TLDR

- Kanye West’s YZY token launched on Solana and briefly hit a $3 billion market cap before falling to around $1 billion

- Insider trading concerns emerged as 94% of token supply was held by insiders, with one wallet controlling 87% before distribution

- Early insiders made millions in profits, with one wallet earning over $1.5 million and another sitting on $6 million in gains

- The token uses a single-sided liquidity pool structure that allows developers to manipulate pricing and cash out easily

- Despite controversies, well-known crypto traders including Arthur Hayes continue buying the token

Rapper Kanye West launched his YZY token on the Solana blockchain Thursday morning, with the cryptocurrency briefly reaching a $3 billion market capitalization. The token has since dropped to approximately $1 billion as traders raise questions about insider access and unfair distribution.

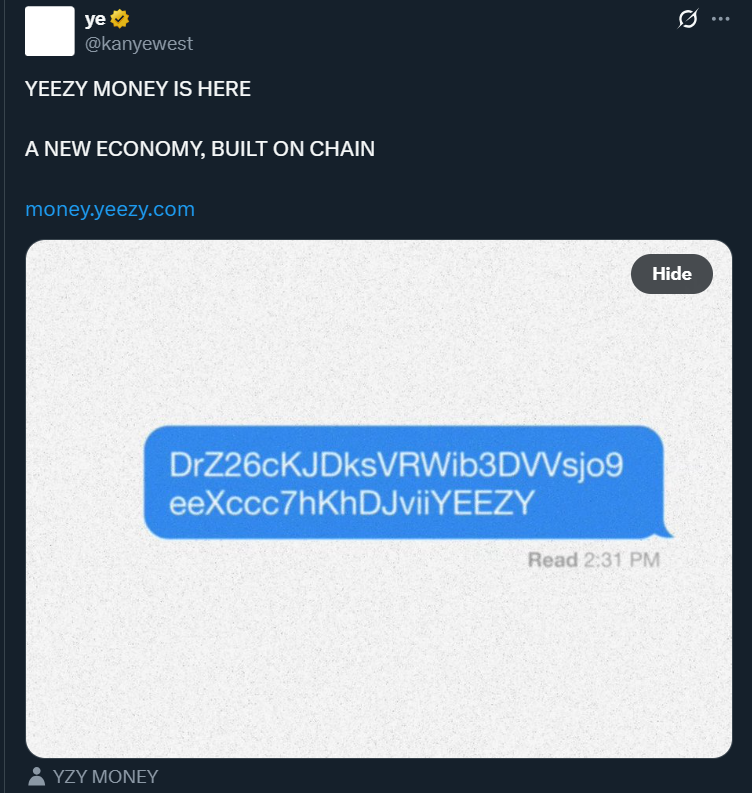

West shared the contract address and website for Yeezy Money on his X account Thursday. The website describes YZY as a currency to power transactions within a broader financial system built on blockchain technology.

The token price surged nearly 6,800% from its launch price to briefly touch $3.16 per token. This rapid price movement occurred within 40 minutes of the token going live on exchanges.

Token Structure Raises Red Flags

Analytics platform Lookonchain identified several concerning aspects of the token launch. The YZY token was added to liquidity pools without being paired against USDC, creating a single-sided setup that allows developers to manipulate pricing.

This structure lets large holders add and remove liquidity at will, effectively allowing them to cash out their positions. The design is similar to the controversial LIBRA token that caused problems in Argentina earlier this year.

Data shows that 94% of the initial token supply was controlled by insiders. One multisig wallet held 87% of all tokens before distributing them to multiple smaller wallets.

Analytics firm OnChain Lens tracked one wallet that knew the contract address before launch. This wallet attempted to purchase tokens before they were officially available and later made over $1.5 million in profits.

Another early investor put in $2.28 million worth of Solana tokens and saw their holdings reach $8.29 million in value. This represents an unrealized gain of approximately $6 million at the token’s peak price.

Mixed Results for Early Traders

Not all early buyers were successful with their YZY investments. One wallet spent $1.55 million to purchase nearly 1 million tokens at $1.56 each but sold them at $1.06, booking a loss of almost $500,000 in under two hours.

Another trader mistakenly bought the wrong token due to similar contract addresses, losing $710,000 initially. However, this trader recovered their losses by purchasing the correct YZY token afterward.

Celebrity Token Precedent

The YZY launch follows a pattern set by other celebrity-backed tokens this year. President Donald Trump’s TRUMP memecoin gained attention when it quadrupled in value within 28 hours of launch.

Argentina’s President Javier Milei caused controversy when he promoted the LIBRA token on social media. The token reached a $4 billion market cap before Milei deleted his post, causing the price to crash and creating public outrage.

Traders Still Buying Despite Concerns

Several well-known cryptocurrency traders have purchased YZY tokens despite the insider trading allegations. BitMEX co-founder Arthur Hayes posted about buying the token on his social media accounts.

Pls don't rug me @kanyewest !!!$YZY for the win … cause bull market.

Yachtzee pic.twitter.com/16ZruT8WqA

— Arthur Hayes (@CryptoHayes) August 21, 2025

Leverage trader James Wynn said he bought YZY tokens during a 60% price pullback, citing the Trump token’s performance as justification. Wynn stated he views this as a short-term investment opportunity.

The token launched with 25 different contract addresses deployed simultaneously. One address was randomly selected as the official token to discourage automated trading bots from gaining early access.

YZY currently trades at approximately $1 per token, down from its peak of over $3. The token’s website warns users about the risks of digital assets, including the potential for complete loss of investment.