TLDR

- Seven major asset managers filed for spot Solana ETFs with SEC decision due by October 10

- Forward Industries raised $1.65 billion from crypto heavyweights to buy and stake SOL

- CME futures open interest hit record $1.49 billion as institutional demand surges

- Technical analysis shows widening triangle pattern with targets between $280-$350

- Network upgrade will reduce transaction finality from 12 seconds to 150 milliseconds

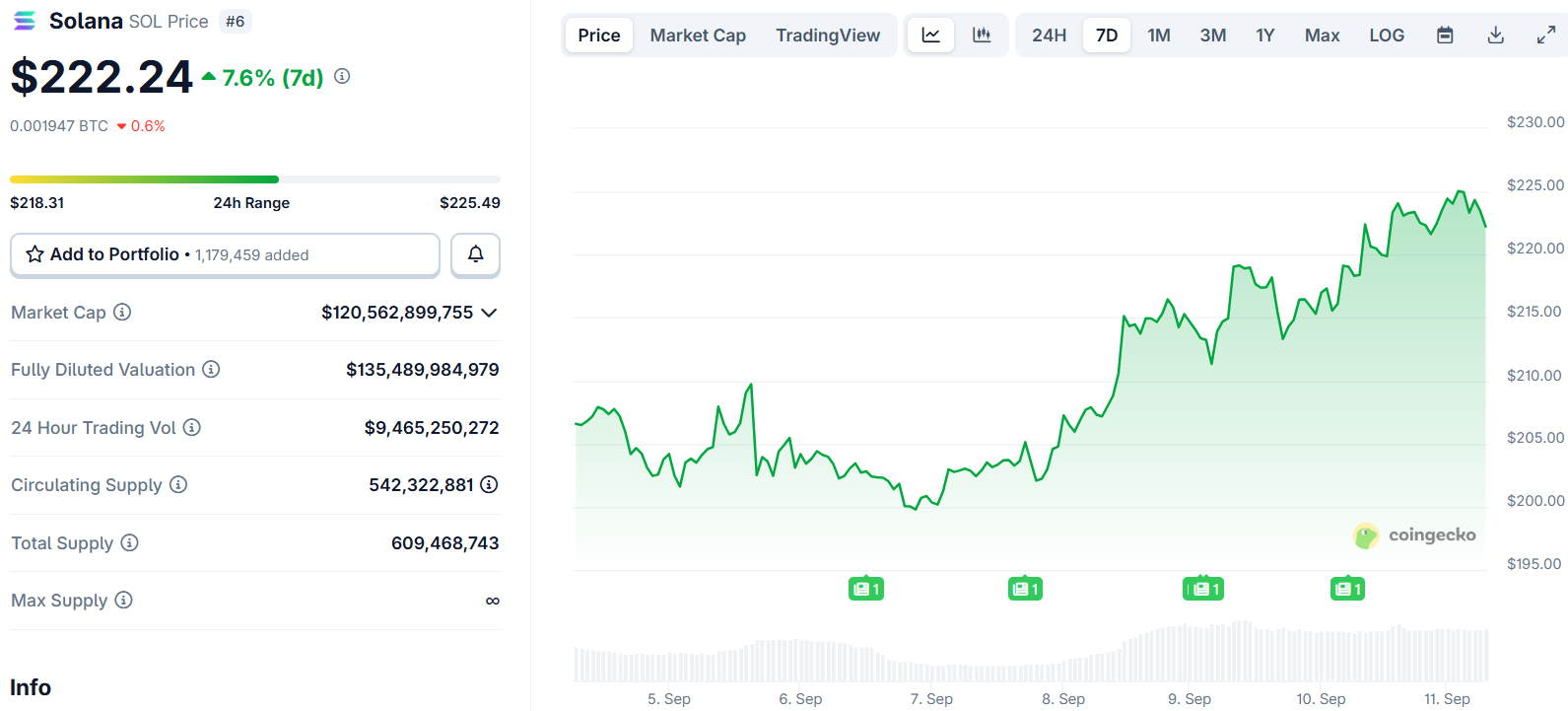

Solana has gained 24% over the past month as multiple catalysts align to drive institutional interest in the blockchain platform. The cryptocurrency is trading around $216 with a market cap of $116 billion.

Seven major asset managers have filed applications for spot Solana exchange-traded products. The group includes Bitwise, Grayscale, Fidelity, and VanEck. The U.S. Securities and Exchange Commission must rule on these filings by October 10.

If approved, retail and institutional investors could buy SOL through traditional brokerage accounts. This would mirror the success seen with Bitcoin and Ethereum ETFs earlier this year.

Forward Industries announced it raised $1.65 billion from Galaxy Digital, Jump Crypto, and Multicoin Capital. The company plans to buy SOL, stake it, and generate yield for shareholders. Kyle Samani, co-founder of Multicoin Capital and early Solana supporter, leads this initiative.

Bitwise CIO Matt Hougan compared this setup to Bitcoin’s institutional adoption phase. He noted the same conditions that drove Bitcoin from $40,000 to current levels are forming around SOL.

Forward Industries’ investment could have outsized impact due to Solana’s smaller market cap. Hougan calculated the $1.65 billion SOL purchase equals a $33 billion Bitcoin investment in relative terms.

Technical Setup Points Higher

Solana is trading within a widening triangle pattern on price charts. The structure shows higher highs and higher lows as bullish momentum builds. Support levels hold firm at $204 and $209 with current price action near $216.

The widening triangle often precedes larger price moves as volatility expands. Analysts identify the next resistance zone between $260 and $280. A clean break above this level could trigger extension toward $320-$350.

$SOL is probably one of the best large-cap bets right now.

DATs raising billions to buy SOL.

Ecosystem activity is picking up again.

And the chart pattern is screaming parabolic.

Are you holding $SOL? pic.twitter.com/Akiaf1NYTE

— Cas Abbé (@cas_abbe) September 9, 2025

Futures markets show growing institutional engagement. CME Solana futures open interest reached a record $1.49 billion, up from $1 billion in August. This represents the highest level of derivatives activity in Solana’s history.

On-chain metrics support the bullish case. Active wallet count and new account creation both increased across the Solana network. This organic growth often sustains price rallies beyond technical breakouts.

Network Improvements Drive Adoption

Solana’s value proposition centers on speed and low costs. The blockchain processes transactions on a single layer unlike Ethereum which uses additional scaling solutions. Transaction fees remain under one cent.

A new network upgrade will reduce transaction finality time from 12 seconds to 150 milliseconds. This improvement makes Solana more competitive for high-frequency applications like trading and payments.

The platform ranks third in stablecoin liquidity and fourth in tokenized assets. Asset volume on Solana increased 140% this year according to industry data.

Critics point to centralization concerns compared to other blockchains. Supporters argue Solana offers the only infrastructure fast and cheap enough for global-scale applications.

Solana’s smaller market cap means inflows have greater price impact than Bitcoin or Ethereum. Bitcoin’s $2.2 trillion valuation and Ethereum’s $519 billion dwarf Solana’s $116 billion.

$SOL $245 next pic.twitter.com/TZ4eD3Ty4N

— Johnny (@CryptoGodJohn) September 9, 2025

Analyst Johnny identifies $245 as the next upside target if current support levels hold. The ascending trendline structure suggests momentum remains intact for further gains.

CME futures open interest at $1.49 billion represents the highest institutional participation in Solana derivatives markets to date.