TLDR

- Bitcoin price traded near $109,000 in September 2025, showing daily gains of 0.29%

- Whale addresses holding at least 100 BTC reached a record high of 19,130, surpassing the 2017 peak

- September remains Bitcoin’s historically weakest month with average losses of 4.68% since 2010

- Technical analysis shows BTC broke below key support levels, suggesting potential decline to $100,000

- August saw a 6.5% drop ending a four-month winning streak, with ETFs losing $751 million

Bitcoin price traded near $109,000 during early September 2025, maintaining relative stability despite facing its historically weakest month. The world’s largest cryptocurrency showed daily gains of 0.29% at the time of writing.

September has consistently proven challenging for Bitcoin throughout its history. Data from Bitwise Asset Management covering 2010 to 2025 revealed that September posted average declines of 4.68% during this period.

September has historically been Bitcoin’s weakest month.

Did Bitcoin front-run the red September, or is more selling ahead?

What do you think? 🤔 pic.twitter.com/krqFLRR8Zv

— Bitcoin Archive (@BTC_Archive) August 30, 2025

This seasonal weakness stems from recurring profit-taking behavior and reduced market liquidity. Historical patterns show eight of the past 12 September months since 2013 closed in negative territory.

The cryptocurrency fell 6.5% in August 2025, breaking a four-month winning streak. This decline coincided with US-listed spot exchange-traded funds bleeding $751 million according to SoSoValue data.

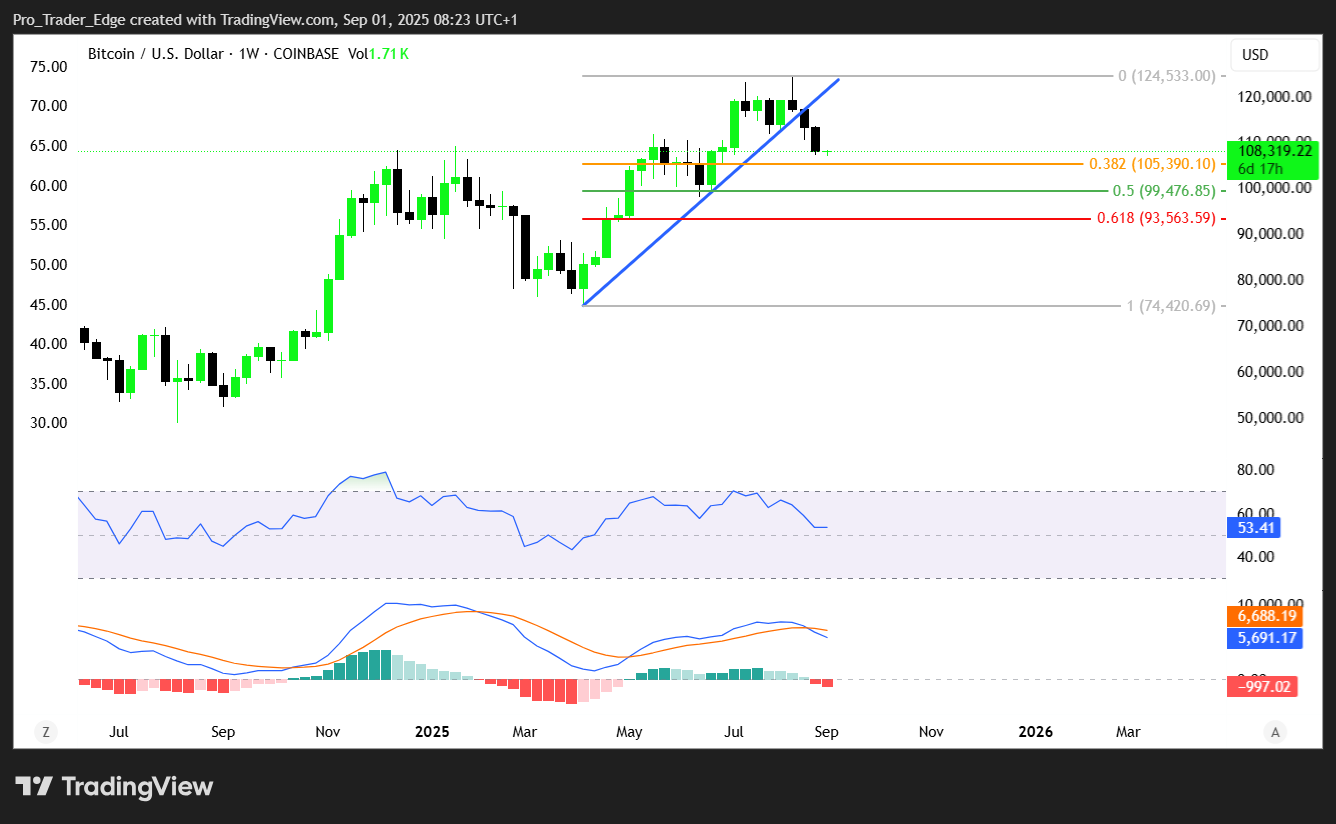

Technical indicators paint a concerning picture for Bitcoin’s short-term outlook. The cryptocurrency breached several key support levels including the Ichimoku cloud and both 50-day and 100-day simple moving averages.

BTC also pierced crucial horizontal support zones formed by the May high of $111,965 and December high of $109,364. These breakdowns confirm growing market weakness and bearish momentum shifts.

Whale Activity Reaches Historic Peaks

Despite seasonal headwinds, large Bitcoin holders demonstrated unwavering confidence through increased accumulation. Addresses containing at least 100 BTC climbed to a record 19,130 in 2025.

JUST IN: Bitcoin addresses holding 100+ BTC reach an all-time high.

Whales are buying at an unprecedented pace. 🐳

You know what comes next. 🟧 pic.twitter.com/7iH5Vdk3Ym

— Bitcoin Archive (@BTC_Archive) August 30, 2025

This figure surpassed the previous peak of 18,544 reached during 2017’s bull market. The growth trajectory remained steady over time, starting from just 1,375 such addresses in 2010.

By 2024, the number had grown to 17,761 before reaching the current record. This consistent accumulation pattern suggests long-term investor confidence despite short-term volatility concerns.

Market observers closely monitor whale buying patterns as large inflows often precede major price movements. Heavy accumulation typically signals institutional confidence in the asset’s future prospects.

The Guppy Multiple Moving Average shows the short-term exponential moving average band crossing below the longer-term band. This technical signal indicates a clear bearish momentum shift in the near term.

Weekly MACD histogram readings dropped below zero, suggesting a transition from bullish to bearish trend conditions. These combined signals point toward potential sustained selling pressure ahead.

Bitcoin Price Prediction

Analysts project possible downside targets based on current technical formations. The 200-day simple moving average sits at $101,366, representing the first major support level below current prices.

A break below this level could drive Bitcoin toward the psychological $100,000 mark. Support levels include $105,240 representing the 38.2% Fibonacci retracement of the April-August rally.

Resistance levels remain at $110,756 marking the lower end of the Ichimoku cloud and $113,510 representing the August 28 lower high. Bulls need to reclaim $113,510 to negate the current bearish outlook.

The balance between seasonal weakness and whale accumulation creates an interesting dynamic for September trading. Historical data suggests caution while whale behavior indicates underlying strength.

At press time, Bitcoin maintained its position near $109,000 as markets weighed competing factors of seasonal trends versus institutional accumulation patterns reaching historic levels.