TLDR

- ETH currently trading near $4,470, consolidating below its 2021 all-time high of $4,878

- Analyst Ted Pillows predicts a correction to $3,700-$3,800 before major rally to $10,000 by early 2026

- Ethereum DEX trading volume surpassed $3.5 trillion milestone, showing strong network activity

- Bitmine purchased another $69 million worth of ETH, bringing total holdings to 1.949 million tokens

- ETH stock price surged over 2% following Bitmine’s latest purchase announcement

Ethereum is showing price patterns that mirror its 2021 bull run behavior. The cryptocurrency currently trades at $4,470, just below its previous cycle peak.

Analyst Ted Pillows shared technical analysis suggesting ETH may experience a correction before major gains. The consolidation below the 2021 all-time high of $4,878 follows historical patterns.

$ETH has been consolidating just below its 2021 ATH.

And this is a normal thing.

In 2021, ETH had a 25%+ correction after touching the 2017 ATH.

A similar correction this time will put Ethereum around $3,700-$3,800 before reversal.

After that, ETH will rally towards $10,000… pic.twitter.com/c9ouW0JiOu

— Ted (@TedPillows) September 20, 2025

In 2021, Ethereum saw a 25% correction after retesting the 2017 ATH of $1,400. This correction preceded the token’s climb to new highs above $4,800.

Applying this pattern to current market conditions, Pillows projects a pullback to $3,700-$3,800. This correction would set up conditions for a potential rally to $10,000 by early 2026.

The $10,000 target represents approximately 100% gains from current price levels. Historical data supports this bullish projection based on past cycle behavior.

Network Activity Remains Strong

Ethereum’s decentralized exchange volume reached $3.5 trillion in cumulative trading. This milestone demonstrates the network’s role as the backbone of decentralized finance.

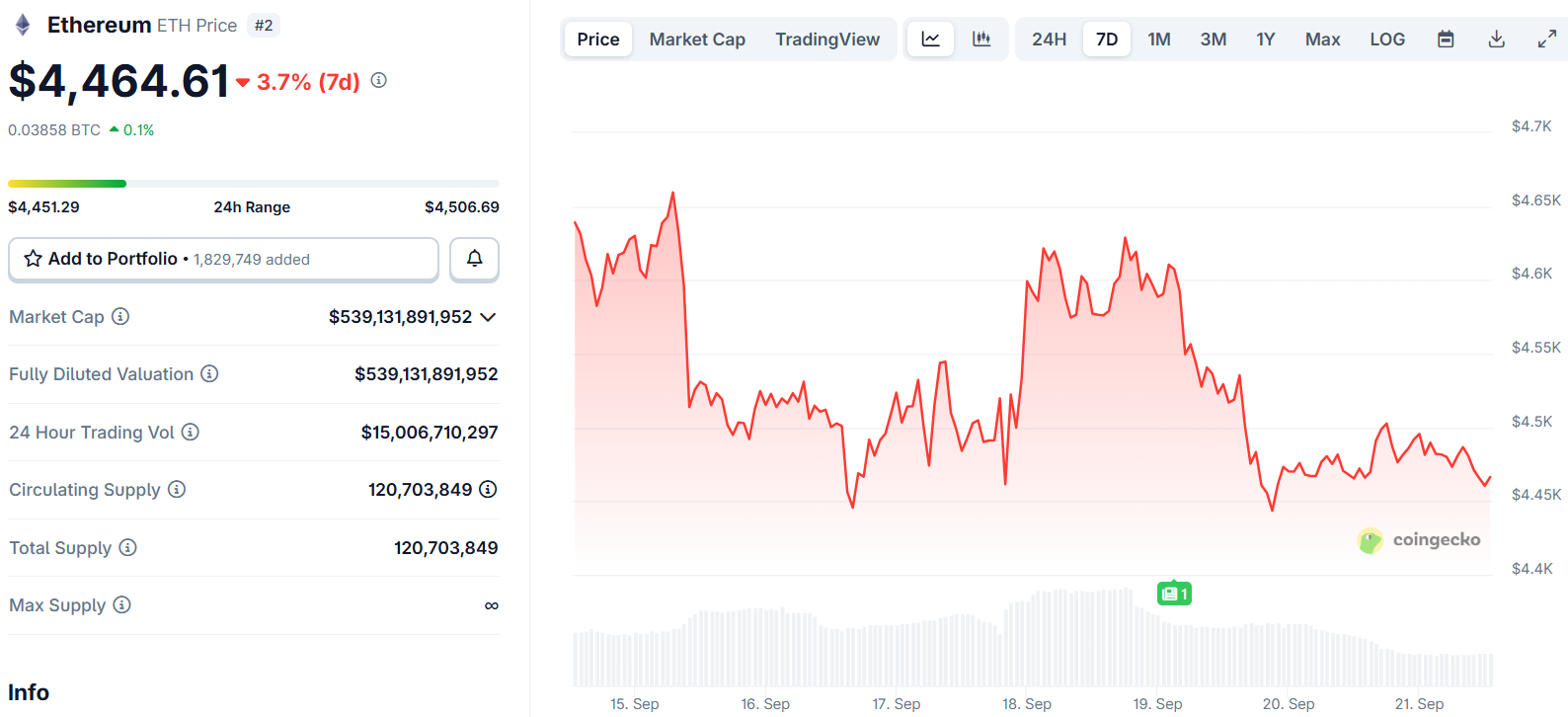

The DEX volume achievement comes despite recent price pressure across crypto markets. ETH has declined 4.32% over the past seven days.

Daily trading volume dropped 47.31% to $17.1 billion. The price decline affected market dominance, with ETH controlling 13.58% of the total crypto market.

Institutional Investment Continues

Bitmine made another major Ethereum purchase worth $69 million through Galaxy Digital. This acquisition brings their total ETH holdings to 1.949 million tokens.

TOM LEE IS BUYING EVEN MORE $ETH

Tom Lee’s Bitmine just bought another $69M of ETH from Galaxy Digital. They now hold $8.66 BILLION of ETH.$BMNR is bullish on $ETH. pic.twitter.com/t9BWh9btPR

— Arkham (@arkham) September 19, 2025

Bitmine leads among Ethereum treasury companies. Sharplink Gaming follows with 797,704 ETH in their reserves.

The purchase boosted Bitmine’s stock price by 2.22% in the latest trading session. The stock opened at $60.00 and reached a high of $64.25.

Bitmine stock shows strong performance metrics over multiple timeframes. The stock gained 22.58% in the past five trading sessions.

Monthly gains reached 21.90%, while quarterly growth hit 1,174.22%. The stock trades above key exponential moving averages.

Canadian companies including Mogo Inc., Neptune Digital Asset, and GameSquare Holdings continue accumulating Ethereum. These firms show institutional interest in the cryptocurrency.

Bitmine gained institutional recognition through inclusion in major investment portfolios. Ark Invest, VanEck Onchain Economy ETF, and The Founders Fund hold positions.

Technical Levels to Watch

Key support levels for ETH sit between $4,000 and $4,200 according to Pillows’ analysis. A break below $4,000 would still align with historical bullish patterns.

Resistance levels for Bitmine stock appear at $64.38, followed by $74.17 and $89.99. Support levels are identified at $32.72 and $22.94.

ETH maintains trading above crucial exponential moving averages despite recent weakness. The token added 3.21% over the past month.

Market capitalization stands at $540.43 billion with $641.79 million added in 24 hours. Monthly market cap growth reached 3.27%.

The Ethereum Foundation holds ETH worth over $1 billion, providing additional institutional backing. Multiple treasury companies continue building positions.

Current technical indicators show mixed signals with RSI at neutral levels. The analysis suggests patience during the consolidation phase before potential breakout moves.