TLDR

- Crypto experts remain bullish on Bitcoin despite stagflation fears, focusing on Fed rate cuts and monetary tailwinds

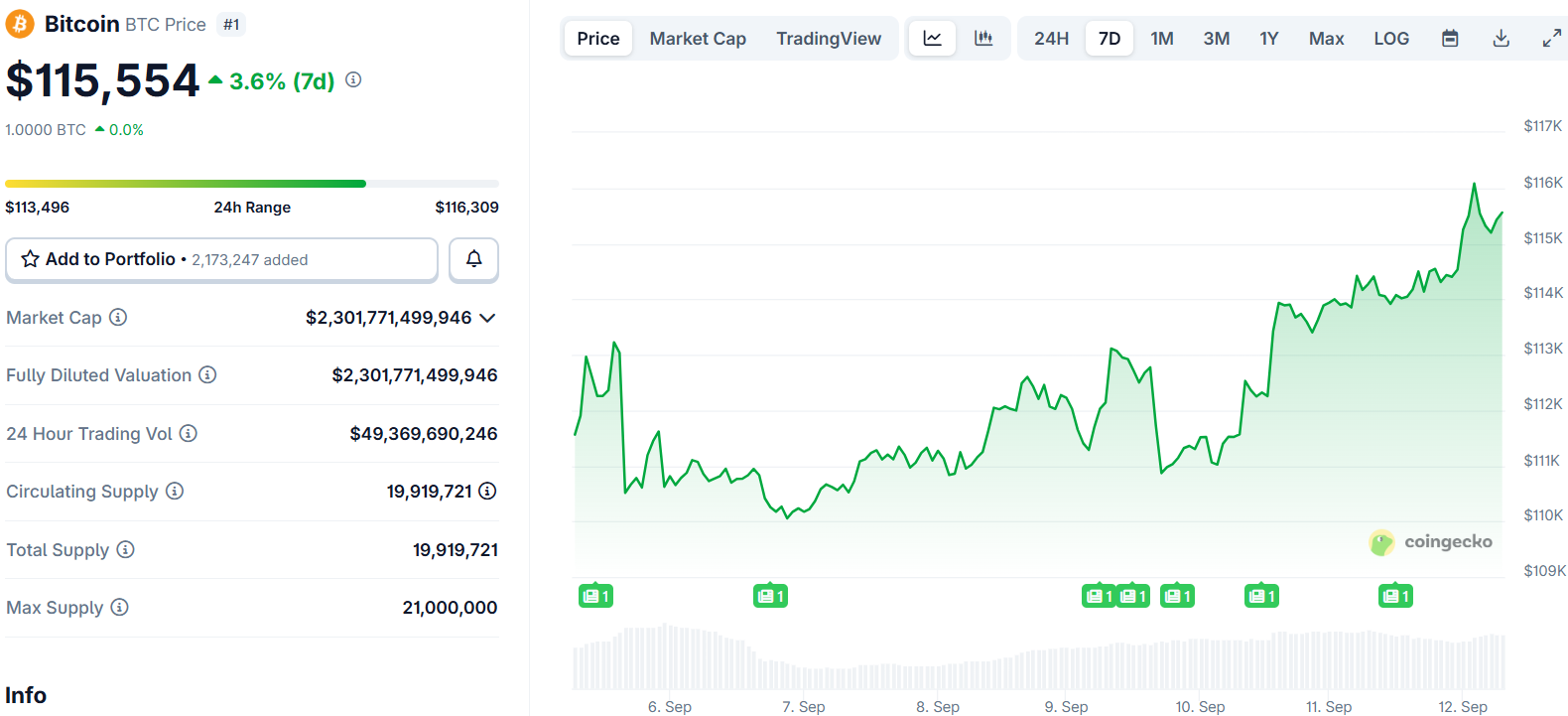

- Bitcoin briefly topped $116,000 as S&P 500 hit new highs, with traders expecting 25bp Fed rate cut on Sept 17

- Coinbase analysts predict crypto bull market will extend into Q4 2025 due to strong liquidity and favorable conditions

- Digital asset treasuries hold over $130 billion in BTC, ETH, and SOL, providing price support

- Key altcoins to watch include Solana (SOL), Ethena (ENA), and Hyperliquid (HYPE) tokens

Bitcoin continues its upward trajectory as crypto experts maintain their bullish outlook despite emerging stagflation risks in the US economy. The leading cryptocurrency briefly surpassed $116,000 this week, building momentum from recent technical breakouts.

Economic data released Thursday showed concerning signs for the US economy. Consumer prices rose 0.4% month-over-month in August, pushing annual inflation to 2.9% – the highest level since January. First-time unemployment claims also surged to their highest point in four years.

Despite these warning signs, traditional markets responded positively. The S&P 500 reached new all-time highs while the dollar index dropped 0.5% to 97.50. Traders appear focused on anticipated Federal Reserve rate cuts rather than inflation concerns.

Shane Molidor from crypto advisory platform Forgd believes the monetary environment remains supportive. He explains that Bitcoin and crypto serve as hedges against currency debasement rather than simple risk bets. This fundamental shift differentiates the current cycle from previous ones.

Market participants widely expect a 25 basis point rate cut on September 17. Additional reductions are anticipated through year-end. The Fed appears likely to prioritize labor market support over persistent inflation concerns.

Fed Policy Creates Crypto Opportunity

Markus Thielen from 10x Research predicts inflation will resume its downward trend in coming months. His inflation models and leading indicators suggest falling prices ahead. This backdrop would provide room for risk assets to advance further.

Sam Gaer from Monarq Asset Management sees attractive risk-reward ratios in cryptocurrency markets. Recent economic releases delivered no major shocks or negative surprises. This gives traders confidence for the expected rate cut next week.

Even potential stagflation scenarios could benefit crypto long-term. If the Fed prioritizes price stability over employment, temporary selling pressure might emerge. However, this would strengthen the case for scarce, non-sovereign assets like Bitcoin.

Le Shi from market maker Auros notes that major technology stocks appear insulated from stagflation fears. The continued strength in large-cap tech companies supports overall bull market sentiment. Their planned AI investments worth billions provide additional confidence.

Coinbase analysts David Duong and Colin Basco remain optimistic about the fourth quarter outlook. They cite resilient liquidity, favorable macro conditions, and supportive regulatory signals as key drivers.

Digital Asset Treasuries Provide Support

Public digital asset treasuries now hold substantial cryptocurrency positions. These entities control over 1 million Bitcoin worth $110 billion, 4.9 million Ethereum valued at $21.3 billion, and 8.9 million Solana tokens worth $1.8 billion as of September 10.

This institutional demand provides a price floor for major cryptocurrencies. Late entrants are now pursuing smaller altcoins further down the risk spectrum. Coinbase believes this creates a “player-versus-player” dynamic favoring large-cap tokens.

Several altcoins show particular promise according to industry experts. Solana has attracted strong demand over the past two weeks. The SOL-Bitcoin ratio reached seven-month highs, approaching the psychological 0.002 level with strong upward momentum.

Alternative Token Opportunities

Ethena’s ENA token and USDe synthetic dollar present unique opportunities. As Fed rate cuts reduce returns on traditional fixed-income instruments, Ethena’s tokenized basis trade becomes more attractive. This creates an unusual situation where Ethena yields increase as Fed rates decrease.

Hyperliquid’s HYPE token appeals to younger investors seeking higher returns than traditional 7% annual yields. The platform caters to users trading with leverage in perpetual markets. It offers permissionless, always-on access for high-risk, high-reward strategies.

Market participants also highlight CRO, BNB, and other exchange tokens as potential outperformers. These assets benefit from increased trading activity during bull market phases.

Coinbase notes that historical September weakness for Bitcoin broke in 2023 and 2024. The small sample size and wide outcome dispersion limit seasonal indicator usefulness. Current digital asset treasury cycles provide more meaningful guidance than historical patterns.