TLDR

- Bitcoin price is gaining strength as technical, macroeconomic, and on-chain indicators align for a potential breakout.

- A golden cross pattern has appeared on the weekly chart, which has historically signaled major rallies in Bitcoin.

- The price has been trading above a trendline support since April and has recently rebounded from the $112,000 level.

- Immediate resistance is at $117,500, and a breakout could push the price toward $121,000 and $123,800.

- The Stock to Flow ratio has reached a record high of 154, showing growing scarcity of Bitcoin.

Bitcoin price momentum is strengthening as technical patterns, macroeconomic developments, and on-chain metrics align for a potential breakout. Analysts highlight a rare golden cross formation on the weekly chart, which has preceded major rallies in past cycles. Policy developments and market structure now point toward increased upside potential in the months ahead.

Golden Cross Sparks Renewed Optimism

Market analyst Merlijn The Trader confirmed that the Bitcoin price recently achieved a golden cross on the weekly chart. He described it as “the signal that never misses,” referencing rallies in 2016, 2017, and 2020. Those historical instances saw increases of 139%, 2200%, and 1190% respectively.

BITCOIN JUST SENT THE SIGNAL THAT NEVER MISSES.

When $BTC prints the Golden Cross, it doesn’t walk, it explodes:

139% in 2016

2200% in 2017

1190% in 2020Now? 2025 is next in line.

Same setup. Same signal. Same rocket fuel.Miss it now and you’ll regret it for years. pic.twitter.com/JyvhrQN0V5

— Merlijn The Trader (@MerlijnTrader) August 8, 2025

He stated that the current setup in 2025 mirrors those past structures with similar traction. Therefore, he believes this could serve as “rocket fuel” for a new surge. The golden cross occurs when the 50-week moving average crosses above the 200-week moving average, often marking intense bullish phases.

On the daily chart, Bitcoin price trades are above an ascending trendline support that has been held since April. The price recently rebounded from $112,000 and now trades around $116,000. The immediate resistance is at $117,500, which coincides with the 0.236 Fibonacci level.

- BTC:USD 1-Day Chart Source- TradingView

Key Support Could Decide Bitcoin Price Direction

A breakout above $117,500 could push Bitcoin price toward $121,000 and $123,800, aligned with the 0.382 and 0.5 Fibonacci extensions. The Relative Strength Index stands at 53, signaling neutral momentum and no signs of overbought conditions. This suggests room for upward movement if buying pressure increases.

However, failure to maintain above the ascending trendline could trigger a correction toward $112,000. This level remains a crucial short-term support for sustaining the current bullish bias. Market participants are now watching whether bulls can defend this structure in the coming sessions.

Technical analysts emphasize that historical golden crosses on the weekly timeframe have consistently signaled multi-month rallies. They argue that the pattern’s reappearance, alongside stable trendline support, reinforces the case for continued appreciation.

On-Chain Metrics Strengthen Bullish Case

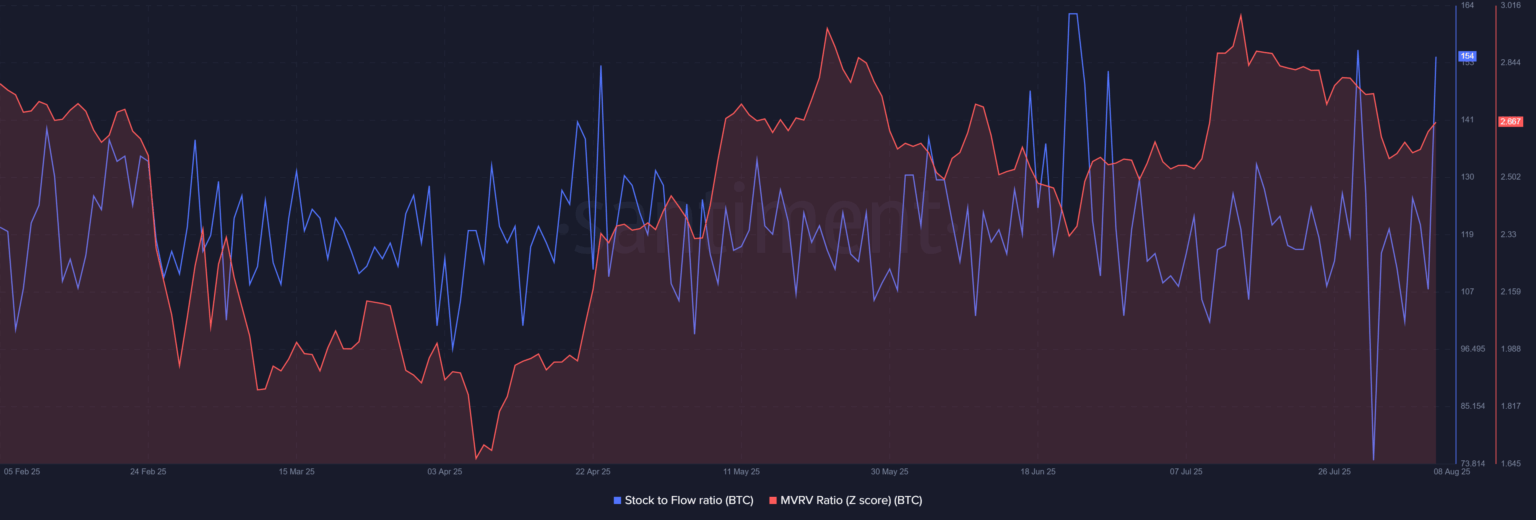

On-chain data further supports the positive outlook for Bitcoin price in the medium term. The Stock-to-Flow ratio has reached a record 154, indicating an increasing scarcity of the asset. Historically, higher S2F values have aligned with intense demand cycles.

The MVRV Z-score currently sits at 2.667, showing that the market is not overheated yet. This reading suggests potential for further gains before reaching maximum risk levels. Such conditions typically emerge during the early expansion stages of bull cycles.

- Source: Santiment

Analysts view the combination of technical and on-chain indicators as reinforcing each other. If momentum holds, these factors indicate that Bitcoin’s price could be entering another significant growth phase.

Macro Developments Add Momentum

Macro policy developments are also influencing the Bitcoin price outlook. President Donald Trump nominated pro-Bitcoin economist Stephen Miran to the Federal Reserve Board. Miran supports rate cuts and integration of digital assets into the financial system.

Historically, looser monetary policy has supported Bitcoin and other risk assets during the early phases of bull cycles. Traders see this nomination as a potential boost to market sentiment ahead of the fourth quarter. Policy changes could provide additional tailwinds for the Bitcoin price if they align with market expectations.

With technical signals, on-chain metrics, and macro conditions converging, analysts suggest the market is positioned for a decisive move. Sustaining key support levels will remain critical for confirming the next leg higher.