Legal Clarity Ignites XRP Momentum

XRP surged back into the spotlight in August 2025 following one of the most significant legal outcomes in its history. The long-running SEC v. Ripple case has officially concluded, with Ripple agreeing to pay a $125 million fine. This resolution has removed one of the largest uncertainties hanging over the token and has opened the door to renewed institutional interest. Almost immediately after the announcement, XRP rallied nearly 11%, reaching approximately $3.27, while trading volume and derivatives open interest spiked sharply. Institutional participation has grown markedly, and this has been reflected in a clear shift in market sentiment.

Technical Outlook and Price Levels to Watch

XRP is currently consolidating around the $3.25 range, with short-term resistance appearing between $3.45 and $3.66. The $3.09 to $3.10 zone has emerged as a key level of support. If buyers can maintain momentum above this range, the path toward the psychologically significant $5 mark becomes more realistic, especially with macro and regulatory winds now working in Ripple’s favor. However, not all indicators are flashing green. Previous patterns such as the “tweezer top” formation near $3.65 and a relatively subdued RSI reading have suggested that there may be short-term profit-taking before the next leg upward.

Analyst outlooks vary widely for 2025. Conservative technical views see XRP holding in a range between $2.77 and $3.32 unless significant new catalysts appear. More optimistic forecasts, supported by the recent legal clarity and institutional flows, see $5 as an achievable target by year-end. The most aggressive scenarios, backed by historical fractal comparisons and renewed global adoption, place potential highs between $10 and $15 if conditions align. Recent AI-driven models have also forecasted XRP rising to around $5.50, based on historical price data and key Fibonacci levels, as reported by CoinDesk.

Strategic Moves and Market Catalysts

Ripple is moving quickly to capitalize on its strengthened position. The company recently acquired stablecoin infrastructure provider Rail in a $200 million deal, signaling an ambitious expansion into the RLUSD stablecoin and broader cross-border payment ecosystems. Regulatory developments in the United States have also turned more favorable, with discussions emerging about integrating XRP into a proposed national crypto reserve, further supporting its long-term case.

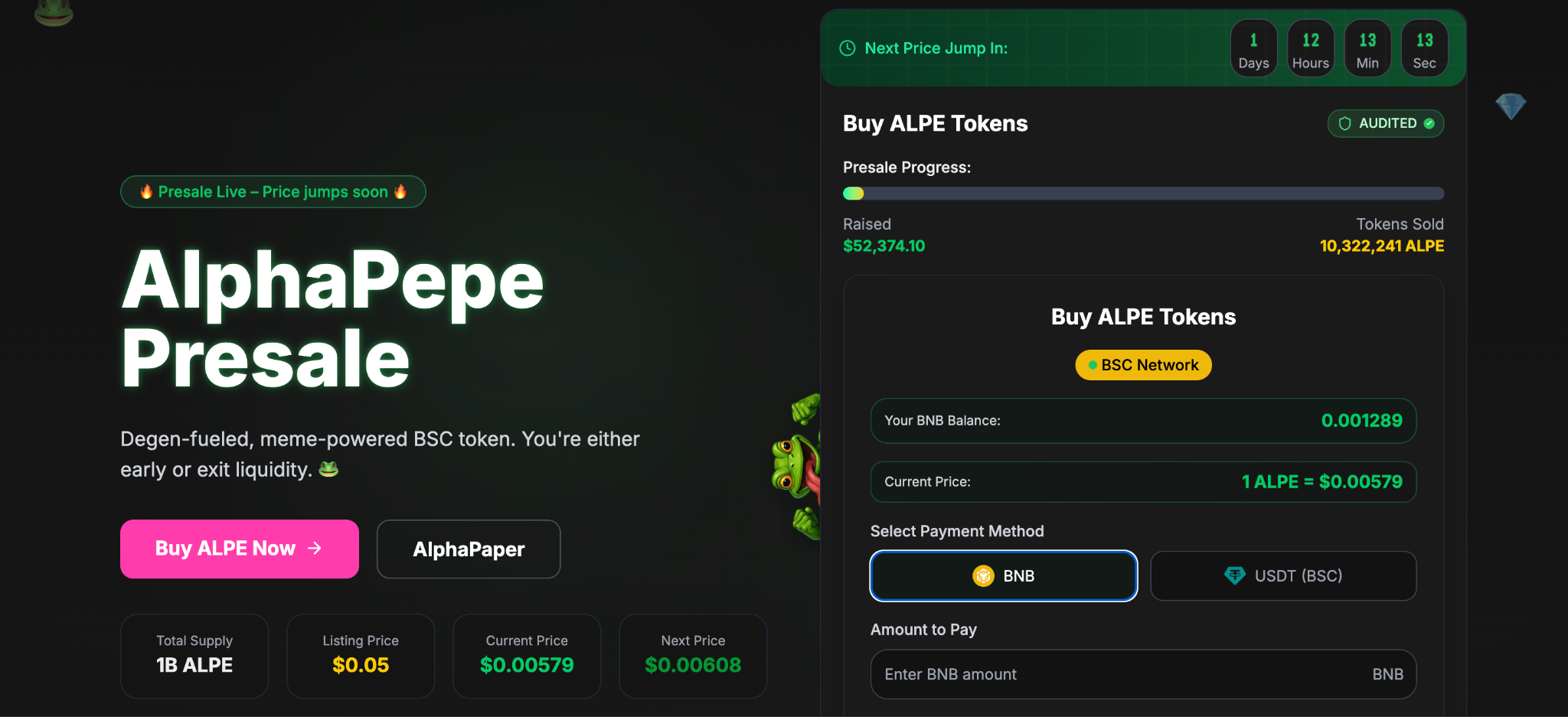

AlphaPepe (ALPE) as a High-Upside Alternative

While XRP offers a compelling combination of stability, liquidity, and institutional momentum, some investors are also looking toward higher-risk, high-upside opportunities to diversify their portfolios. One such project gaining attention is AlphaPepe, a Binance Smart Chain token that merges meme culture with structured tokenomics. AlphaPepe differentiates itself by offering instant token delivery to buyers, staking options before exchange listing, a four percent redistribution mechanism that rewards holders, and a monthly USDT reward pool for top participants.

Its smart contract is fully audited and carries no allocation for team or private wallets, underscoring its transparent approach. AlphaPepe was highlighted in CoinCentral’s “best crypto to buy now” coverage, where its unique structure and early-stage momentum were identified as standout traits.

Final Takeaway

In the months ahead, XRP’s ability to break and hold above the $3.66 resistance level will determine how quickly it can challenge the $5 target and potentially set the stage for a move toward double-digit territory. For those seeking a balanced approach, XRP provides the security of a proven, institutionally supported asset, while AlphaPepe offers speculative upside in a different segment of the market. Together, they represent two ends of the crypto investment spectrum, each with its own set of drivers and potential rewards.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.