TLDR

- Solana broke past $220 for the first time in eight months, triggering over $17 million in short liquidations

- Galaxy Digital acquired $536 million worth of SOL (2.31 million tokens) in just 24 hours through multiple exchanges

- Galaxy led a $1.65 billion investment in Forward Industries, which is transitioning to become a Solana treasury company

- Technical analysis points to potential targets of $300-$400 as SOL holds above key support levels

- Industry leaders including Galaxy CEO Mike Novogratz declare “Solana Season” is beginning

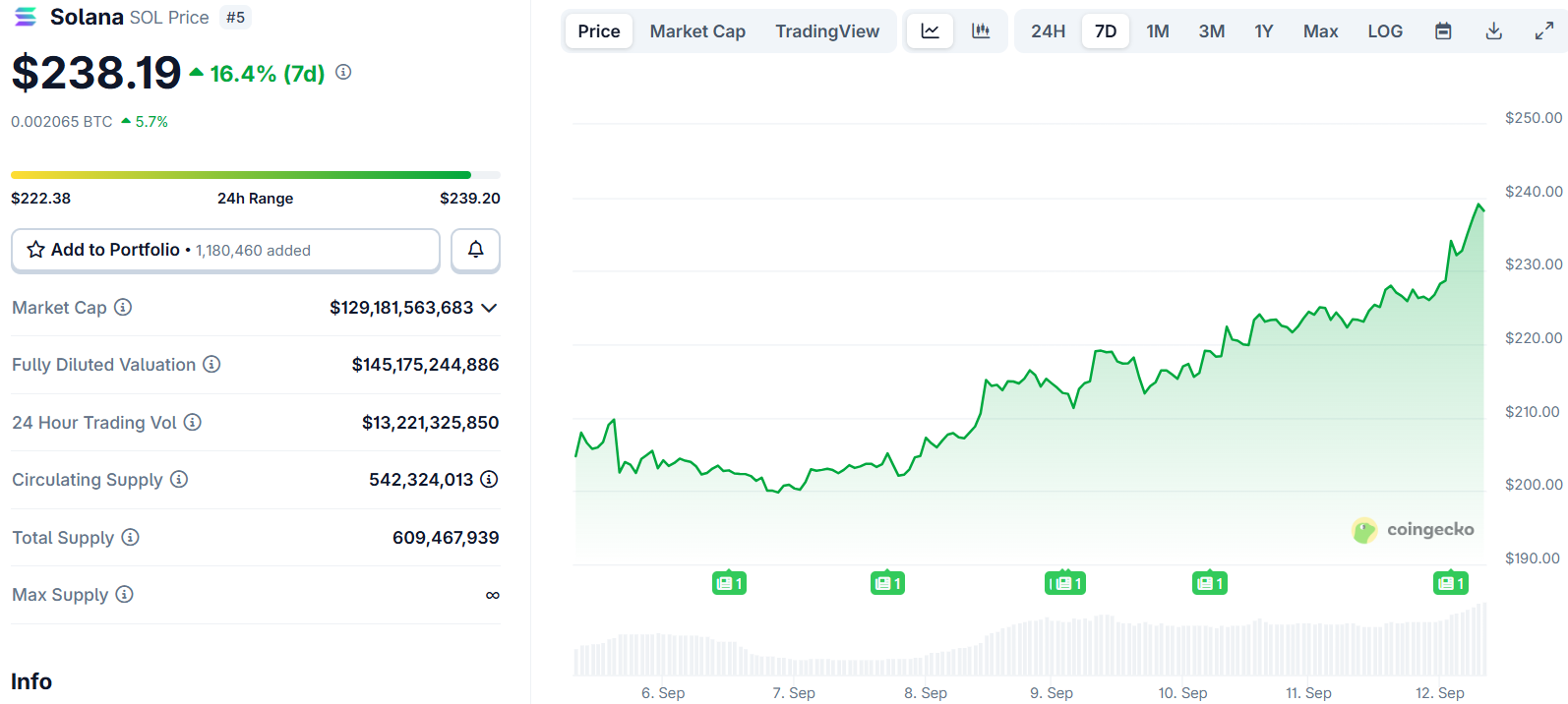

Solana has surged past the $220 mark for the first time in eight months. The breakout triggered over $17 million in short liquidations across various trading platforms.

The price movement comes as institutional buying pressure intensifies. Galaxy Digital acquired approximately 2.31 million SOL tokens worth $536 million within a 24-hour period.

Data from Arkham Intelligence shows Galaxy received the tokens through multiple transactions. The transfers came from wallets on major exchanges including Binance, Coinbase, and Bybit.

Galaxy Digital just bought another 706,790 $SOL($160M).

In the past 24 hours, their total buy is a massive 2,159,182 $SOL($486M).https://t.co/OFLLaSJQdS pic.twitter.com/RUoK7NXZMM

— Lookonchain (@lookonchain) September 12, 2025

This institutional accumulation follows Galaxy’s recent investment activity. The firm led a $1.65 billion private placement in Forward Industries alongside Jump Crypto and Multicoin Capital.

Forward Industries is transitioning into a Solana digital asset treasury company. The company closed its private placement and plans to purchase Solana with the proceeds.

Major Institutional Investment Strategy

Galaxy’s investment represents part of a broader corporate treasury trend. Many firms are adopting “reverse merger” approaches by acquiring publicly traded companies and converting them into crypto treasury entities.

Forward Industries stock rose 135% over five trading days following the announcement. The company trades on the Nasdaq under the ticker FORD.

The three investment firms collectively subscribed for more than $300 million of the placement. They plan to provide Forward Industries with capital and strategic support.

Current data shows public Solana treasuries hold 4.67 million SOL tokens total. Galaxy’s recent acquisition represents a substantial addition to institutional holdings.

Technical Price Targets Emerge

Technical analysis suggests Solana could target the $300 level next. The cryptocurrency has established strong support above the $220-$225 zone.

$SOL | I repeat, $400 incoming. pic.twitter.com/NirAkW5Pw1

— iWantCoinNews (@iWantCoinNews) September 11, 2025

Chart patterns show a series of higher lows leading into the breakout. This formation often precedes sustained upward price movements.

Immediate resistance levels sit at $238 and $250. These zones previously acted as supply areas during earlier price movements.

Analysts point to the $350-$400 range as longer-term targets. The weekly chart shows Solana building a strong base since early 2024.

The 100-day moving average trends positively underneath current prices. This technical indicator reinforces the bullish momentum structure.

Galaxy CEO Mike Novogratz stated the crypto market is entering a “season of Solana.” He cited strong market momentum and favorable regulatory signals as key factors.

Bitwise Chief Investment Officer Matt Hougan echoed similar sentiment in a recent memo. He highlighted corporate treasury purchases and upcoming spot Solana ETFs as bullish catalysts.

Solana currently trades at $236.83, representing a 6% gain over 24 hours. The cryptocurrency has surpassed BNB to become the fifth largest by market capitalization at $126.4 billion.