A cryptocurrency mainnet is the “live” blockchain that facilitates the transfer of digital currency between recipients. Think of it like the live version of a website, whereas a “testnet” is more of a developer-oriented working prototype, but to test various upgrades and changes before pushing them live.

The following article explores everything you should know about mainnets; we’ve included an analysis of two different crypto mainnets.

What is a Cryptocurrency Mainnet: A Detailed Look

As alluded to above, think of a cryptocurrency mainnet as the main network for a blockchain project such as Bitcoin or Ethereum. These mainnents are made of distributed computer nodes that all communicate to form a peer-to-peer network keeping that blockchain live.

Often referred to simply as “nodes”, these individual computers or servers all form a cryptocurrency mainnet– as opposed to a single computer, therefore a single point of failure, hosting the mainnet. These nodes are incentivized by various financial mechanisms to verify, process, validate, and record user transactions– whether that be through Proof-of-Work mining, or Proof-of-Stake staking, or whatever new consensus algorithm emerges to keep these hosts incentivized.

It’s important to note that mainnet’s typically refer to Layer-1 projects, such as Bitcoin, Ethereum, Solana, Binance Smart Chain, which have their own native currency. ERC-20 tokens, for example, run on Ethereum.

Testnets are the prototypes that demonstrate the potential capabilities of a project. Mainnets are the actual “end product”, which is available for the public to use. However, just like testnets or code frameworks, mainnets can be changed whenever project teams or cryptocurrency open-source communities decide there is a need for updates and/or revisions.

Should I Invest in a Project Without a Mainnet?

While it might be ideal that all projects already have a mainnet released at the time of ICO, this is rarely the case. In fact, a lot of projects don’t even have a testnet prepared during the ICO period. In terms of fundraising, tons of blockchain projects have been able to raise sufficient capital based on potential use cases, technical concepts, and other factors like the team behind the project and partnerships. Oftentimes, teams use a lot of the funds from their ICOs towards building out the testnet and mainnet versions of their projects.

So how does a mainnet help an investor/user of a particular cryptocurrency? From an investor’s perspective, the mainnet proves that a project is making technical progress. Even if you don’t want to invest in a project before the mainnet launch, it’s important to realize how a mainnet can have a positive (or even potentially negative) impact on a cryptocurrency’s value. Many investors choose to buy cryptocurrencies in advance of a mainnet because a successful launch can sometimes lead to significant increases in value.

How Does a Mainnet Launch Affect Prices?

Does a successful mainnet correlate to higher price values of a given cryptocurrency? Not necessarily. It’s also important to understand the market context as well. To get a better understanding, here are two mainnet-related events from this year so far.

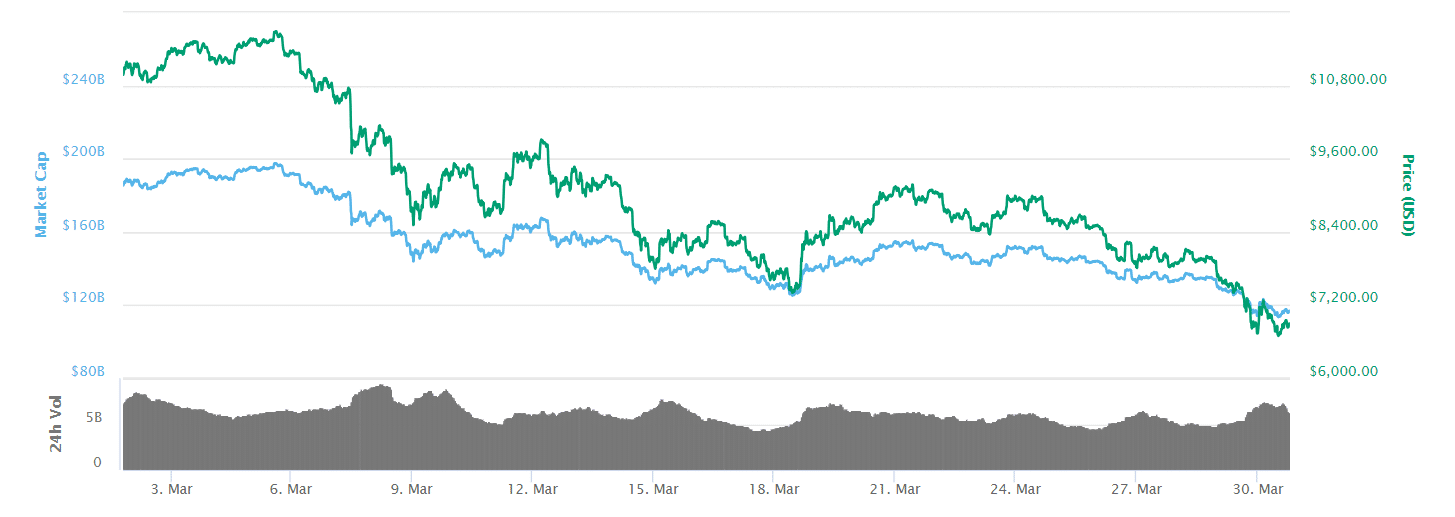

BTC and the Lightning Network: March 2018

As outlined earlier in this post, initial main nets launches aren’t the only important milestone determining the success of a cryptocurrency project. Continuous updates and integrations to the mainnet are also a major part of trying to understand the ever-changing value of any given cryptocurrency.

One recent example is the Lightning Network launch on the Bitcoin mainnet on March 15, 2018. The Lightning Network is an off-chain solution that adds a “second layer” on top of the blockchain. While this project will ultimately try to help all cryptocurrencies scale up, the most important implementation to date is on the Bitcoin mainnet. The Lightning Network is significant because it aims to make BTC a more scalable cryptocurrency by adding the capability to handle far more transactions per second. Without the Lightning Network, BTC can only handle around 7 transactions per second.

Despite the launch of the Lightning Network mainnet, BTC’s prices didn’t increase immediately afterward. Looking at the data, in the period from March 1 to March 30, the value actually decreased from around $10,600 to around $6,900.

Why is this the case? It’s important to look at this event in the context of the market. In March, pretty much the entire cryptocurrency market realized stagnant or declining prices in an extremely bear market. Even though this was a significant technical milestone, other factors limited BTC’s prices from rising at that time. Therefore, it’s difficult to say whether or not the Lightning Network’s launch on the Bitcoin mainnet had any real effect on BTC’s value in the short-term.

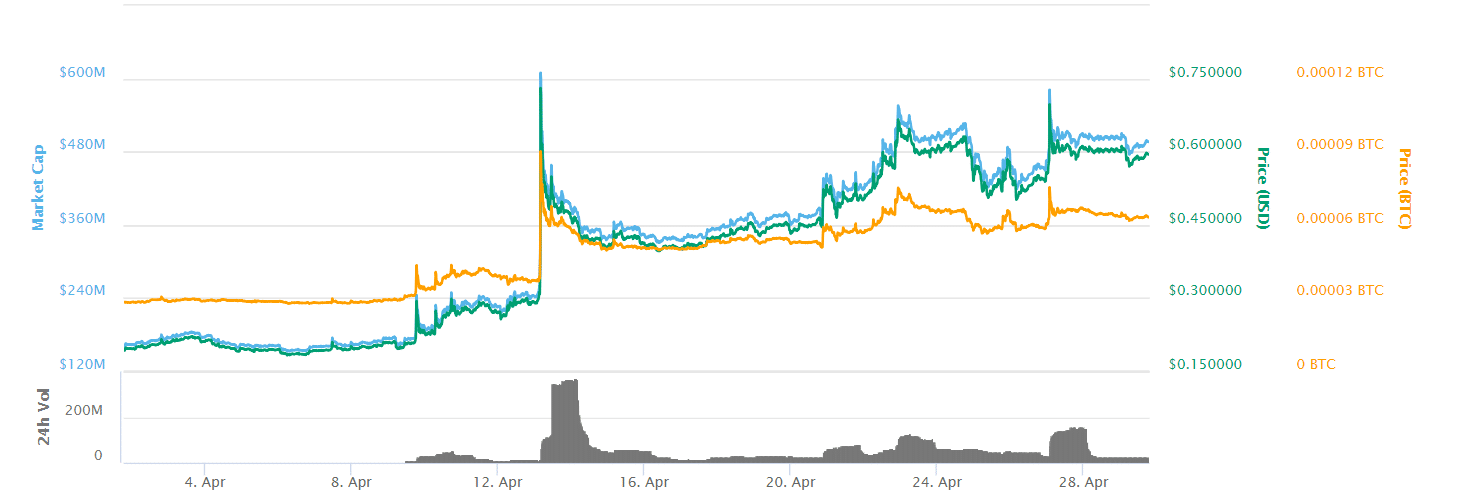

Golem (GNT) Mainnet Launch in April 2018

Golem (GNT) first launched as an Ethereum token, but it was not an ERC-20. It swapped over to an ERC-20 contract in November 2020, changing its ticker to GLM. The following example follows the original GNT mainnet.

Golem’s Brass Mainnet source code was released on Github on April 10, 2018. The purpose of Golem (GNT) is to offer a P2P system for sharing computing power. Essentially, users who need extra computing power pay GNT to users on the network who have extra computing power. Looking at the data from March 31 to April 29, the price did increase from around $0.20 to $0.60. This includes a spike to $0.73 on April 13.

At first glance, this would indicate a direct correlation between the Brass Mainnet launch and value increases. However, just like the Lightning Network launch on Bitcoin’s mainnet, it’s also important to look at this case in a market context. It’s possible to conjecture that GNT’s value increased at a more significant rate because of the mainnet (especially on April 13), but this is still difficult to conclude for certain. That’s because a vast majority of cryptocurrencies increased in value throughout April’s bullish market. It could very well be argued that the price would have risen at the same rate simply due to favorable market conditions.

Final Thoughts: How Should We Look at Cryptocurrency Mainnets?

Mainnets are important because they prove or disprove the ability of a project to take a blockchain project from ideation to implementation. While the initial release of a mainnet doesn’t always give a good insight into a project’s overall progress, it’s an essential technical aspect to consider when investing in cryptocurrencies. As seen in many cases throughout the past, it’s difficult to tell exactly what effect mainnets have on short-term price changes. However, they do indicate the potential for better overall functionality.

Still, other factors like the overall market trends and real-world adoption are also equally, if not more, important to consider. Regardless if an initial mainnet version is considered a success or not, it’s important to remember that mainnets are constantly improving with new iterations, making cryptocurrency projects more innovative and functional over time.