TLDR

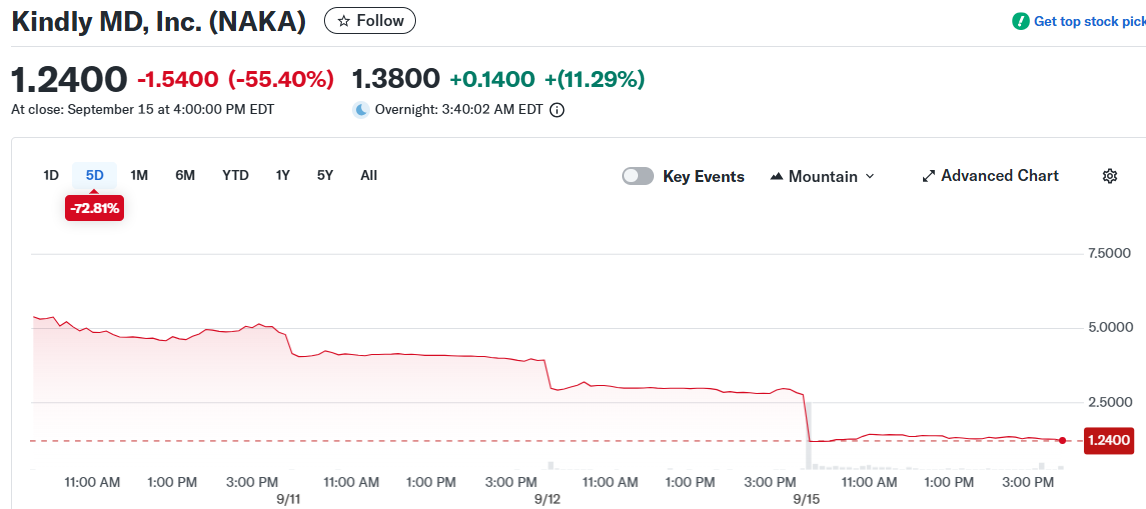

- KindlyMD (NAKA) drops 55% after PIPE investor shares were registered for sale on Friday

- AI-focused mining stocks Bitfarms, IREN, and Hive continue strong performance with double-digit gains

- Tesla rises 6% to $420 following Elon Musk’s purchase of 2.6 million shares revealed in SEC filing

- NAKA CEO David Bailey tells short-term traders to exit, acknowledging 96% decline from record highs

- CapitalB adds 48 BTC to treasury, bringing total holdings to 2,249 BTC

Crypto mining stocks showed mixed performance Monday as AI-focused companies extended their rally while KindlyMD faced heavy selling pressure. The sector continues to attract investor interest despite broader market volatility.

KindlyMD (NAKA) suffered the day’s biggest decline, falling 55% after PIPE investor shares were registered late Friday. The registration allows these investors to begin selling their positions from the recently completed SPAC merger.

The bitcoin treasury company has now lost 96% of its value from record highs. CEO David Bailey addressed the volatility in a Monday shareholder letter.

“We know resilience and discipline separate those who endure from those who fade,” Bailey wrote. He directly told short-term traders to exit the stock.

Wow. Intense volume. Thankful for all the messages of support. Today is a day of transition. We are upgrading our shareholder base from short term traders to long term investors. Brave the storm.

To the ₿ullievers go the spoils.

— David Bailey🇵🇷 $1.0mm/btc is the floor (@DavidFBailey) September 15, 2025

AI Mining Stocks Extend Gains

Bitfarms (BITF) jumped 15% in pre-market trading to $2.55. The company has gained 75% over the past week as investors focus on AI-related mining operations.

IREN rose 3% in early trading, building on gains of over 230% year-to-date. The AI-focused mining company has benefited from growing interest in artificial intelligence applications.

Hive Blockchain (HIVE) added 5% in pre-market sessions. The stock has climbed 40% over the past month as part of the broader AI mining rally.

These gains highlight continued investor appetite for companies positioned at the intersection of cryptocurrency mining and artificial intelligence. The sector has outperformed traditional bitcoin mining stocks in recent months.

Tesla Rallies on Musk Share Purchase

Tesla (TSLA) traded at $420, up 6% from Friday’s close. The electric vehicle maker gained 7% last week before Monday’s additional gains.

An SEC filing revealed that Elon Musk purchased nearly 2.6 million Tesla shares. The purchase adds to Musk’s existing stake in the company he leads as CEO.

The filing provided transparency on Musk’s recent trading activity. Tesla shares have shown increased volatility in recent weeks.

Bitcoin Treasury Activity

CapitalB (ALCPB) acquired 48 bitcoin, expanding its cryptocurrency holdings. The company now holds 2,249 BTC in its treasury reserves.

The European markets showed CapitalB trading up 15% following the bitcoin purchase announcement. Corporate bitcoin adoption continues across various sectors.

Treasury bitcoin strategies have become more common among public companies. The purchases represent long-term cryptocurrency exposure for shareholders.