TLDR

- Ethereum gained 5.52% in 24 hours to $4,369 but remains down 8.27% over the past week

- Binance leads ETH futures market with over $4 trillion in trading volume, surpassing 2024’s $3.7 trillion record

- Technical analysis shows key resistance at $4,380 level with potential for further declines if broken

- Open interest on Binance grew from $2.8 billion to nearly $13 billion since April when ETH was below $1,500

- Derivative-driven rally raises concerns about market stability and increased liquidation risks

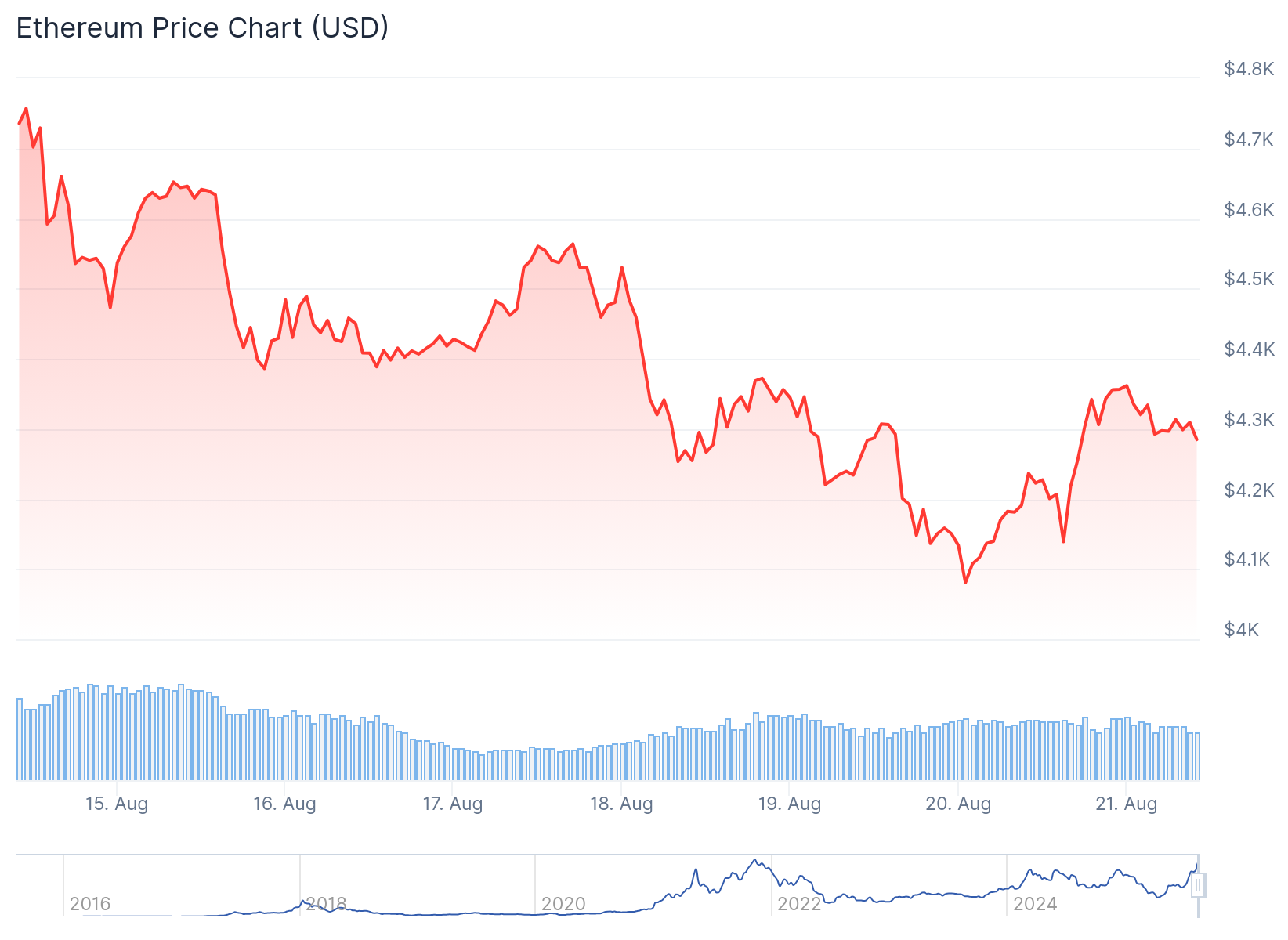

Ethereum price reached $4,369 with a 5.52% gain over 24 hours. The second-largest cryptocurrency by market cap shows mixed signals after declining 8.27% over the past week.

Trading volume increased 1.22% to $51.65 billion in the last 24 hours. This represents growing market activity despite the recent weekly decline.

The recent rally started from the $4,050 support zone. ETH moved above the $4,150 and $4,220 levels during its recovery wave.

Technical analysis reveals key resistance levels ahead. The price faces barriers near $4,350 and $4,380 zones.

A bearish trend line forms with resistance at $4,355 on hourly charts. The cryptocurrency trades below the 100-hourly Simple Moving Average.

Ethereum Price Prediction

Binance holds the dominant position in Ethereum futures markets. The exchange recorded over $4 trillion in ETH futures trading volume this year.

This figure exceeds Binance’s previous record of $3.7 trillion achieved in 2024. The platform maintains its lead over competitors including Bybit, OKX, and Hyperliquid.

Open interest on Binance grew dramatically since April. When ETH traded below $1,500, open interest stood at $2.8 billion.

The metric has since expanded by almost $10 billion. This liquidity influx contributed to Ethereum’s recent price recovery.

Technical Levels and Market Structure

Current price action shows ETH trading below key resistance zones. The $4,350 level aligns with the 61.8% Fibonacci retracement from recent highs.

If the price breaks above $4,380 resistance, the next target sits at $4,460. A move beyond this level could push ETH toward $4,500 and potentially $4,550.

Downside risks remain present if support fails. Initial support appears at $4,240 with major support at $4,200.

A break below $4,200 could target the $4,120 level. Further weakness might push the price toward $4,050 support.

The hourly MACD indicator shows weakening momentum in bearish territory. However, the RSI moved above the 50 level, indicating some buying interest.

Analysts express caution about the derivative-driven nature of the current rally. High open interest levels create potential for increased volatility and liquidation events.

Binance achieved a new milestone with $4 trillion in ETH futures volume, cementing its market leadership position.