TLDR

- Cardano dropped 6.67% to $0.86 following Bitcoin’s decline but maintains bullish chart structure

- Whale wallets added 130 million ADA tokens while smaller holders reduced positions

- Mean coin age trending higher indicates network-wide accumulation after months of distribution

- Daily transaction volume averages 2.6 million with steady active address count throughout 2025

- Analysts target $1.20 next if $1 psychological resistance breaks, with year-end projections reaching $2.05

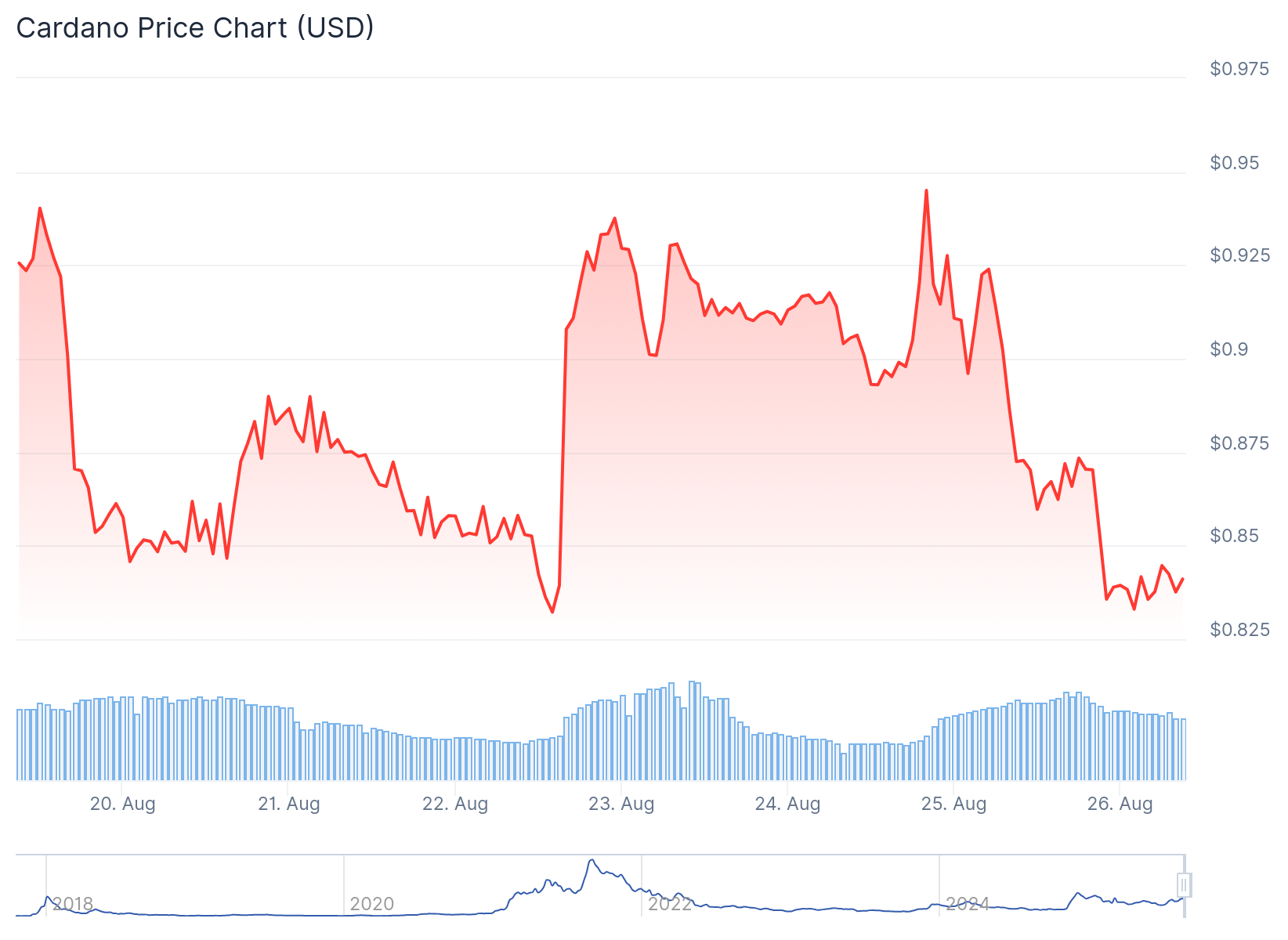

Cardano has pulled back from recent highs but maintains strong underlying fundamentals as the cryptocurrency approaches another test of the $1 resistance level. The altcoin fell 6.67% over three days, dropping from $0.93 to $0.86 as Bitcoin declined 4.6% from $117,000 to $111,500.

The price action follows Bitcoin’s weekend pullback that continued into Monday, August 25. Despite the recent decline, Cardano’s 1-day chart structure remains bullish with relatively high trading volume throughout August.

On August 14, ADA tested the $1 level as resistance but failed to climb higher. The cryptocurrency appears positioned for another attempt at breaking through this psychological barrier.

Technical analysis using Fibonacci extension levels suggests the next target would be $1.20 if the $1 resistance successfully breaks. The weekly performance shows resilience with a 13% rise from support at $0.70 to reach $0.81.

Cardano Price Prediction

Recent blockchain data reveals growing whale activity across the Cardano network. Wallets holding between 10-100 million ADA tokens have accumulated 130 million additional tokens in recent days.

This accumulation occurred while other holder cohorts reduced their positions. The contrasting behavior suggests institutional-level confidence despite broader market uncertainty.

Mean coin age has begun trending higher over the past two weeks after months of declining values. This metric tracks the average age of all tokens on the network, with rising trends indicating accumulation rather than distribution.

The dormant circulation has remained relatively low throughout August. This suggests profit-taking activity has not yet materialized despite many holders being in profit.

Network engagement continues at robust levels. August 2025 has seen ADA process approximately 2.6 million transactions daily, totaling around 450 million transactions in the first half of the year.

Development activity maintains a strong score of 80.86, though this represents a decline from earlier 2025 levels. For comparison, Ethereum’s development activity score stands at 25.05.

Daily active addresses have remained steady throughout 2025 despite transaction volume dropping 90% from November 2024 peaks. Two major step-downs in transaction activity occurred in November 2024 and April 2025.

Market Positioning and Future Outlook

The 180-day MVRV ratio reflects that many Cardano holders are currently in profit. This creates potential for profit-taking activity but has not yet materialized based on circulation metrics.

MVRV Z-scores above 0.4 and rising funding rates indicate healthy demand-supply dynamics. Long-term ADA futures open interest has reached $1.44 billion, showing institutional commitment.

Long-term holders demonstrate conviction with many expecting over 80% probability of ETF approval. These investors have maintained positions despite macro uncertainty rather than selling during recent rallies.

Analyst projections vary widely for Cardano’s price trajectory. Coinpedia analysts suggest ADA could reach $2.05 by the end of 2025 under optimal conditions including ETF approval and retail adoption.

Yahoo Finance projects an average price near $0.945, representing approximately 79% returns from current levels. Bullish estimates range from $0.94 to $2.69 depending on momentum and ecosystem adoption.

The resistance level around $0.884 represents the immediate hurdle for continued upward movement. Breaking this level could confirm the path toward $1.01-$1.15 targets.

Current market positioning shows ADA maintaining support above key levels despite the recent pullback. Growing institutional sentiment and whale accumulation provide foundation for potential breakout attempts.