETFs, which attracted $73.3 million in inflows during the same period.

The divergence between Bitcoin and Ethereum institutional flows suggests selective investor behavior rather than blanket crypto rejection. Long-term holders appear to be cashing out positions, while fresh capital inflows have slowed.

Major altcoins posted steeper losses than Bitcoin during the selloff. Ethereum declined 2.43% while XRP fell 4%, leading the retreat among large-cap cryptocurrencies.

High-risk crypto sectors including SocialFi tokens, NFTs, and meme coins experienced the sharpest declines. Fartcoin dropped nearly 11%, struggling to maintain support above the $1 level.

Technical Levels and Seasonal Factors

Bitcoin’s failure to sustain momentum above the $114,500-$116,000 resistance zone has increased downside risks. A break below $112,000 support could trigger additional selling toward lower price levels.

The total crypto market cap currently holds above $3.61 trillion support after failing to break $3.73 trillion resistance. If this support level fails, analysts expect a decline toward $3.49 trillion.

August has historically proven challenging for Bitcoin and other major cryptocurrencies. Lower trading volumes and seasonal investor behavior patterns often contribute to price weakness during this month.

Regulatory uncertainty continues to weigh on market sentiment, with ongoing discussions about new US crypto rules and enforcement actions. The combination of macroeconomic headwinds and regulatory concerns has created a cautious trading environment.

The current market conditions reflect a convergence of weak economic data, persistent concerns about high US interest rates, and technical resistance levels. Trading volumes remain elevated as investors navigate the uncertain landscape.

Final Thoughts

For investors asking “why is crypto down today,” the answer lies in this combination of tariff uncertainty, weak economic indicators, and seasonal trading patterns. The market now faces key technical levels that will determine whether the selloff continues or if buyers step in to support prices.