TLDR

- XRP’s market capitalization has surpassed major corporations including Shopify, Verizon, and Citigroup, reaching $184.20 billion

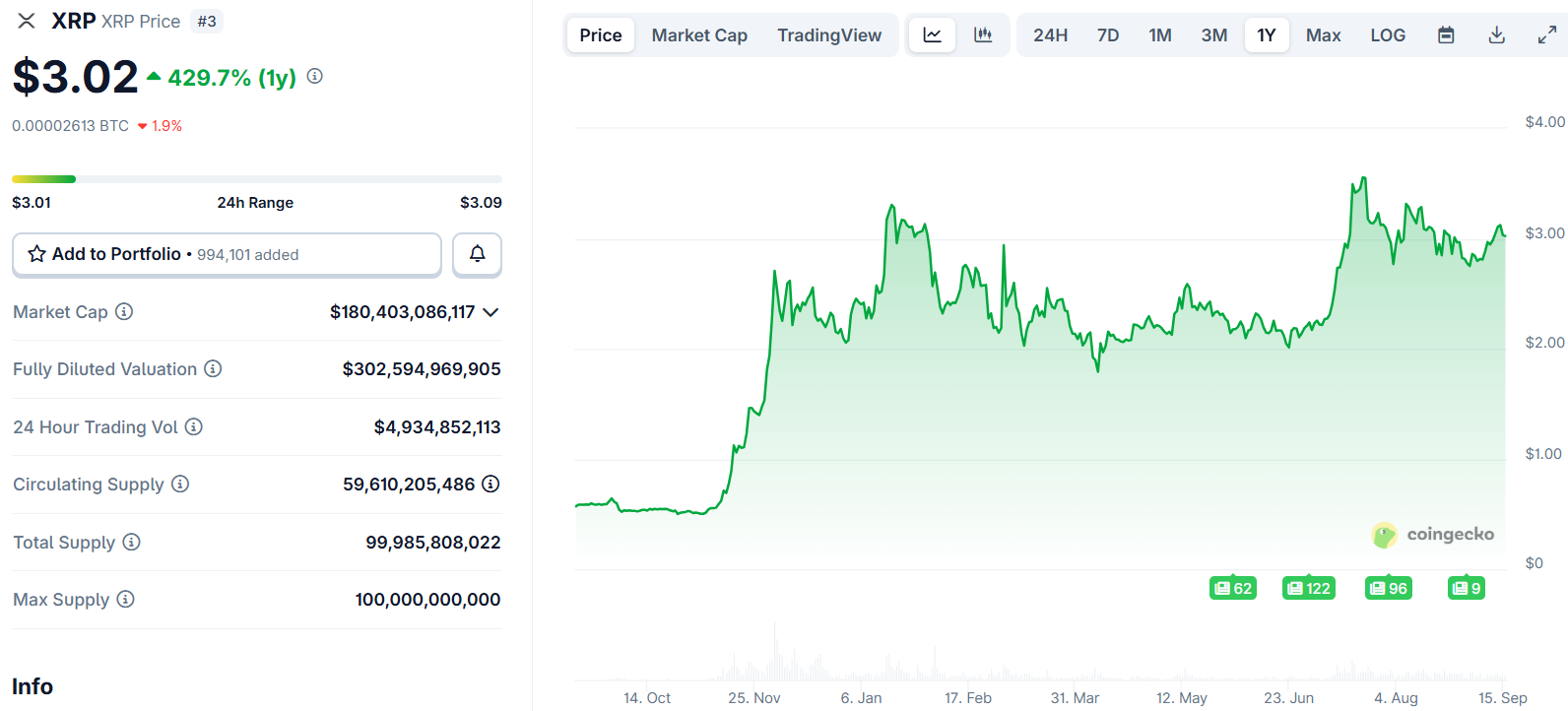

- The cryptocurrency experienced a 12% weekly gain, trading above $3.10 for the first time in weeks

- Analysts project potential price targets of $6, $13, and $23 if XRP breaks key resistance at $3.60

- ETF speculation is driving bullish sentiment, with REX-Osprey’s XRP ETF expected to launch next week

- XRP now ranks as the 94th most valuable asset globally by market capitalization

XRP has achieved a historic milestone by overtaking several major corporations in market capitalization. The cryptocurrency now holds a market value of $184.20 billion, surpassing Citigroup’s $183.62 billion valuation.

The digital asset has also moved ahead of other corporate giants including Shopify, Verizon, and other established companies. This marks the first time a cryptocurrency has exceeded a major Wall Street institution by market value.

XRP experienced a 12% weekly gain during its latest rally. The cryptocurrency traded above $3.10 for the first time in several weeks.

The surge has positioned XRP as the 94th most valuable asset globally by market capitalization. This ranking places the cryptocurrency in direct competition with multinational corporations and financial institutions.

ETF Speculation Drives Market Optimism

Bloomberg analyst James Seyffart stated that REX-Osprey’s XRP ETF is likely to launch next week. The ETF launch was originally scheduled for this week but faced delays.

This speculation around the Ripple ETF launch in the United States has become a key driver of the current rally. Traders and analysts cite this development as a major catalyst for price movement.

XRP CRO identified a weekly bull flag pattern forming in the price charts. The analyst shared projected targets of $6, $13, and $23 if the token breaks key resistance levels.

$XRP weekly bull flag forming.

Next explosive leg is loading… 🚀🎯 Potential targets by the EOY once it breaks the $3.6 resistance: $6, $13, $23.

Are you ready? pic.twitter.com/7voqHDr2E7

— XRP_Cro 🔥 AI / Gaming / DePIN (@stedas) September 13, 2025

The first resistance level sits at $3.60. Breaking through this level could trigger further upward movement according to technical analysis.

Technical Analysis Points to Higher Targets

Crypto analyst Dark Defender revealed that XRP is breaking its initial weekly resistance. The analyst identified targets at the $4.39 and $5.85 Fibonacci levels.

"The Power of the Waves"

Initial weekly resistance is being broken right now.#XRP targets, $4.39 and the $5.85 Fibonacci levels

Supports: $3.01, $2.85.

As clear as it gets. pic.twitter.com/MjaAqczjSU

— Dark Defender (@DefendDark) September 12, 2025

Support levels to monitor include $3.01 and $2.85. These levels could provide buying opportunities if the price retreats.

Egrag Crypto confirmed that XRP is breaking out of a symmetrical triangle pattern. This pattern suggests equal probability for upward or downward movement.

Real-World Usage Supports Valuation

XRP functions as a bridge currency through Ripple’s On-Demand Liquidity feature. Financial institutions use this service to process cross-border payments.

This real-world application distinguishes XRP from purely speculative digital assets. The practical utility provides fundamental support for the cryptocurrency’s valuation.

The success represents more than numerical comparisons between XRP and traditional financial institutions. It indicates growing institutional adoption of cryptocurrency assets.

For XRP to maintain bullish momentum, analysts emphasize the need for solid follow-up candles. The next two days are crucial for achieving a bullish candle close above $3.07.

Maintaining the body above this level will be key to sustaining the current momentum. A successful break could lead to new all-time highs for the cryptocurrency.

The milestone achievement establishes a foundation for long-term institutional investment interest. XRP now competes directly with established financial institutions for investor capital and market attention.