TLDR

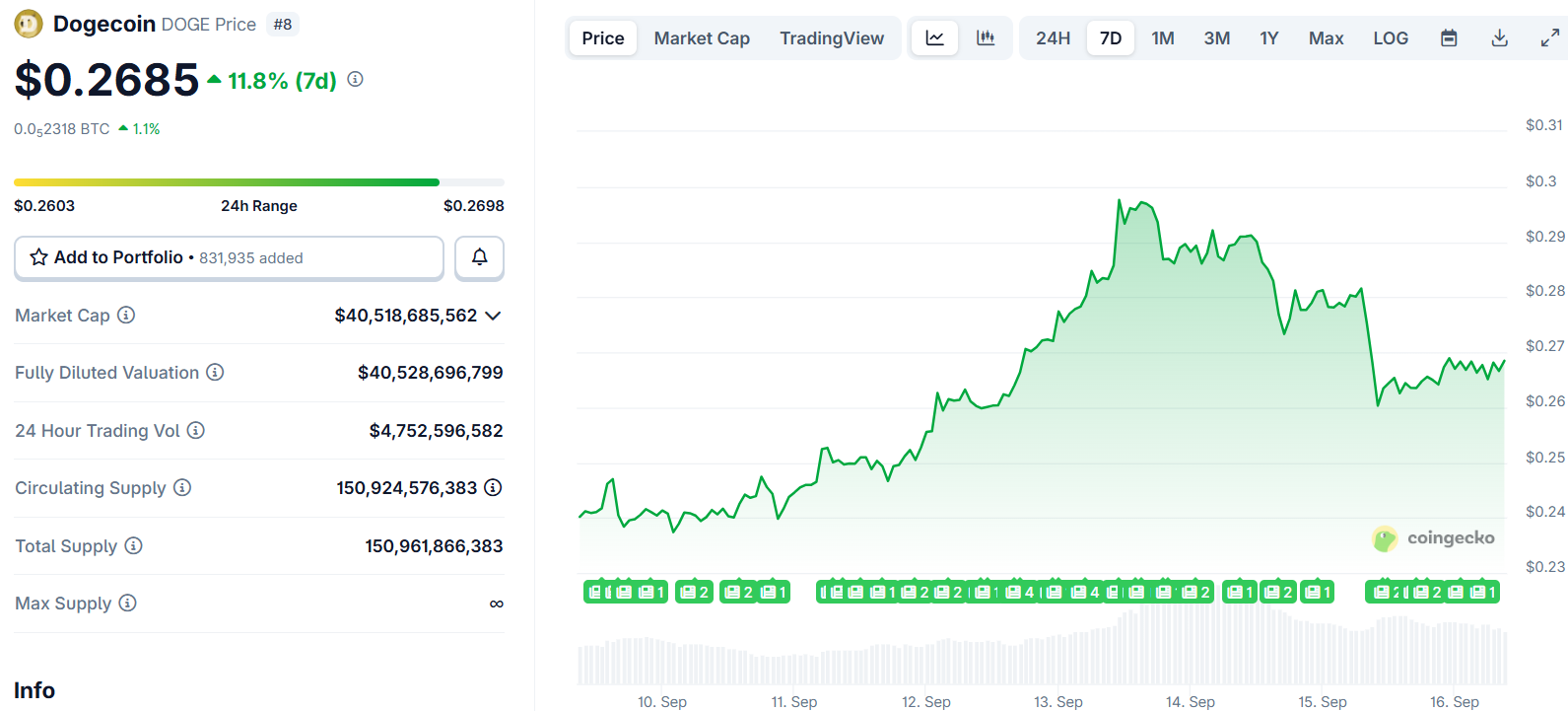

- Dogecoin dropped 7% to $0.2625 ahead of Rex-Osprey DOGE ETF expected launch on Thursday

- Large liquidations totaling $26.28 million in 24 hours drove the price decline, with long positions hit hardest

- The DOJE ETF will use futures exposure through a Cayman subsidiary rather than holding actual DOGE tokens

- Federal Reserve policy meeting uncertainty and broader market jitters contributed to the selloff across meme coins

- ETF carries a 1.5% expense ratio with no leverage, raising concerns about investor appeal

Dogecoin plunged 7% to $0.2625 on Monday as traders liquidated positions ahead of the Rex-Osprey DOGE ETF debut. The meme coin led losses among top 10 cryptocurrencies.

The Rex Shares-Osprey Dogecoin ETF, trading under ticker DOJE, could launch Thursday according to Bloomberg analysts Eric Balchunas and James Seyffart. The fund faced multiple delays after originally being slated to debut last week.

Meme coin ETF era about to kick off it looks like with $DOJE slated for a Thursday launch, albeit under the 40 Act a la $SSK. There's a big group of '33 Act-ers waiting for SEC approval still. Pretty sure this is first-ever US ETF to hold something that has no utility on purpose pic.twitter.com/BIcpu1zR4o

— Eric Balchunas (@EricBalchunas) September 9, 2025

DOGE had surged 16% over the past month as excitement built around the ETF launch. Whales accumulated over 280 million tokens while futures open interest climbed to $4.5 billion.

Coinglass data shows $26.28 million in Dogecoin positions were liquidated in 24 hours. Long positions accounted for $21.81 million of the liquidations, driving the sharp price decline.

The broader crypto market faced pressure ahead of this week’s Federal Reserve policy meeting. Markets expect a 25 basis point rate cut, though uncertainty remains about the central bank’s decision.

Bitcoin and Ethereum prices held relatively steady during the selloff. Meme coins overreacted to the market tension, with most dropping 6% in collective market cap.

ETF Structure Raises Questions

The DOJE fund will not hold Dogecoin directly. Instead, it uses a Cayman Islands subsidiary to gain exposure through futures and derivatives contracts.

This structure sidesteps physical custody requirements while offering traders access through traditional brokerage accounts. The approach differs from bitcoin ETFs that hold the actual cryptocurrency.

DOJE operates under the Investment Company Act of 1940, typically used for mutual funds. This sets it apart from bitcoin ETFs approved under the Securities Act of 1933.

The fund carries a 1.5% expense ratio with no leverage features. Critics argue this makes it more expensive than simply owning DOGE tokens directly.

Some analysts question whether institutionalizing a meme coin could invite regulatory scrutiny. Dogecoin generally lacks utility or clear economic purpose compared to other cryptocurrencies.

First Meme Coin ETF Milestone

The launch would mark the first U.S. ETF focused on a meme coin. Other applications for spot DOGE ETFs remain under SEC review.

Several firms including 21Shares, Bitwise, and Grayscale have filed traditional Dogecoin ETF applications. These would hold actual tokens rather than derivatives contracts.

Balchunas described DOJE as the first U.S. ETF to hold something with no utility on purpose. The comment highlights the speculative nature of meme coin investments.

Despite lacking fundamental use cases, meme coins have attracted billions in speculative capital. Tokens like Dogecoin, Shiba Inu, and Bonk gain popularity through internet culture and celebrity endorsements.

The ETF market may follow similar patterns to the broader crypto space. Investor demand could outweigh concerns about underlying value or utility.

Seyffart noted many existing financial products serve as vehicles for short-term trading rather than deeper investment purposes. He expects similar reception for meme coin ETFs.

Market Recovery Possible

Some analysts view Monday’s decline as a normal pullback within a bullish trend. The ETF could still bring increased liquidity and credibility to DOGE.

Previous ETF launches for Bitcoin generated significant price rallies after initial volatility. DOGE supporters hope for similar dynamics once the fund begins trading.

Technical analysts had identified resistance at $0.29 with potential targets at $0.50 on strong volume. The recent decline may have reset these levels lower.

CleanCore Solutions holds over 500 million DOGE tokens worth $125 million as the token’s official treasury partner. Such institutional backing could provide price support during volatile periods.