TLDR

- Cardano whales accumulated nearly $100 million worth of ADA tokens in the last 24 hours, showing strong institutional confidence

- Large wallet holders added 130 million ADA tokens while smaller holders sold 20 million tokens during recent market dips

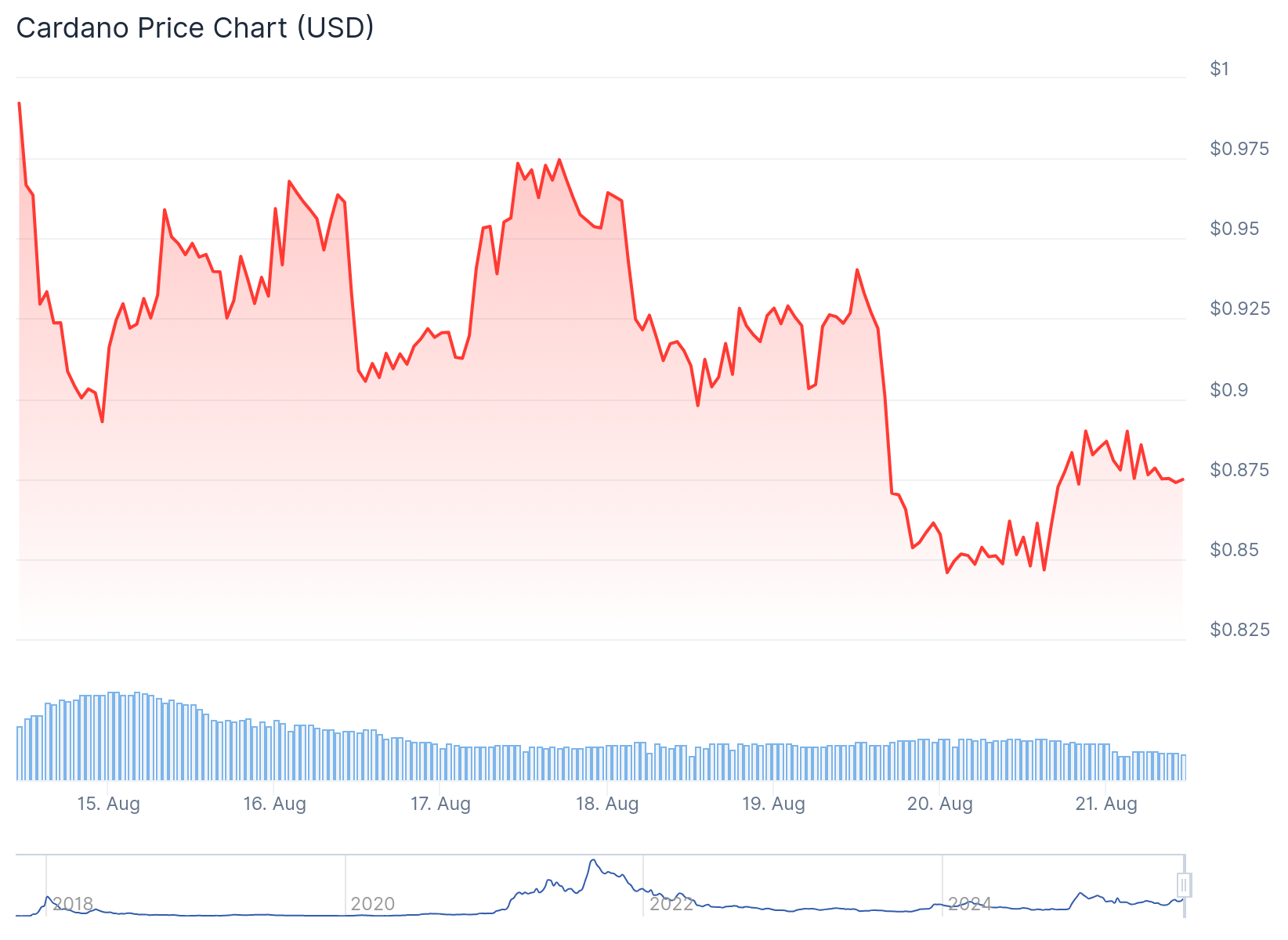

- ADA price rebounded from key support at $0.84 and is trading around $0.88 with positive funding rates indicating bullish sentiment

- Technical upgrades including Hydra and Mithril are improving Cardano’s scalability and efficiency for DeFi and enterprise applications

- Price predictions suggest ADA could reach $1.13 by September 2025, representing a 27.98% increase from current levels

Cardano price has rebounded from key support levels as whale investors accumulate tokens during recent market dips. The token is trading around $0.88 on Thursday after finding support at $0.84 the previous day.

Data from Santiment shows that large wallet holders have been actively buying ADA during the recent price decline. Whales holding between 10 million and 100 million ADA tokens accumulated 130 million tokens from Tuesday to Thursday.

%20[08-1755748402402-1755748402414.50.28,%2021%20Aug,%202025].png)

The whale buying behavior suggests institutional confidence in Cardano’s long-term prospects. According to crypto analyst Ali Martinez, nearly $100 million worth of ADA has been accumulated by whales in the last 24 hours.

100 million Cardano $ADA scooped up by whales in the last 24 hours. pic.twitter.com/nA8qNyGBkB

— Ali (@ali_charts) August 20, 2025

Derivatives market data supports the recovery narrative. Coinglass funding rate data shows positive sentiment among traders with the OI-Weighted Funding Rate reading 0.0072% on Thursday.

When funding rates flip from negative to positive, it indicates that long positions are paying shorts. Historical data shows this pattern has preceded sharp price rallies for Cardano, including a surge on July 6.

Technical Developments Support Growth

Cardano has been implementing key technical upgrades to improve its blockchain functionality. The network recently deployed Hydra scaling solutions that process bulk transactions off-chain through specialized “heads.”

These Hydra components aim to support mass deployment across DeFi, gaming, and enterprise applications. The upgrade allows Cardano to handle higher transaction volumes while maintaining security.

The Mithril upgrade has also enhanced ADA’s accessibility by enabling data processing on a singular index. This improvement makes the Cardano network more efficient for developers and users.

Cardano developers launched Cardinal, a new smart contract bridge that allows Bitcoin traders to access the platform. This cross-chain functionality could attract additional trading volume to the network.

Cardano Price Prediction

Technical analysis shows the Relative Strength Index on the daily chart sits around 56 after rebounding from the neutral level of 50 on Tuesday. The indicator points upward, suggesting bullish momentum is building.

However, the Moving Average Convergence Divergence lines are converging, indicating some indecisiveness among traders. ADA price rose above $1 on August 14, rallying nearly 20% that week.

CoinCodex data suggests Cardano may reach $1.13 by September 19, 2025, representing a 27.98% increase from current levels. The prediction is based on technical indicators showing neutral sentiment with a Fear & Greed Index of 44.

Cardano recorded 16 out of 30 green days with 8.71% price volatility over the last 30 days. The token continues to be part of the ETF discussion with asset managers like Grayscale exploring ADA exchange-traded fund products.

If ADA continues its recovery, it could extend the rally toward the psychological level of $1. A correction could see the token test support at $0.84 again.