TLDR

- Bitcoin maintained position around $115,000 after August CPI data showed 0.4% monthly increase, highest since January

- Consumer price inflation rose to 2.9% annually while jobless claims spiked to 263,000, highest in nearly four years

- Markets still expect Federal Reserve rate cut on September 17, with some traders seeing possibility of larger 0.5% reduction

- Crypto IPO activity continues with Figure Technology raising $787 million and Gemini targeting $3.08 billion valuation

- Trading sentiment remains mixed with some calling for higher prices while others predict short-term pullback

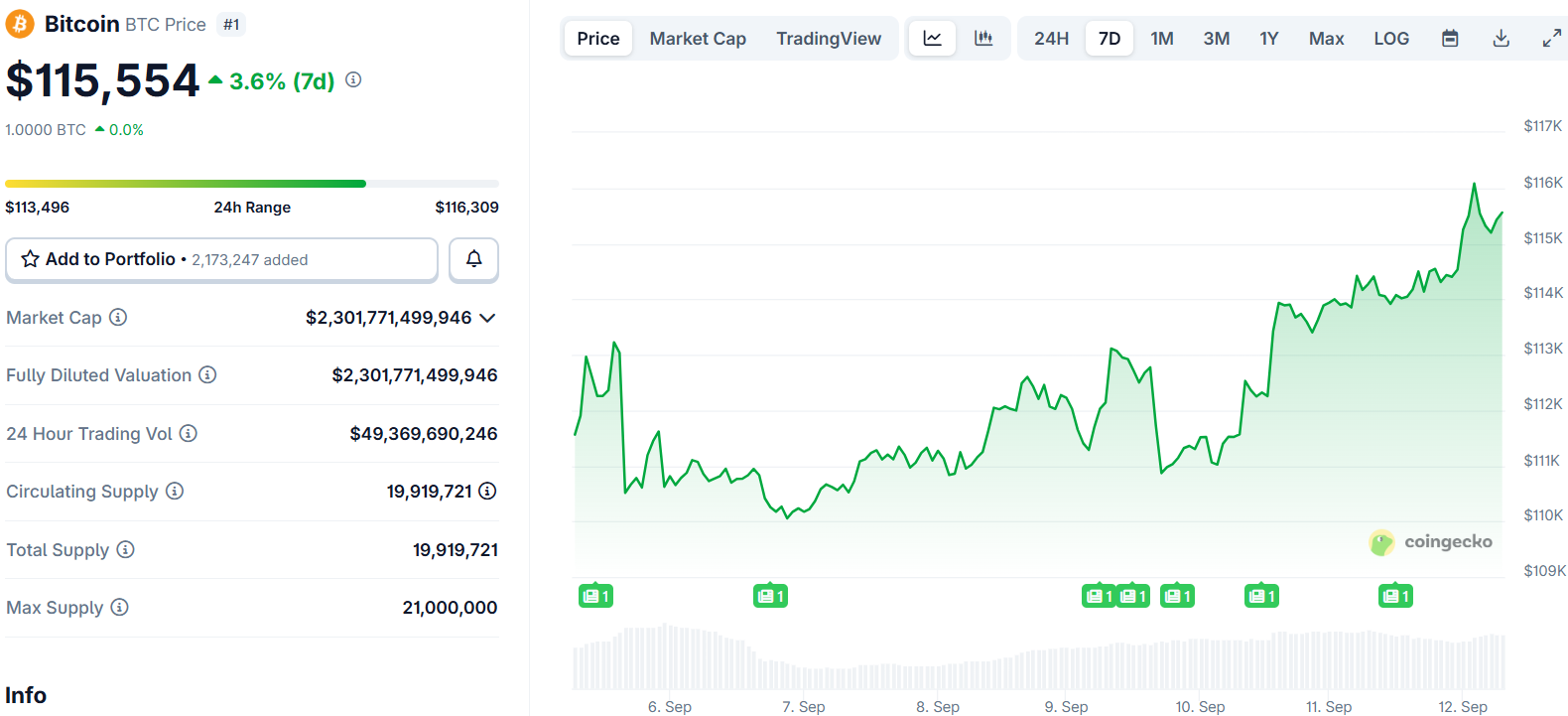

Bitcoin price action remained relatively stable on Thursday despite mixed signals from key economic data releases. The cryptocurrency traded at $115,000 by mid-morning, showing modest gains of 0.7%.

The August Consumer Price Index reading came in at 0.4% monthly growth. This marked the sharpest increase since January and pushed the annual inflation rate to 2.9%.

Core CPI, which excludes volatile food and energy prices, rose 0.3% monthly and 3.1% annually. These figures matched economist forecasts exactly.

However, jobless claims data provided a different narrative. Weekly claims jumped to 263,000, well above the expected 235,000 and reaching the highest level since October 2021.

Weekly jobless claims just hit 263,000. That's the highest weekly number since October 2021. pic.twitter.com/5hoLBpNCEM

— Josh Schafer (@_JoshSchafer) September 11, 2025

The labor market weakness has traders maintaining expectations for Federal Reserve rate cuts. Markets are pricing in a 75 basis point reduction by year-end, with the first cut expected at the September 17 meeting.

Fed Policy Expectations Drive Market Sentiment

Interest rate policy remains the primary driver for cryptocurrency markets. Lower rates typically benefit digital assets by increasing market liquidity available for speculative investments.

Bitcoin’s recent performance reflects this dynamic. The cryptocurrency has recovered from mid-August lows but remains well below its record highs from earlier this year.

Futures markets show full pricing for a quarter-point rate cut next week. Some traders see an 11% chance of a larger half-point reduction given the employment data.

Producer Price Index data earlier this week came in softer than expected. This helped ease concerns about inflation pressures from potential trade policies.

The combination of contained inflation and labor market softness supports the case for monetary easing. Fed officials have multiple data points to consider heading into next week’s meeting.

Crypto Industry IPO Activity Continues

Public market activity in the cryptocurrency sector remained active this week. Figure Technology completed its initial public offering, raising $787 million by selling 31.5 million shares at $25 each.

The offering price exceeded the company’s initial guidance range. Figure also increased the total number of shares offered to meet investor demand.

Gemini, the exchange backed by the Winklevoss twins, raised its proposed IPO price range this week. The company is targeting a valuation of up to $3.08 billion.

Several other crypto companies have successfully gone public this year. Circle Internet Group, Bullish, and eToro all completed strong market debuts.

Regulatory changes under the current administration have created a more favorable environment for crypto companies. This has increased investor interest across the sector.

Trading perspectives on Bitcoin’s near-term direction remain divided. Some analysts point to the $113,500 level as key support that could lead to higher prices.

$BTC has reclaimed a very crucial level.

The $113.5K level which acted as a resistance has now been flipped into support.

Now the next key level for Bitcoin is to reclaim $117K level, and a new ATH will be confirmed. pic.twitter.com/3QdrCtH4ho

— BitBull (@AkaBull_) September 11, 2025

Others suggest that CPI data releases often create temporary rallies followed by selloffs. Historical patterns show Bitcoin sometimes gains before data releases then declines afterward.

$BTC current price action is exactly mimicking past CPI price action.

In the last 3 CPI data releases, Bitcoin rallied before CPI data and dumped right after the data release.

This time, BTC has rallied before today's CPI data release, which means a dump could happen.

What do… pic.twitter.com/qaFmm960uF

— Ted (@TedPillows) September 11, 2025

Order book data shows approximately 2,000 BTC worth of liquidity appearing on exchanges. This could indicate preparation for increased trading activity.

The cryptocurrency market continues to react to traditional economic indicators. Inflation data, employment figures, and Fed policy all influence digital asset prices.

Bitcoin currently trades near three-week highs following the economic data releases. The next key level to watch is whether the cryptocurrency can break above $115,000 and maintain those gains.