TLDR

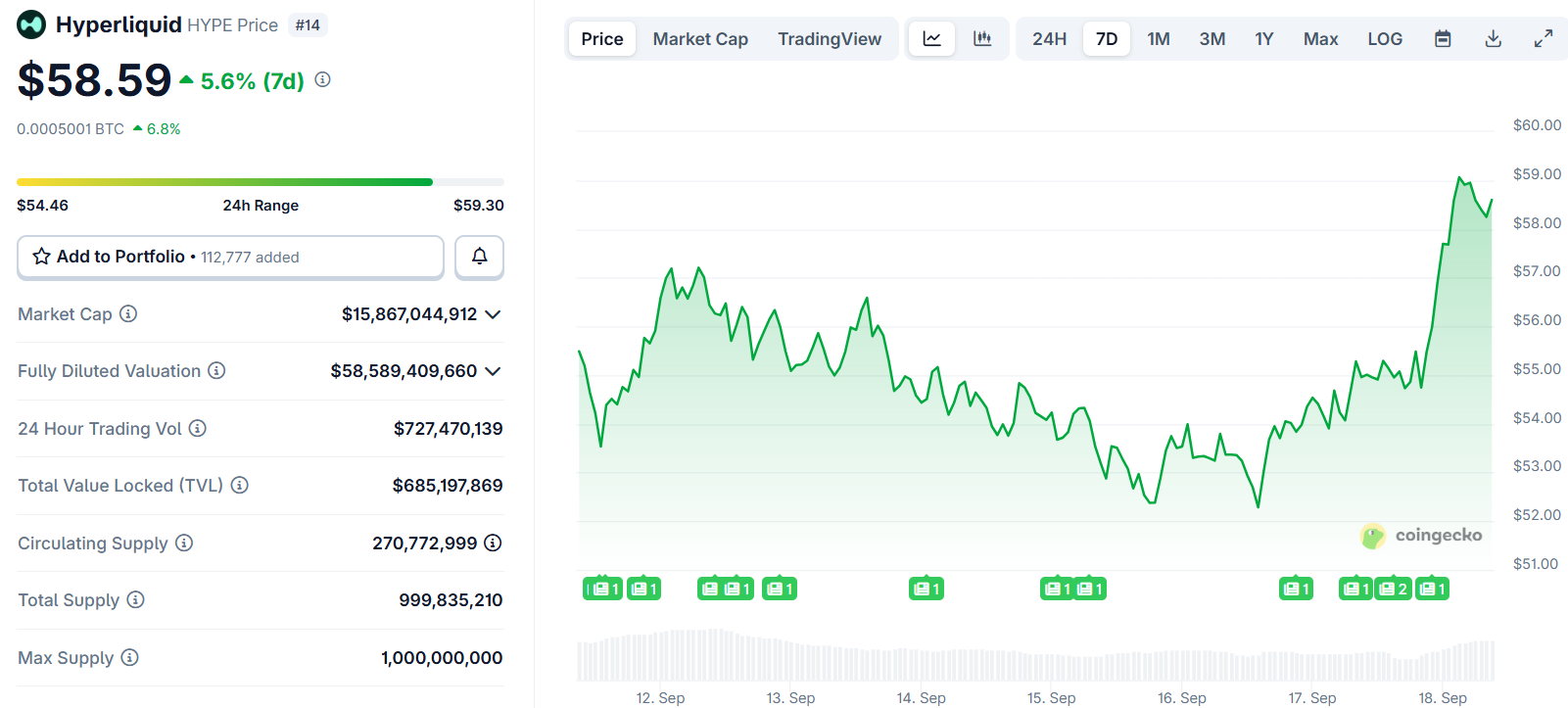

- HYPE token hit an all-time high of $59.29 on Thursday with 8% daily gains

- The token has a market cap of nearly $16 billion and surged 40% over the past month

- Binance founder CZ promoted rival ASTER token, which jumped 350% after launch

- Circle announced USDC expansion on Hyperliquid network and made first HYPE investment

- Upcoming USDH stablecoin launch expected to boost the platform further

HYPE token reached a new all-time high of $59.29 during Thursday trading. The Hyperliquid native token closed near $60 after posting 8% daily gains.

The decentralized derivatives exchange token now has a market capitalization just under $16 billion. HYPE has surged almost 40% over the past month.

Hyperliquid operates as a decentralized exchange for perpetual futures. These derivative contracts have no expiry date and allow traders to take leveraged positions on crypto assets.

BitMEX founder Arthur Hayes called the milestone an “All-time Hype” on social media. Hayes previously stated the token has potential 126 times upside based on stablecoin expansion projections.

The former BitMEX CEO estimates that stablecoin growth could push the DEX’s annualized fees to $258 billion. Current annualized revenue sits at $1.2 billion.

Nansen data shows one trader holds a $30 million leveraged long position on HYPE. The trader has unrealized profits of $1.39 million and continues adding to their position.

You might be bullish, but are you as bullish as @tummyy1 on $HYPE?

Tummyy has a 3x long position on $HYPE with a position value of $30.3m.

Currently holding an uPnL of 1.39M, and still adding onto his position 🧵 👇 pic.twitter.com/E321Ed5Woa

— Nansen 🧭 (@nansen_ai) September 18, 2025

The same trader started their position three hours before the all-time high. They have been adding approximately 123 HYPE tokens every 30 seconds.

Circle Expands to Hyperliquid Network

Circle announced expansion onto the Hyperliquid network through native USDC and CCTP V2 on HyperEVM. The USDC creator also became a direct stakeholder by making its first HYPE investment.

The platform expects to launch its USDH stablecoin in partnership with Native Markets. The new stablecoin will initially cap transactions at $800 per trade.

DeFi Llama data shows perpetual futures trading on Hyperliquid reached over $336 billion in the last 30 days. BasedApp, the second-largest player, handled $10 billion in volume.

Total value locked in the Hyperliquid layer-1 network rose to more than $7.72 billion. This represents growth from a January low of $400 million.

Stablecoin holdings on the network jumped to a record $6.2 billion. This makes Hyperliquid one of the largest players in decentralized finance.

Binance Founder Promotes Rival ASTER

Former Binance CEO Changpeng Zhao posted a chart for ASTER token hours before HYPE’s peak. ASTER serves as the native token for a rival derivatives DEX backed by CZ-affiliated YZi Labs.

Well done! 👏 Good start. Keep building! pic.twitter.com/oMfOxfsBRS

— CZ 🔶 BNB (@cz_binance) September 17, 2025

The ASTER token launched Wednesday and has already gained over 350% to reach an all-time high of $0.50. YZi Labs formerly operated as Binance Labs.

PancakeSwap also backs the Aster Chain project as a direct competitor to Hyperliquid. Industry observers noted that CZ rarely shares trading charts publicly.

Hyperliquid currently handles $790 million in daily volume compared to Binance’s $34 billion. The DEX has been gradually gaining market share from centralized exchanges.

HYPE price recently broke above the $50.27 resistance level from an ascending triangle pattern. Technical analysis suggests the token could target the $100 psychological level.

The recent pullback to $53.77 represents a break-and-retest pattern that often signals trend continuation. Circle’s investment and the upcoming USDH stablecoin launch provide additional fundamental support for higher prices.